Target’s Earnings Miss Signals Challenges Ahead for Retail Sector

Last Tuesday evening, Target Corp. (TGT) reported earnings that missed expectations significantly.

This disappointing performance is unfortunate, especially considering Target’s past reputation as a strong player in the retail market. Unfortunately, prospects for a recovery appear bleak in the near term.

Following the report, Target lowered its guidance, prompting analysts to revise their earnings estimates downward.

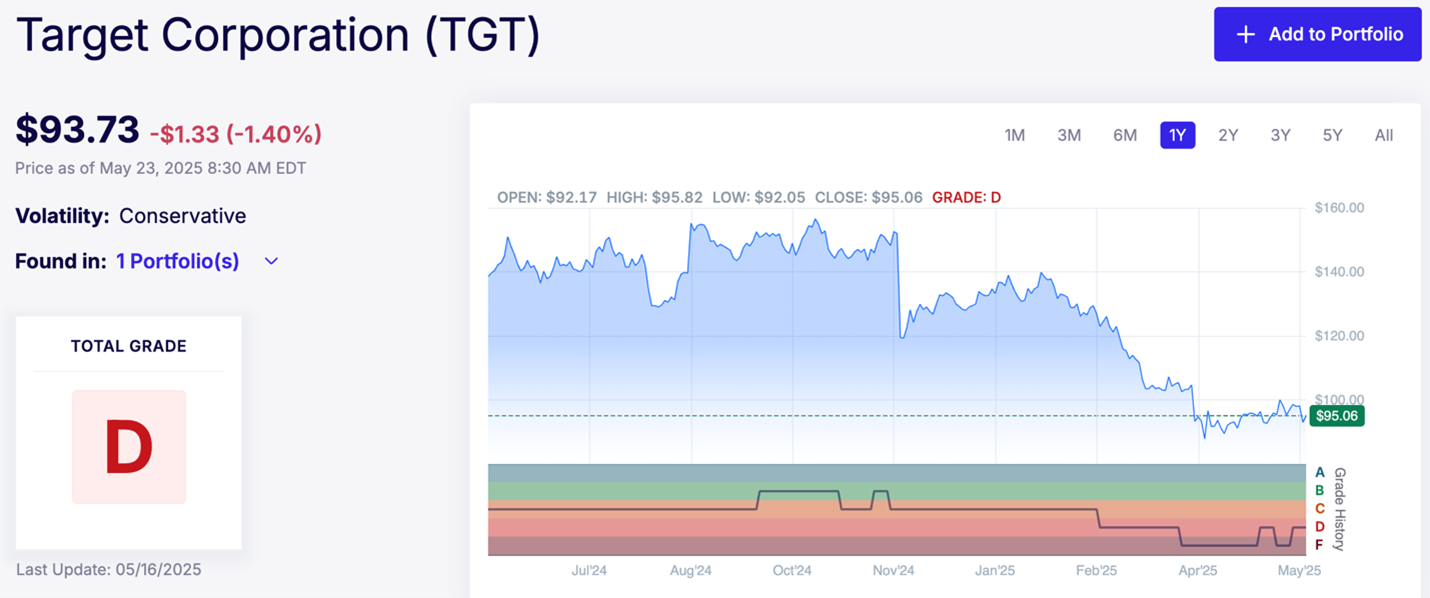

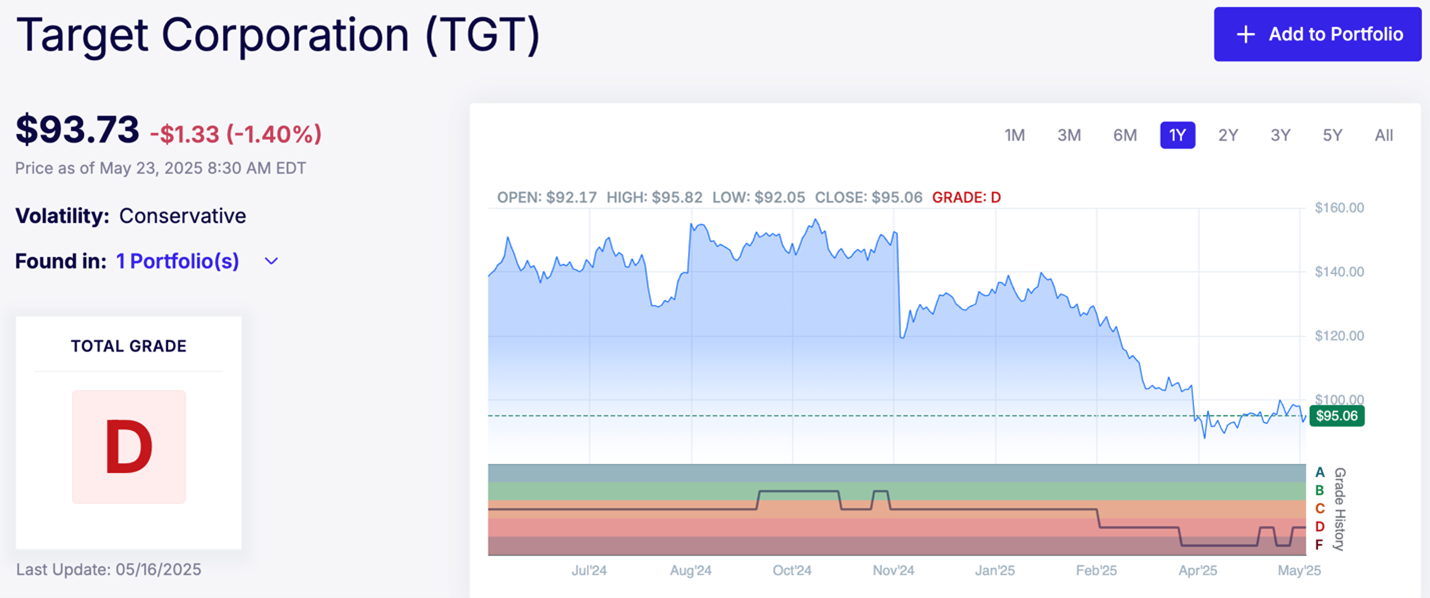

While some investors may have been caught off guard by the results and subsequent drop in the stock price, I anticipated weak performance. My quantitative Stock Grader system confirmed these concerns.

Target’s Fundamental Grade is a “C” — not ideal but manageable. However, its Quantitative Grade received a lowly “F.” This grade indicates a lack of buying interest from substantial investors, such as investment banks and hedge funds, despite general consumer spending at the register.

Consequently, Target’s Total Grade stands at a significant “D.”

Management has attributed Target’s disappointing earnings to President Donald Trump’s tariffs, which have impacted the company since it imports nearly 30% of its products from China. Despite some reduction in tariffs, they remain significant and won’t return to zero anytime soon.

However, tariffs are not Target’s only issue. The company has struggled to maintain its customer base amid shifting political landscapes. During the Obama/Biden administration, Target lost conservative shoppers by adopting a more progressive stance, while recent shifts away from diversity initiatives have alienated liberal customers, leaving the retailer with diminished appeal on both sides.

For over three years, Target has not performed favorably in my Stock Grader system.

