Analyzing RingCentral’s Stock Potential Amid AI Innovations

https://www.youtube.com/watch?v=9SYyZTRY_9U

The prevailing stock market principle of “Buy Low, Sell High” appears relevant for RingCentral RNG shares, especially as they hover below $30. Following a downturn from its 52-week peak of over $40, an upward momentum looks promising for RNG.

Achieving a Zacks Rank #1 (Strong Buy), RingCentral’s strong operational performance and investments in AI are supporting a bullish perspective on its stock.

Company Overview

RingCentral operates as a top-tier provider of contact center software-as-a-service (SaaS), offering a comprehensive range of communication and collaboration solutions for businesses.

For example, RingCentral Analytics delivers valuable insights into communication trends and performance, enabling businesses to refine marketing strategies and enhance productivity. Additionally, the RingCentral Integration feature connects over 330 popular business applications, including Microsoft MSFT Teams, Salesforce CRM, and Alphabet’s GOOGL Google Workspace.

Despite initial skepticism about its potential against competitors like Zoom Communications ZM, RingCentral has successfully tripled its operating profit since 2021. Notably, the company has surpassed EPS expectations in every quarter since its 2013 IPO, including a remarkable performance in Q4 where adjusted EPS increased 14% to $3.70, supported by a 9% revenue rise to $2.4 billion.

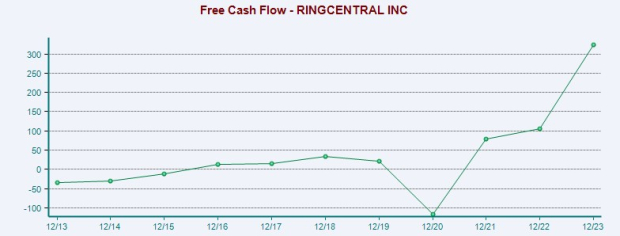

Robust Cash Flow

The company’s strong cash flow is crucial as it seeks to enhance its offerings with AI technology. In Q4, RingCentral achieved a record free cash flow of $112 million, bringing the full-year total to $403 million, a 20% increase from the previous year. The firm is optimistic about generating $500 million in free cash flow this year.

Image Source: Zacks Investment Research

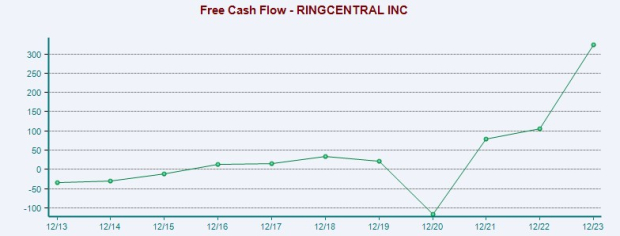

Positive Guidance for Revenue and Earnings

Looking ahead, RingCentral anticipates a revenue growth of 4-6% in fiscal 2025, aligning with the Zacks Consensus estimate of $2.52 billion—indicating a 5% growth. Furthermore, projections suggest a 6% increase in FY26, reaching $2.68 billion.

Image Source: Zacks Investment Research

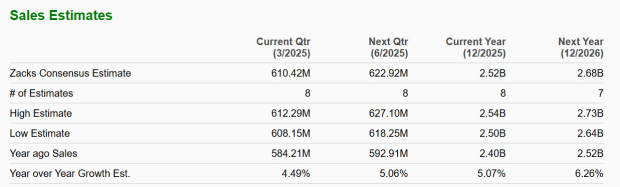

For fiscal year 2025, RingCentral projects adjusted EPS between $4.13 and $4.27, depicting roughly a 14% rise at the midpoint. The yearly earnings are expected to grow by 13% in FY25 and an additional 12% next year, bringing it to $4.71 per share according to Zacks forecasts.

Image Source: Zacks Investment Research

AI Developments

Further strengthening the bullish case for RingCentral Stock is its focus on AI initiatives. The company aims to be an AI-first platform, recently launching its AI Receptionist (AIR), a generative AI phone agent integrated into its system. AIR acts as a digital assistant that enables customers to maximize efficiency.

Additionally, RingCentral’s native AI product, RingCX, supports customer satisfaction and improves support services, evidenced by a 40% increase in its user base last quarter, expanding from 500 to 700 companies.

Attractive Valuation for Investors

An appealing aspect for potential investors is RingCentral’s current trading valuation at only 6.8 times forward earnings. In comparison, Zoom Communications Stock trades over $70, with a multiple of 13.6 times forward earnings. Additionally, RingCentral’s valuation falls below the S&P 500’s forward price-to-earnings ratio and is also lower than the Zacks Internet-Software and Services Industry average of 12.7 times forward earnings.

Why Investors are Turning Attention to RingCentral’s Growth Potential

As investors reassess their options, RingCentral (RNG) appears to be attracting more attention than established players such as Zoom Communications. Recent analysis suggests that major money could shift toward RingCentral as its growth narrative becomes increasingly compelling.

Currently, RingCentral is trading well below the typically favorable ratio of 2X sales. In contrast, many tech companies often fetch a premium, making RingCentral’s valuation particularly appealing to savvy investors.

Image Source: Zacks Investment Research

Potential Growth Driven by AI

While the market may not have fully recognized RingCentral’s potential yet, the company stands poised to gain significantly from advancements in artificial intelligence. With the generation of free cash flow, RingCentral is sharpening its focus on enhancing internal AI capabilities, indicating a potential rush toward its stock as investors seek opportunities in AI-driven companies.

The narrative around RingCentral exhibits considerable upside. It has not only received a strong buy rating but also boasts an overall “A” in Zacks’ VGM Style Scores, a composite that evaluates Value, Growth, and Momentum metrics.

Zacks Releases Top Stock Picks for 2025

Investors looking to position themselves early can explore Zacks’ recently unveiled top 10 stocks for 2025. Curated by Zacks’ Director of Research, Sheraz Mian, this portfolio has achieved remarkable success. Since its inception in 2012 until November 2024, the Zacks Top 10 Stocks portfolio has surged +2,112.6%, dramatically outperforming the S&P 500’s +475.6% return. Mian diligently reviewed 4,400 companies to select the ten most promising stocks for investors to buy and hold in 2025. Early adopters can view these high-potential stocks now.

Interested in other top recommendations from Zacks Investment Research? You can download “7 Best Stocks for the Next 30 Days” today. Click here to access this free report.

For more insights, consider obtaining free stock analyses on: RingCentral, Inc. (RNG), Microsoft Corporation (MSFT), Salesforce Inc. (CRM), Alphabet Inc. (GOOGL), and Zoom Communications, Inc. (ZM).

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.