As of October 2025, the cryptocurrency market is experiencing significant downturns, with Bitcoin poised for its worst annual performance since 2022. After peaking at over $120,000 following the 2024 U.S. Presidential election, Bitcoin’s momentum has diminished due to regulatory uncertainties, especially with the stalled progress of the Clarity Act in Congress.

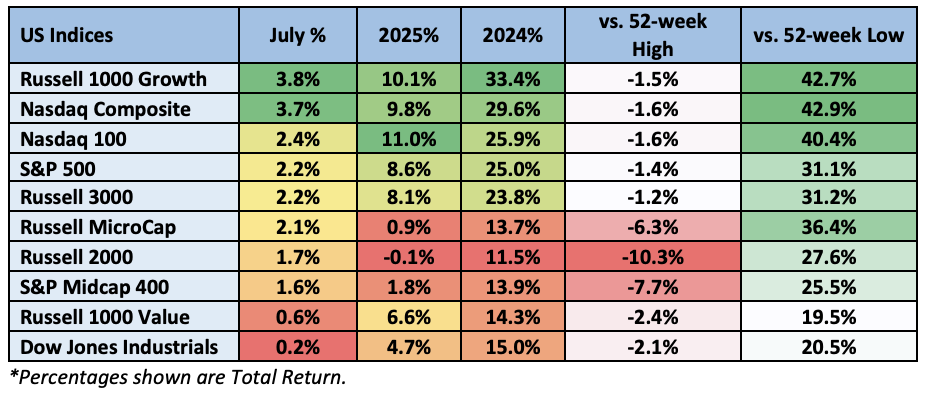

As the U.S. House of Representatives attempts to establish clearer regulations, global regulatory environments are tightening, posing additional challenges for the cryptocurrency market. In 2025, Bitcoin has notably underperformed compared to traditional asset classes, correlating poorly with tech stocks, commodities, and bonds.

Investors are advised to be cautious of SharpLink Gaming Inc. (NASDAQ: SBET) and TeraWulf Inc. (NASDAQ: WULF), both of which have substantial exposure to the volatile crypto market. SharpLink faces potential regulatory hurdles and financial instability, while TeraWulf’s significant debt load could create issues as rising costs threaten its financial health.