“`html

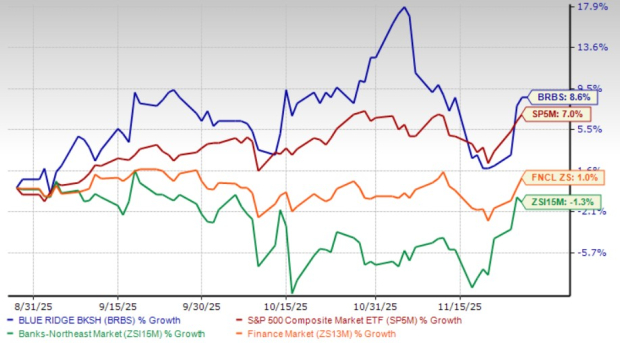

Blue Ridge Bankshares, Inc. (BRBS), based in Richmond, VA, has seen its stock price increase by 8.6% over the last three months, outperforming the banking industry, which declined by 1.3%. During the same period, the S&P 500 and broader sector gained 7% and 1%, respectively.

Recent developments include the termination of a Consent Order by the Office of the Comptroller of the Currency in November 2024 and the release of the third-quarter 2025 results in October. BRBS reported significant increases in net interest income and noninterest income, bolstered by the recovery of troubled credits and effective cost-control measures.

Despite facing pressures from larger competitors and transitioning away from fintech-related deposits, BRBS aims to enhance its traditional banking operations and profitability. The bank’s current price-to-sales ratio stands at 2.7, outperforming the industry average of 2.2.

“`