ProShares S&P 500 Dividend ETF Shows Potential Analyst Upside

At ETF Channel, we analyze the underlying holdings of various ETFs within our coverage. Recently, we compared the trading price of each holding to the average analyst 12-month forward target price. For the ProShares S&P 500 Dividend Aristocrats ETF (Symbol: NOBL), the implied analyst target price is $108.04 per share.

Currently, NOBL trades at approximately $97.19 per share, indicating that analysts foresee an 11.16% upside for this ETF based on expected prices of its underlying assets. Among NOBL’s holdings, three stocks standout with significant upside to their analyst target prices: Smith (A O) Corp (Symbol: AOS), Walmart Inc (Symbol: WMT), and PepsiCo Inc (Symbol: PEP).

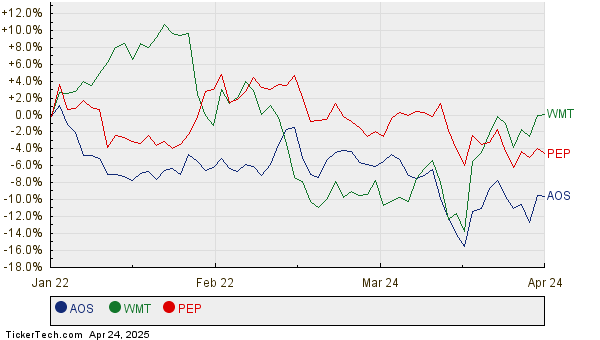

AOS is currently priced at $63.80 per share, but analysts predict a target of $72.44 per share, representing a potential upside of 13.55%. Similarly, Walmart, trading at $94.93, has a target price of $107.61, suggesting a possible increase of 13.36%. Lastly, PEP’s recent price of $142.20 comes with an expected target price of $159.79, which is 12.37% higher. Below, we present a twelve-month price history chart to illustrate the stock performance of AOS, WMT, and PEP:

Here’s a summary table highlighting the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| ProShares S&P 500 Dividend Aristocrats ETF | NOBL | $97.19 | $108.04 | 11.16% |

| Smith (A O) Corp | AOS | $63.80 | $72.44 | 13.55% |

| Walmart Inc | WMT | $94.93 | $107.61 | 13.36% |

| PepsiCo Inc | PEP | $142.20 | $159.79 | 12.37% |

Investors may wonder whether analysts’ targets are justified or if they are overly optimistic about the performance of these stocks in the next year. It is crucial to examine whether analysts have valid reasons for these targets or if they are lagging behind recent developments within these companies and their industries. A high target price compared to a stock’s current trading price can reflect optimism. However, it could also lead to potential downgrades if the targets are based on outdated information. Further investor research is recommended to navigate these questions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Services Stocks Hedge Funds Are Buying

• DPZ MACD

• MOSY Split History

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.