Uber Partners with NVIDIA to Drive Autonomous Vehicle Innovation

Analyst Justin Post at BofA Securities has reaffirmed a Buy rating for Uber Technologies Inc UBER, setting a price target of $96 following the company’s recent collaboration with NVIDIA Corp NVDA aimed at enhancing autonomous vehicle capabilities.

Valuation Insights Reflecting Future Growth

The $96 price target is based on a multiple of 20 times the estimated free cash flow for 2026, which Post considers reasonable in comparison to the FANG companies’ average of 28 times. This evaluation is supported by Uber’s anticipated EBITDA growth of 28% in 2026, significantly higher than the FANG average of 17%.

Understanding the Partnership’s Focus

The partnership emphasizes the development of AI-driven autonomous vehicles (AVs), leveraging Uber’s vast data from millions of daily trips alongside NVIDIA’s recently unveiled Cosmos platform, first revealed at CES. This collaboration promises to be a significant stride towards integrating AI in vehicles.

NVIDIA’s Role in AV Development

NVIDIA’s Cosmos serves as their state-of-the-art generative AI platform, designed for “physical AI systems.” It creates simulated environments that can enhance robotics breakthroughs without incurring high costs.

Uber’s Commitment to Autonomous Tech

With the criticality of this strategy, Uber is expected to allocate substantial resources towards achieving these advancements. NVIDIA CEO Jensen Huang recently highlighted at CES that Cosmos marks the first foundational model dedicated to “Physical AI.” In his remarks, he indicated that autonomous vehicles could represent the first multi-trillion-dollar robotics sector.

New Technologies and Strategic Partnerships

During CES, Huang also discussed a new chip designed for AVs, named “Drive Thor.” This chip is a progression from the earlier “Drive Orin” model, enabling manufacturers to streamline multiple functions, thereby decreasing overall system expenses. The array of partnerships and announcements regarding AV technologies suggests a growing trend among automotive OEMs to adopt Level 4 self-driving features, potentially increasing Uber’s prospects in this emerging market.

Competitive Landscape and Uber’s Data Advantage

Post identified several companies in the AV sphere, like Toyota Motor Corp TM, Aurora Innovation, Inc AUR, and Continental, all of which could align with Uber for ridesharing solutions. With competitors like Alphabet Inc.’s GOOG, Tesla Inc TSLA, and Amazon.com Inc.’s AMZN Zoox entering the fray, the competition for Level 4 autonomy may escalate.

Future Prospects for Uber Stock

As Uber aims to provide critical data and insights for vehicle manufacturers, it may help accelerate the reach of Level 4 automation, potentially avoiding a scenario where only one player dominates the market. The company’s rich dataset on ride patterns stands to benefit partnerships by offering valuable information for all stakeholders.

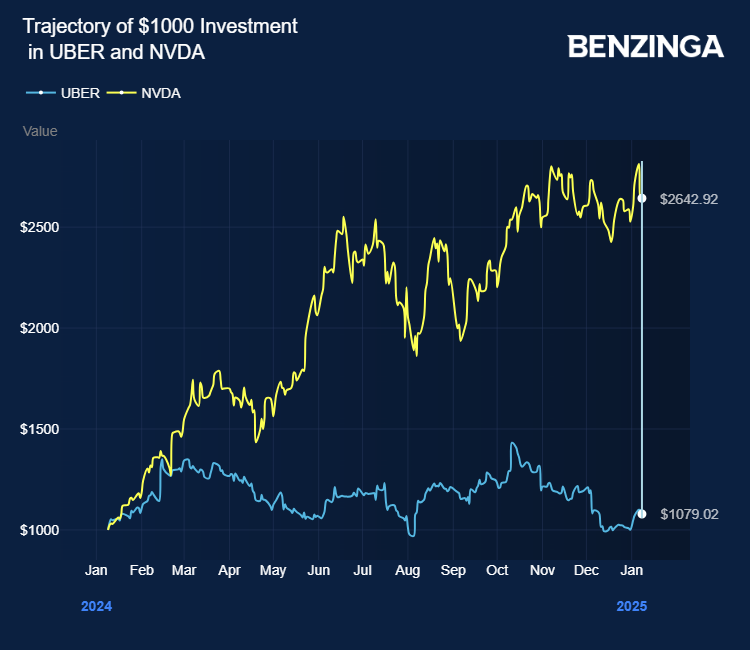

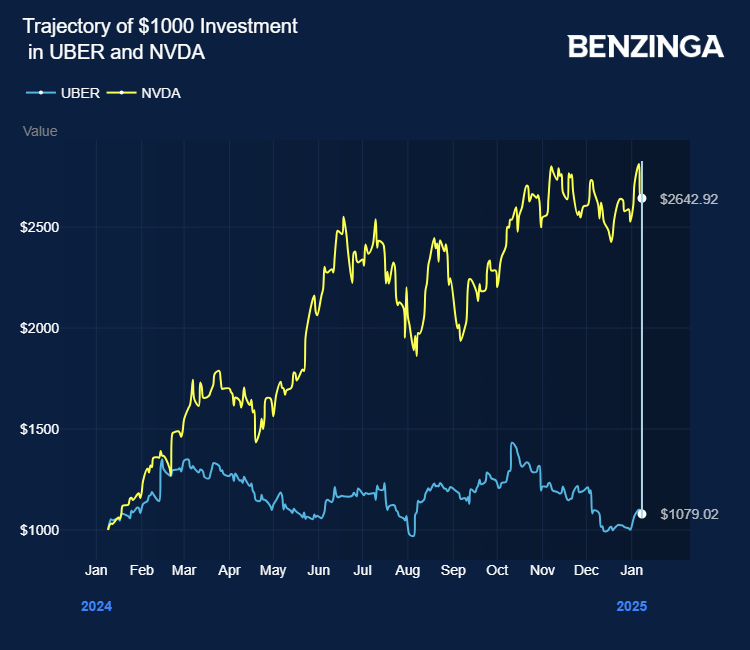

In the latest market update, Uber’s stock has decreased by 2.72% to $64.35 as of publication on Wednesday.

Also Read:

Photos: Shutterstock

Market News and Data brought to you by Benzinga APIs