Exploring Small-Cap Stocks: 7 Picks for Potential Growth

Welcome to this week’s Sunday Digest with Tom Yeung.

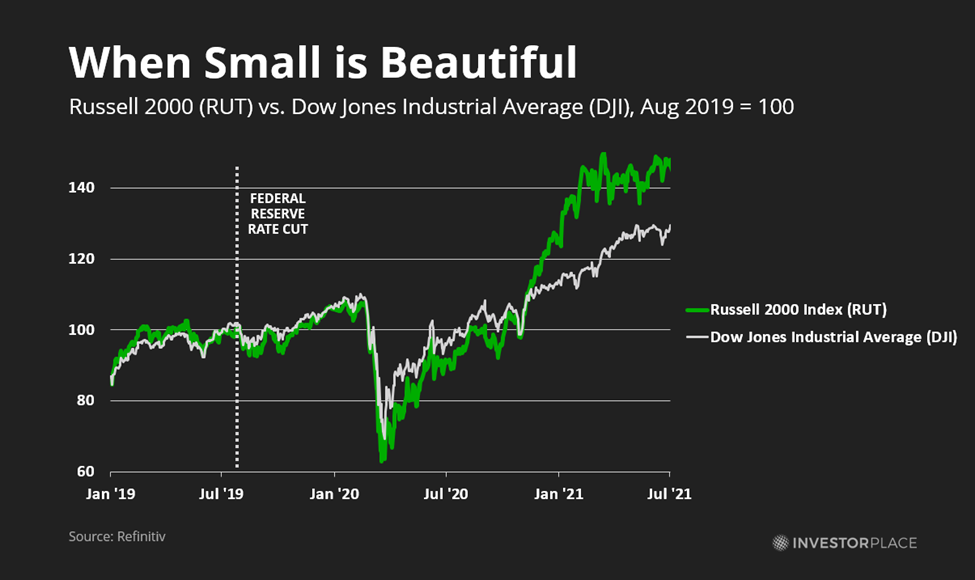

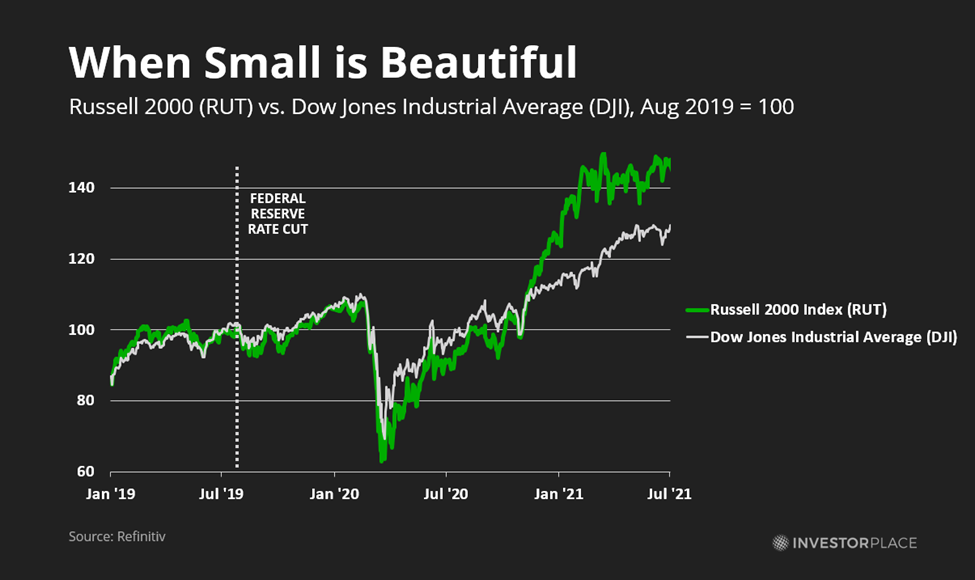

In mid-2019, the U.S. Federal Reserve began lowering interest rates for the first time since the global financial crisis of 2007-2008. This action came as the economy showed signs of slowing, amid concerns over trade disputes and weak growth potentially leading to a recession. The onset of the COVID-19 pandemic in 2020 confirmed those worries.

At the time, many believed blue-chip stocks—such as Microsoft Corp. (MSFT), Apple Inc. (AAPL), and Walt Disney Co. (DIS)—would remain stable. However, that was not the case. Instead, smaller companies outperformed their larger counterparts. The Russell 2000 index, which tracks 2,000 small-cap companies, increased by 34%, while the Dow Jones gained only 19% during the same timeframe.

Some individual small-cap stocks performed exceptionally well. For instance, shares of Enphase Energy Inc. (ENPH) soared sixfold, Digital Turbine Inc. (APPS) saw a tenfold rise, and vaccine developer Novavax Inc. (NVAX) experienced an astounding 40-fold increase in stock prices.

A similar scenario unfolded after rate cuts in mid-2007. The Russell 2000 took about three years to return to its previous price levels, while the Dow Jones needed an additional 16 months, and the S&P 500 took six more months following that.

Smaller stocks are often more volatile, but they also offer greater potential for rapid growth, especially during economic recoveries. These firms can triple, quintuple, or even more when interest rates fall and consumer confidence rises.

