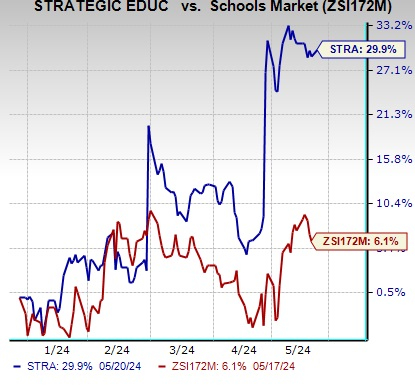

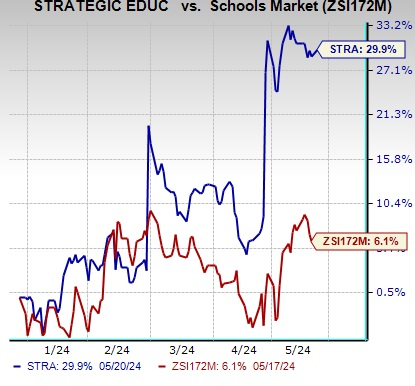

Strategic Education, Inc. STRA or SEI’s shares gained 29.9% in the year-to-date period, handily outperforming the Zacks Schools industry’s 6.1% growth.

This provider of a range of post-secondary education and other academic programs is benefiting from strong enrollment growth, especially in the U.S. Higher Education (“USHE”) segment, improving contributions from the Australia/New Zealand (“ANZ”) segment and diversified program offerings.

The Zacks Consensus Estimate for the company’s 2024 earnings has risen to $4.96 per share from $4.60 in the past 30 days. The estimated figure depicts 33.3% growth from the prior year’s reported levels. Also, the consensus mark for second-quarter earnings per share is pegged at $1.20, indicating 46.3% growth from the prior year’s reported levels. STRA delivered a trailing four-quarter earnings surprise of 36.2%, on average.

Image Source: Zacks Investment Research

The growth prospect of this current Zacks Rank #1 (Strong Buy) company is further solidified by a VGM Score of B, backed by a Growth and Momentum Score of A. The positive trend signifies bullish analysts’ sentiments and robust fundamentals in the near term.

Attractive Factors of the Stock

Solid Enrollment Trends in the USHE: Strategic Education has been witnessing strong enrollment growth in its USHE segment for some time now. During the first quarter of 2024, total student enrollment within this segment increased 9.8% to 87,731 from 79,935 reported a year ago. The primary driver was the increase in employer-affiliated enrollments.

The employer-affiliated enrollment grew 22% year over year, which showcases continuous strength in Strategic Education’s corporate partnerships. Total employer-affiliated enrollments were 29.2% of all USHE enrollments, up 290 basis points year over year. Also, in the quarter, 29% of the company’s USHE total enrollment came from its corporate partnerships, which currently stand with a network of more than 1000 corporate partnerships.

Improvement in ANZ’s Contributions: After a year of declining student enrollment through 2023, SEI’s ANZ segment displayed notable student enrollment growth during the first quarter of 2024.

During the first quarter of 2024, the segment’s total student enrollment increased 4.8% to 20,197 from 19,269 reported a year ago. The uptrend was driven by onshore international enrollment, which was understood to be international students already in Australia who either reenrolled or transferred to Torrens University during the quarter. This, along with increased revenue per student, aided the uptick in the revenues by 14.1% to $47.4 million year over year.

Diversified Program Offerings: SEI believes in providing various innovative programs to improve student outcomes. Under SEI’s USHE segment, Capella continuously invests in introducing new programs and specializations to improve student outcomes. Continuous innovation and course updates expand its product portfolio, which in turn boosts enrollment and drives long-term growth.

Furthermore, the company is focusing on providing programs based on a “competency-based learning model and direct assessment capabilities”. One of these innovations is FlexPath, which continues to be one of the company’s fastest-growing programs. It allows students to focus on leveraging their skills and knowledge gained during professional hours. In first-quarter 2024, FlexPath enrollments represented 23% of all USHE enrollments, up from 21% reported in the prior-year period.

Other Key Picks

Here are some other top-ranked stocks from the Consumer Discretionary sector.

Netflix, Inc. NFLX presently sports a Zacks Rank of 1. You can see the complete list of today’s Zacks Rank #1 stocks here.

NFLX has a trailing four-quarter earnings surprise of 9.3%, on average. The stock has hiked 72.2% in the past year. The Zacks Consensus Estimate for NFLX’s 2024 sales and earnings per share (EPS) implies a rise of 14.7% and 52.1%, respectively, from the year-ago levels.

Hasbro, Inc. HAS currently sports a Zacks Rank of 1. HAS has a trailing four-quarter earnings surprise of 17.5%, on average. The stock has risen 2.5% in the past year.

The Zacks Consensus Estimate for HAS’ 2024 sales indicates a decline of 17.2% while the estimate for EPS indicates a rise of 45.4% from the year-ago levels.

Royal Caribbean Cruises Ltd. RCL currently sports a Zacks Rank of 1. RCL has a trailing four-quarter earnings surprise of 18.3%, on average. The stock has surged 84.7% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS implies growth of 16.6% and 61.9%, respectively, from the year-ago levels.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.