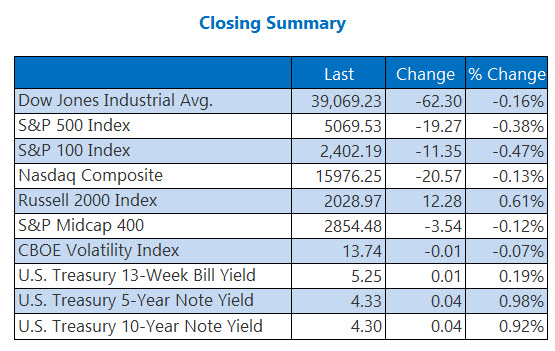

With Wall Street holding its breath for impending inflation data due Thursday, market players are navigating cautiously. A subdued showing midday translated into the afternoon, as the Dow and S&P 500 retreated from recent highs, ending their three-day winning streaks abruptly. Amazon.com (AMZN) made an entrance to the former index, displacing Walgreens Boots Alliance (WBA). The Nasdaq, on the other hand, faced declines while the 10-year Treasury note surged to 4.301%.

Unpack further insights on today’s market happenings:

- A reliable signal emerges from this retail stock.

- A cloud stock grapples with post-earnings woes.

- Unveiling surging META calls, GPS’ upgrade, and Alcoa’s recent acquisition.

Notable Market Highlights for Today

- The Federal Trade Commission (FTC) initiates a lawsuit to halt a $24.6 billion merger between Kroger (KR) and Albertsons (ACI). (CNBC)

- The U.S. Treasury conducts its largest-ever auction of 5-year notes. (MarketWatch)

- Meta stock emerges as a favorite among call traders.

- A positive market sentiment lifts Gap stock.

- The billion-dollar merger impacts Alcoa stock performance.

Resilient Oil Prices Rebound after Weekly Decline

Oil prices recaptured some lost ground following last week’s downward trend, with traders analyzing the supply and demand dynamics of crude. April’s West Texas Intermediate (WTI) crude witnessed a rise of 91 cents, or 1.4%, closing the day at $77.58 per barrel.

Gold prices waned ahead of impending inflation figures, as April’s gold dropped by $10.50, representing a 0.5% decrease, to settle at $2,038.90 per ounce.

Opinions and views expressed in this article belong to the author, not necessarily reflecting Nasdaq, Inc.’s stance.