“`html

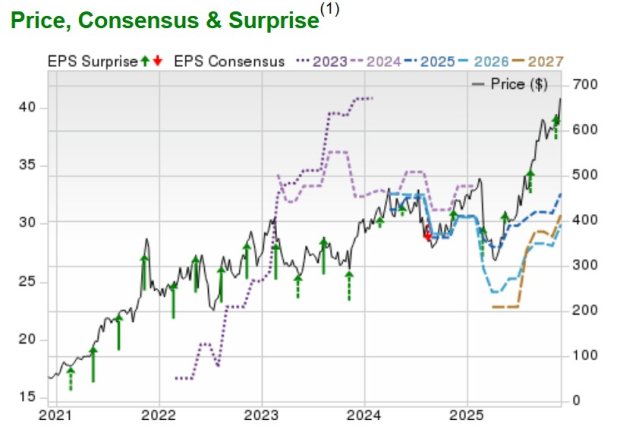

Dillard’s (DDS) Stock Performance: Dillard’s shares have surged over 50% year-to-date, reaching over $600 per share, amid record-breaking Black Friday sales in the U.S. The company has garnered a Zacks Rank #1 (Strong Buy) due to strong earnings that have outperformed analyst expectations and optimism surrounding Federal Reserve rate cuts.

Business Model Efficiency: Dillard’s boasts a robust ownership structure, owning most of its stores, which reduces rent expenses and stabilizes costs. The company reports a 20% return on invested capital (ROIC) and maintains an impressive free cash flow conversion rate of 108%. Moreover, projected earnings per share (EPS) for fiscal 2026 have recently increased from $30.92 to $32.61, while FY27 EPS estimates rose over 6% from $28.10 to $29.93.

Valuation Context: Dillard’s is currently trading at a forward P/E ratio of 20, which is competitive compared to peers like Kohl’s (KSS) at 11X and suggests room for growth even amidst high profitability.

“`