CyberArk Software’s Growth Amid Rising Cybersecurity Threats

Company Overview

CyberArk Software (CYBR) is an Israeli information technology security firm that serves over 5,400 global businesses, including more than half of the Fortune 500. The company focuses on Privileged Access Management (PAM), enabling clients to secure and monitor privileged access to critical systems. This technology reduces cyberattack risks by controlling access to sensitive data.

Increase in Global Cyber Data Breaches

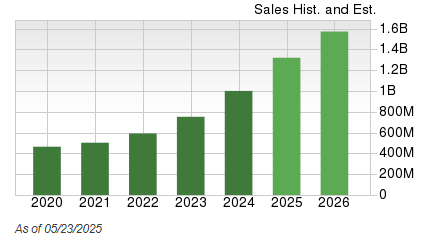

The number of data breaches in the United States has surged from 444 in 2012 to over 3,000 in 2023. The rise of cloud computing has intensified global cybersecurity demands. CyberArk’s specialized security infrastructure positions it well for sustained growth, with revenue projected to increase from approximately $400 million in 2020 to around $1.2 billion by 2025.

Image Source: Zacks Investment Research

Impact of BYOD and Hybrid Work

The COVID-19 pandemic complicated cybersecurity as many companies adopted remote work and BYOD (bring your own device) policies. This trend has led companies to implement stricter data-security measures, a shift likely to continue.

CYBR Exceeds Analyst Expectations

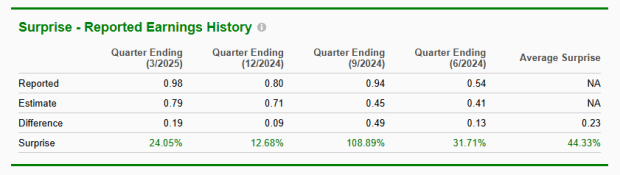

CyberArk has consistently outperformed Wall Street expectations, beating Zacks Consensus Analyst Estimates for five consecutive quarters, with an average surprise of 44.33% over the last four quarters.

Image Source: Zacks Investment Research

Stock Performance and Technical Patterns

CYBR shares have shown strong relative performance, ranking in the top 10% of S&P 500 stocks. The stock is currently forming a cup-with-handle technical pattern, indicating potential upward momentum.

Image Source: Zacks Investment Research

Strong Financials

CyberArk boasts a strong balance sheet, featuring ample liquidity and zero debt. This financial stability reflects effective cash flow management and sound investments by the leadership team.

Bottom Line

As cybersecurity threats rise alongside cloud computing and hybrid work models, CyberArk Software is well-positioned as a leader in the Privileged Access Management sector.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.