One key detail investors should note is that Target’s same-store sales dropped by 3.8%. In contrast, Walmart Inc. (WMT) saw a 4.5% increase in same-store sales in its latest earnings report.

This stark comparison illustrates that Walmart is currently outperforming Target. As the largest grocery retailer in the U.S., Walmart has successfully attracted a substantial number of middle-class shoppers.

Walmart is also better positioned to endure any ongoing trade tensions. According to CFO John David Rainey, two-thirds of Walmart’s U.S. merchandise is “made, grown, or assembled in America.” Many imports originate from Mexico, which largely bypasses tariffs.

A result of this strong positioning, Walmart earned an “A” in my Stock Grader system and is favorably recommended in my advisory services.

You might argue that Target is now facing challenges linked to the shifting political narrative under Trump 2.0.

However, this new regime also presents opportunities for certain sectors. The changing policies encompass broader themes such as tax liberation, tech liberation, and energy liberation, which may favor various stocks moving forward.

Today, I will outline what to anticipate in this evolving economic framework.

It is clear that Trump 2.0 will produce not only winners but also losers.

A Dramatic Economic Shift Is Coming

There was a time for…

Market Shift: Preparing for the Impact of Tariffs and Policy Changes

A few weeks this year, I found myself repeating a key message: President Donald Trump’s tariffs are being used to negotiate better trade deals and promote onshoring of manufacturing in the U.S.

I maintained that these tariffs would likely not be permanent, suggesting there was little reason for concern. As this perspective gained traction among investors, we witnessed one of the swiftest reversals in market history. Yet, companies like Target might still face negative consequences.

As the market digests this recent shift, it’s essential to strategize for the future—what I refer to as Liberation Day 2.0.

