Co-authored by Treading Softly.

These words were penned by Henry Wadsworth Longfellow, from his poem entitled Rainy Day.

The day is cold, and dark, and dreary; It rains, and the wind is never weary; The vine still clings to the mouldering wall, But at every gust the dead leaves fall, And the day is dark and dreary.

My life is cold, and dark, and dreary; It rains, and the wind is never weary; My thoughts still cling to the mouldering Past, But the hopes of youth fall thick in the blast, And the days are dark and dreary.

Be still, sad heart! and cease repining; Behind the clouds is the sun still shining; Thy fate is the common fate of all, Into each life some rain must fall, Some days must be dark and dreary.

I was first introduced to this poem and its thoughts when I was just a freshman in college. It was a poem that I was assigned to recite in front of my entire Speech 101 class. The goal was to properly encapsulate the thoughts and feelings behind the poem by first digesting it and understanding it.

You likely haven’t been alive long if you’ve never experienced a bad day. Almost every one of us has had a day where we wake up starting the day aiming for it to be a great day and everything seems to go wrong. It’s part of the universal human condition. Many of us will take steps to try to avoid or counteract it when we’re having a bad day, yet we can’t avoid them all.

When it comes to the market, investors are so keen on trying to avoid losses. By fearing the things that they believe will cause them, like a recession or a bear market, they make foolish choices in an attempt to avoid them. Some investors ascribe to the idea of “sell in May and go away.” They believe that the summer months, which typically are marked by less volume and more volatility, should be avoided. They simply sell out of their shares.

There’s a famous saying by Peter Lynch that’s highly applicable:

“Far more money has been lost by investors trying to time corrections than in all corrections combined.”

Sadly, many believe that they’re applying a rule that Warren Buffett has said about never losing money, and they sell pre-emptively in the name of capital preservation, only to really be locking in losses instead of allowing themselves to have success in the long run.

So today, I want to discuss how recessions and bear markets are beneficial to your portfolio and what my recommendation would be in those times. It’s no surprise that a recession is coming. We’ve all been hearing about it for one to two years, and the Federal Reserve is trying its hardest to make it as soft of a recession as possible. Some authors, even on Seeking Alpha, are calling for a decades-long bear market or depression, which is causing fear among many readers.

So today, let’s look at the bear in the face and see how it can help you.

Understanding the Necessity

I think the biggest mistake that novice investors make is the expectation that they will be able to properly and effectively time any correction or bear market. Predicting the future, whether using technical analysis, Fibonacci numbers, or any other means, is haphazard at best.

When I’m asked to provide an outlook for the overall market, I try to provide a straightforward answer as much as possible, while fully acknowledging that what I’m saying could be completely incorrect. What I would instead like to focus on is what I would do in each scenario.

It’s a simple fact of the matter that because of the business cycle, there are going to be periods where there is a boom and a subsequent bust. A recession is simply a period where most businesses in the entire country are not booming. It is similar to when you need to clean out your fireplace. If you have a wood-burning fireplace in your home, you know that ashes and soot will build up over time, and this can cause your fires to burn less efficiently. Suppose the entire country and its business productivity is similar to a fire in your fireplace. Over time, you’re going to have companies that are not operating efficiently or that are essentially zombie companies that need to be cleaned out and cleared out so that the economy can burn brighter again.

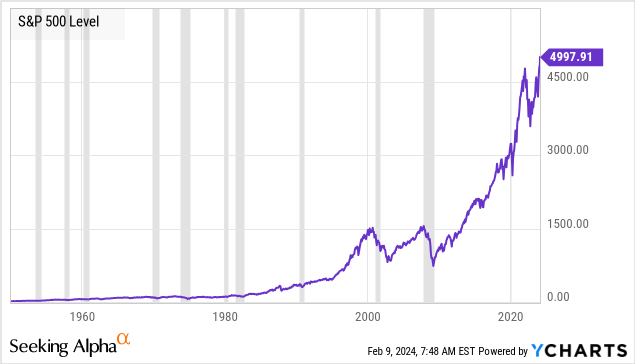

Bear markets usually occur when there is a recession or other sort of economic situation putting pressure on the overall economy; therefore, both are necessary to occur. This allows the market to rebound and glow even brighter than before.

You should not be running in fear of them. You should be expecting them and understanding that they will allow the market to reach higher highs in the future.

Appropriate Actions

So many investors believe that they need to avoid a recession or a correction in the name of capital preservation. So many of those investors are simply causing themselves to experience capital losses. What should you do?!

I have a saying that I often repeat to new members of my private community when asked about what we want to do during a recession or correction or bear market. My answer to them is, “Bull markets make millionaires, but bear markets are where you determine who’s going to be those millionaires.”

When it comes to a bear market, if you are invested in a portfolio that generates strong income, you can see cash coming into your account, and it is available to use to pay for your expenses and/or to reinvest into more investments. The goal of an income portfolio is to generate income regardless of the economic situation. Your portfolio value may drop and likely will drop in a correction or a bear market, but that is not a capital loss unless you’ve sold. If you think you’re preserving capital by selling and locking on losses – you’re only destroying it. You’re actually preserving capital by holding on to those investments even when they’ve dropped in value and continuing to reinvest dividends to grow your portfolio’s income stream. When that portfolio and that market rebound into the next

The Beauty of Income Investing: Embracing Bear Markets and Recessions

Amidst the frenzied ebb and flow of the stock market, a group of savvy investors has discovered the remarkable allure of income investing, transcending the capricious whims of a bull market. While many recoil at the mere whisper of a market downturn, these astute players relish the economic maelstrom, viewing it not as a tempest to be weathered but as an opportunity to thrive.

Embracing Market Volatility

In the tumult of a bear market, conventional wisdom may crumble. Yet, practitioners of income investing stand unfazed, fortified by the knowledge that such setbacks bear witness to a potential surge in their income stream. Just as a skilled sailor harnesses a tempest’s fierce gales to propel their vessel, these investors leverage market dips to amplify their earnings.

The Allure of Steady Income

The dot-com bubble, the housing crisis, the COVID crash—through every historical cataclysm, one constant has endured: a resilient income stream. While portfolio valuations may plummet, the steady cadence of income remains an unwavering lighthouse, guiding investors through the market’s darkest tempests. It is this unwavering constancy that distinguishes incisive income investors from their myopic peers.

The Income Method: A Shelter in the Storm

In the ceaseless ebb and flow of the market, traditional retirement strategies are akin to capriciously navigating treacherous waters without a compass. However, income investors find refuge in the Income Method—an innovative framework that empowers them to eschew the uncertainty of market timing. Championed by thousands, this avant-garde approach moonlights as an impregnable bulwark, assuring retirees a steadfast income even amidst the market’s most tumultuous convulsions.

The Beauty of Resilience

The ethos of income investing transcends mere financial gain; it champions resilience, astuteness, and an undeterred perseverance that scoffs at the caprice of market volatility. To the income investor, bear markets and recessions are not infestations to be eradicated but fertile soil in which their financial acumen flourishes—all while traditional investors scramble to evade the inevitable. This compelling resiliency forms the crux of the beauty of income investing.