Co-authored by Treading Softly.

It’s certainly frustrating to discover that a tool you’ve been using doesn’t align with its intended purpose. Imagine relentlessly swinging an axe, attempting to split wood when, in reality, the axe is built for felling trees. It’s a classic case of utilizing the wrong tool for the job – a situation many investors find themselves in.

Like utilizing a Ferrari to plow a field, misunderstanding the capabilities of income-generating funds can lead to erroneous expectations. Today, we’ll delve into the latest developments of two bond funds, designed for generating robust income and outperforming senior bank loans, but not intended to compete with market indexes.

Let’s explore!

Unveiling The Potential Of Income-Generating Funds

Oxford Lane Capital (OXLC), with a staggering 18% yield, recently declared earnings. The results can be best described as “steady as she goes.” GAAP NII stood at $0.23/share, consistent with the past four quarters. Core NII stood at $0.39/share – a 25% YoY increase but a marginal decrease from the last quarter.

Net asset value slightly increased by $0.01, with valuations remaining relatively stable. During the earnings call, Managing Director Joe Kupka outlined their investment strategy:

“Our investment strategy during the quarter was to engage in relative value trading and to lengthen the weighted average reinvestment period of Oxford Lane’s CLO equity portfolio. In the current market environment, we intend to continue to utilize an opportunistic and unconstrained investment strategy across U.S. CLO equity debt and warehouses as we look to maximize our long-term total return. And as a permanent capital vehicle, we have historically been able to take a longer-term view towards our investment strategy.”

OXLC extended its weighted average reinvestment period to April 2026, a marginal extension from March 2026.

Aside from reinvesting during the reinvestment period, CLO managers can enhance performance (for the equity position) through debt tranche refinancing and “reset.” Refinancing entails replacing debt tranches with lower spread debt. With the average AAA Spread for OXLC’s holdings at 1.48%, refinancings have become rare due to widened spreads in 2022/2023, although newer CLOs boast spreads around 2% or higher.

Regarding “reset,” instead of merely refinancing some debt tranches, it involves refinancing all debt and resetting the reinvestment period. OXLC is considering this approach to capitalize on rising NAVs and narrowing liabilities. CEO Jonathan Cohen emphasized the potential approach during the earnings call:

“Sure. We’ve already begun that process, just taking advantage of rising NAVs and the tightening liabilities. So, we’re starting to have those discussions kind of a case-by-case basis depending on the current status of the CLO. We’re going to look to call some deals, reset when we can, and kind of take it case-by-case. Obviously, regarding your first question, there’s going to be this push and pull on the market as a lot of the post-reinvestment CLOs try to get something done. So I think we’ll be range-bound, but we kind of take what the market gives us in terms of when we want to reset first call.”

These are maneuvers we haven’t observed from CLOs in recent years due to interest rate fluctuations. With rates stabilizing, OXLC is expected to pursue these options to amplify the value of its holdings.

A Safer Alternative within CLOs

The Art of Income Investing: Navigating Risk and Reward

For investors who prefer a more cautious approach, moving higher up in the CLO capital stack is recommended. One way to achieve this is by investing in Eagle Point Income Co Inc (EIC). EIC offers an appealing 15.5% yield and trades at a modest premium to NAV.

EIC primarily invests in the debt structure of a CLO, functioning more like a specialized niche bond fund than a higher-risk CLO fund. While OXLC invests in the riskiest but most lucrative tranche of a CLO, EIC ascends the curve, curbing risk while also moderating returns. This resembles a shift from purchasing the common shares of a BDC to acquiring the baby bonds – a reduction in overall risk while still securing a handsome income.

An American Economic Odyssey

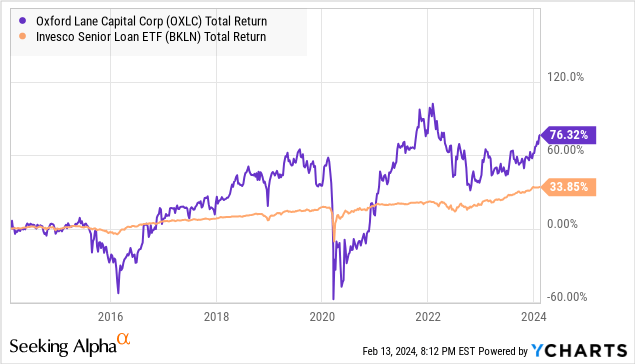

At its core, OXLC and EIC represent a leveraged bet on the U.S. economy, owning substantial CLOs that provide exposure to the debt from a myriad of American companies. The investment decision revolves around the belief in these companies’ ability to withstand economic upheaval. A comparison between the index and the fund itself indicates that while OXLC is more volatile, it generates more robust returns.

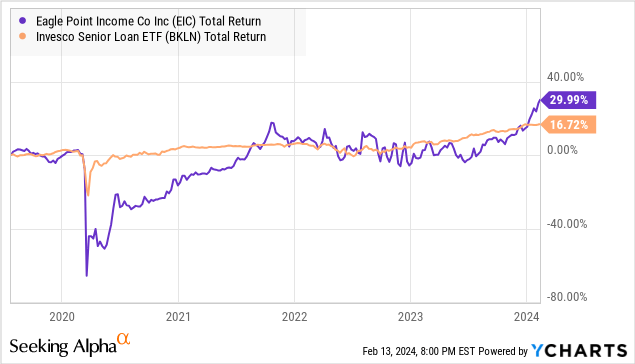

EIC demonstrates a comparable, albeit more modest, outperformance owing to its reduced risk profile:

As an income investor, my choice to invest in OXLC and EIC is driven by the income they generate and their potential to sustain it. Many investors assess the price chart of OXLC or EIC since inception and opt to steer clear due to a misunderstanding that closed-end funds (CEFs) are designed to provide high current income, at the cost of a slowly degrading NAV over time. It’s an inevitable trait of this investment class.

Investing: A Personal Marathon

In retirement planning, success is not solely defined by outperforming others. In all my endeavours, competitive achievements have come from focusing on personal goals rather than comparing with others. The same applies to retirement planning – it’s about individual targets rather than outdoing someone else.

Platforms like Seeking Alpha offer diverse viewpoints and goals, fostering a supportive environment where people pursue distinct financial objectives. There’s no need for animosity towards others with different goals – the community thrives on respecting diverse viewpoints and collaboration.

Ultimately, my wish for anyone building an income portfolio is to experience the financial security and freedom that many members of my private community relish: a retirement funded by the market. If your investment goals align with your aspirations, pursue them without hesitation.

The Beauty of Income Investing

That’s the essence of my Income Method. That’s the allure of income investing.