This term denotes a significant change in economic policy that prioritizes domestic production, strategic resources, and U.S.-centric infrastructure, especially in energy and AI technology. This trend presents opportunities for certain sectors, but some companies now find themselves misaligned with these developments. They depend on outdated global business models, operate with minimal profit margins, or rely on government subsidies that may be dwindling.

Using my Stock Grader system, I’ve compiled a brief list of stocks currently facing vulnerabilities. These aren’t obscure companies; some are well-established names that have maintained blue-chip statuses. However, beneath the surface, their fundamentals are weakening.

Investors should proceed with caution around four key risk profiles.

Identifying the Four Danger Zones

1. China-Dependent Supply Chains

These companies rely on cost-effective manufacturing in China and similar markets. With tariffs becoming more permanent and reshoring on the rise, they face higher costs, increased geopolitical risks, and potential supply disruptions. This situation can lead to squeezed margins, slower operations, and valuations that struggle to keep pace.

2. Low-Margin Consumer Brands

Retailers with narrow profit margins are approaching a profitability cliff. They lack the pricing power needed to cope with the higher costs imposed by tariffs. As inflation pressures mounted, consumer demand decreased, resulting in deteriorating operating margins and declining earnings projections for many of these companies.

3. Subsidy-Dependent “Green” Stocks

Firms that heavily rely on environmental, social, and governance (ESG) mandates or government subsidies are becoming less popular. As policies shift toward energy security and domestic resource extraction, companies in the clean energy sector are losing favorable conditions.

4. Globalist Business Models

Service firms such as consulting, logistics, and finance that were built around open globalization are now facing challenges. The new policy direction emphasizes American manufacturing and national resource independence, leaving many global operators feeling like relics of an older economic cycle.

Stock to Sell Before Liberation Day 2.0

One company exemplifies what I mean: Kohl’s Corp. (KSS), which fits squarely in the “Low-Margin Consumer Brands” category.

Despite its strong brand recognition and extensive retail presence, the underlying situation is concerning. Kohl’s received an “F” rating from my Stock Grader system for good reason.

Kohl’s operates on a slim 3.5% operating margin and profits of less than 1%. Such tight margins leave little room for error.

Facing one of the toughest retail environments, Kohl’s lacks the pricing strength of premium brands and the volume advantage of discount chains. As tariffs drive input costs higher, the pressure on margins will only intensify.

Even prior to the tariffs, Kohl’s struggled with declining same-store sales, reduced foot traffic, and margin compression. Its latest earnings report showed a significant drop in profitability, and the outlook was far from optimistic.

Additionally, the company has dealt with leadership instability, experiencing a revolving door in its executive ranks.

Institutional interest in the Stock is waning, alongside poor revisions and deteriorating cash flow metrics. Given the unfavorable macro environment, it’s clear why Kohl’s earns an F rating.

In summary, Kohl’s appears trapped in a challenging situation, and it would be prudent for investors to avoid it.

Anticipating Future Changes

While I believe many of the forthcoming changes will benefit the country, it’s important to acknowledge that there will be casualties.

Kohl’s is just one example, and I’ve identified several other companies that may encounter similar difficulties ahead.

# Navigating Market Transformations: Key Sectors and Investment Strategies

The financial markets are undergoing significant adjustments. As capital reallocates, traditional leaders are losing their prominence.

Understanding the Shifting Dynamics

It’s critical to stay informed about the upcoming trends in the market. Adapting to these changes can position you for potential profits.

Join Us for Insights on May 28

Mark your calendar for the Liberation Day 2.0 Summit on Wednesday, May 28, at 1 p.m. Eastern. You can reserve your spot for this free event here.

What to Expect During the Summit

- Identifying three sectors poised to lead in the next phase—along with a top-ranked “buy” recommendation for each.

- Recognizing sectors likely to lag during the transition to a new economic landscape—including 10 stocks to avoid or sell based on the Stock Grader system.

- Learning a strategy aimed at achieving paydays of $2,500, $5,000, and even $10,000.

- Gaining insights into the Stock Grader system, which has helped achieve consistent success against Wall Street for nearly five decades.

Be Proactive About Your Investments

If you want to safeguard your investments and be better prepared for what lies ahead, attending this summit is essential.

To reserve your spot, click here.

Sincerely,

Louis Navellier

Editor, Market 360

Disclosure: As of the date of this communication, the Editor owns securities mentioned herein, including those related to Walmart Inc. (WMT).