Microsoft Stock Analysis Amid Sell-Off

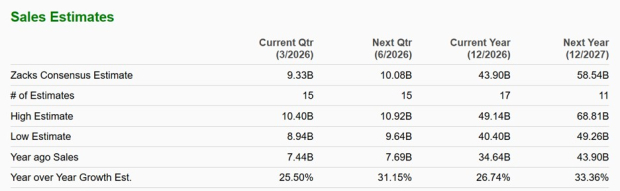

Microsoft (NASDAQ: MSFT) has seen a significant decline, with a 10% drop following its recent earnings report, putting the stock approximately 20% below its all-time high. Despite this, the company’s second-quarter revenue for fiscal 2026 was up 17% year-over-year, reaching $81.3 billion, and Azure, Microsoft’s cloud platform, delivered a revenue increase of 39%.

Currently, Microsoft’s stock is at its lowest valuation in three years based on forward earnings and price-to-operating profits ratios. Analysts suggest this could represent a prime buying opportunity, particularly given past instances where similar price levels have led to significant gains for investors.