Florida’s Cannabis Vote: AYR Wellness Emerges as a Strategic Investment

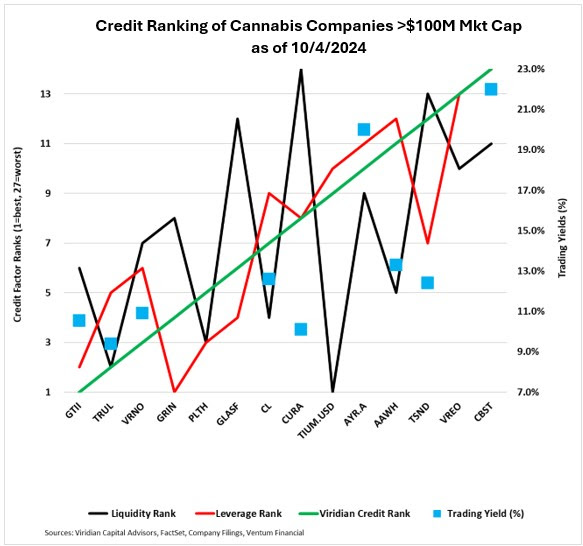

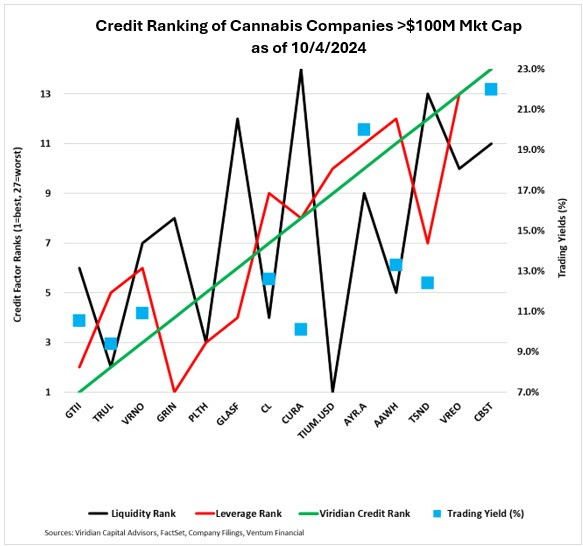

As Florida approaches a crucial decision on recreational cannabis, investors are keenly watching for opportunities in this growing market. The Viridian Credit Tracker has identified AYR Wellness AYRWF as a strong investment choice, boasting an appealing 20% yield thanks to its substantial footprint in Florida’s cannabis sector. Should voters approve recreational cannabis, AYR is positioned to benefit significantly, making it a key target for investors before the vote.

- Stay updated with Benzinga’s exclusive insights and daily news on the cannabis industry. Subscribe to our newsletter here to stay informed.

Unlocking Potential: AYR Wellness and Florida’s Vote

The report from Viridian Capital Advisors highlights AYR’s strong positioning in Florida, which could provide a unique advantage if the state legalizes recreational cannabis.

With an impressive 20% trading yield, AYR outstrips many competitors. If the legalization passes, AYR’s stock valuation could surge, making it a smart buy for investors aiming to capitalize on this pivotal moment.

Comparing Giants: Cresco Labs and Curaleaf

Another noteworthy investment suggestion from the report involves Cresco Labs CRLBF, which offers a 12.6% yield, coupled with selling shares of Curaleaf CURLF, currently yielding 10.1%. This trade provides a yield increase of 250 basis points, relying on Cresco’s solid financials and improving credit status. Investors seeking higher returns should pay attention to this opportunity.

Read Also: EXCLUSIVE: 80% Growth Despite The Chaos: How Dutchie, C3 Defy 2024’s Cannabis Slump

TerrAscend: A Cautious Outlook

In contrast, TerrAscend TRSSF, with a 12% yield, is receiving a sell recommendation. Despite being a significant player in the cannabis market, TerrAscend’s lower yield and limited exposure to Florida’s growth potential make it less attractive compared to AYR.

Cannabist’s Liquidity Issues

While some top stocks show promising yields, Cannabist CCHWF is marked as the weakest credit amid liquidity concerns following recent asset sales. Investors should consider Cannabist’s lower credit rating, which may hinder its prospects in the near future, despite potential improvements.

Strategize Now: Florida’s Vote is Critical

As Florida prepares for a potential expansion in its cannabis market, investors should consider strategic moves: buy AYR at a 20% yield, sell TerrAscend at 12%, and evaluate Cresco Labs at 12.6% compared to Curaleaf at 10.1%. This upcoming vote could reshape the cannabis investment landscape, making proactive steps now vital for significant returns later.

Read Next: SEC Charges ‘Magic Mushroom’ Co. Minerco In $8M Pump-And-Dump Scheme

Market News and Data brought to you by Benzinga APIs