China’s economic landscape is set for a significant shift as the Politburo announced a transition to a moderately loose monetary policy in December 2025, the first such move since 2010. Alongside a 4% budget deficit target, this policy aims to prioritize domestic demand for 2026. Major financial institutions, including Goldman Sachs and the IMF, have responded positively, adjusting China’s GDP growth forecasts to 4.8% and 4.5%, respectively.

The technology and manufacturing sectors in China are leading this anticipated recovery. The e-commerce market reached approximately $2.42 trillion in 2025, projected to grow at a CAGR of 8.9% to about $5.68 trillion by 2035. November 2025 saw electric vehicle sales hit 1.82 million units, capturing 53% of the domestic market, while China’s manufacturing activity reached a five-month high.

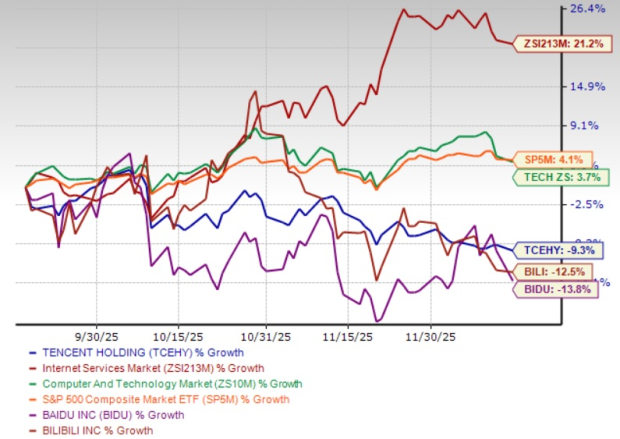

Key U.S.-listed Chinese companies like Tencent Holdings, Bilibili, and Baidu are poised to benefit from these developments. Tencent reported $10 billion in international gaming sales, while Bilibili achieved a RMB469 million net profit and significant user engagement. Baidu’s transition in AI highlights its growth potential. Over the past three months, shares of these firms, including Baidu, Tencent, and Bilibili, have seen declines of 13.5%, 9.3%, and 12.5%, creating potential buying opportunities as China’s economic policies shift towards recovery.