InvestorPlace Senior Analyst Luke Lango will present a promising small-cap stock in a live event tomorrow at 10 a.m. ET, which he anticipates could rise twentyfold in the coming years. Additionally, with Elon Musk unveiling his “robotaxi” later this week, there’s optimism about the impact this could have on a lesser-known supplier. Reserve your spot to hear more about this stock.

Before that, here are three other small-cap stocks that could thrive as the Federal Reserve continues its strategy of lowering interest rates.

Small-Cap Pick for 2025 No. 1: The Automation Play

Last Tuesday at midnight, the International Longshoremen’s Association (ILA) initiated a strike at 36 ports along the U.S. East and Gulf Coasts. The primary concern was wages, as their hourly pay fell short of the nearly $55 an hour earned by West Coast dockworkers.

As noted by InvestorPlace Senior Analyst Louis Navellier, there’s also a pressing issue about job security regarding artificial intelligence and robotic automation.

The dockworkers are worried about the ports getting automated and losing their jobs in the long term. And reports indicate they want assurances that there will be a total ban on automation.

In other words, no robots when it comes to loading and unloading freight. That includes cranes, gates, and moving containers.

Unfortunately, I’ve got bad news for these folks.

Automation and AI are coming whether they like it or not. The proverbial horse has left the barn.

Automation is evolving rapidly, with companies like ABB Ltd. (ABBNY) and Symbotic Inc. (SYM) leading in logistics-related AI. Stock prices for these major firms have surged, limiting their growth potential.

A niche area still ripe for growth is government-related automation. Evolv Technologies Holdings Inc. (EVLV), a Boston-based firm valued at around $600 million, is working to enhance the efficiency of security checks using artificial intelligence. Their system scans individuals for weapons without requiring them to empty their pockets, allowing for a tenfold increase in processing speed compared to traditional methods. The Transportation Security Administration (TSA) is currently testing this innovative technology at select airports, and it boasts thousands of clients, including stadiums and schools.

Shares of Evolv remain relatively inexpensive, suggesting a strong upside potential if the trials with the TSA yield positive results, with estimations of fivefold or greater growth if they succeed.

Small-Cap Pick for 2025 No. 2: The Biggest Smallest Loser

This week, Louis also highlighted one of his preferred choices for balanced returns: Eli Lilly and Co. (LLY). He explains:

Eli Lilly is a well-known drug manufacturer, developing more than 100 drugs…

Eli Lilly’s Growth in Diabetes Treatments and the Race for Weight-Loss Drugs

Record Demand Drives Revenue Surge for Eli Lilly

Eli Lilly and Company (LLY) has been making headlines as the demand for its diabetes and weight-loss medications, Mounjaro and Zepbound, continues to rise. Recently, the company’s second-quarter revenue increased by 36%, highlighting its strong market position.

The GLP-1 weight-loss drug market is projected to reach $170 billion by 2030. Due to its first-mover advantage, Eli Lilly is expected to capture a significant share of this burgeoning market. However, it’s crucial to consider what the term “risk-adjusted returns” means for investors. As a large company, Eli Lilly may find it challenging to deliver substantial growth, with an additional $10 billion in sales potentially resulting in only a 12% increase in market value. This context emphasizes the importance of evaluating alternatives.

Emerging Competitors in the GLP-1 Landscape

Several smaller biotech companies are springing up, presenting attractive opportunities in the GLP-1 space:

- Viking Therapeutics Inc. (VKTX). Based in San Diego, Viking is rapidly advancing its weight-loss drug candidate, which has completed Phase 2 trials and is set to enter Phase 3 as early as 2025. Market analysts suggest this company’s aggressive development pace positions it well, with a current market cap of $7.2 billion.

- Zealand Pharma A/S (ZLDPF). This Danish biotech firm also competes closely with Eli Lilly, having one candidate in Phase 3 trials and two in Phase 2 trials. With a market cap of $8.6 billion, it offers stability but has lower potential for high returns.

- Structure Therapeutics Inc. (GPCR). Valued at $2.4 billion, Structure focuses on oral weight-loss medications. Although its trial data won’t be available until late 2025, its advancement in oral drug development makes it an appealing acquisition target for bigger companies.

- Altimmune Inc. (ALT). This $400 million firm is nearing the end of Phase 2 trials of Pemvidutide, its GLP candidate. While initial weight loss results were less than those offered by newer drugs, they still surpass older treatments.

- Terns Pharmaceuticals Inc. (TERN). At a $700 million valuation, Terns is in the earliest stages, with its drug candidates progressing through Phase 1 trials. However, its diversified pipeline may lead to innovative solutions outside of the GLP-1 category.

These companies present an alternative to Eli Lilly and its main competitor, Novo Nordisk, both established players in the weight-loss market. While investing in these smaller firms entails higher risks, they also offer the potential for greater rewards.

Nuclear Energy Investments on the Rise

In a surprising turn, Luke reports that nuclear energy stocks may present a lucrative investment opportunity.

Last week, Microsoft (MSFT) partnered with Constellation Energy (CEG) to revive the Three Mile Island nuclear power plant. Microsoft plans to purchase energy from the reactivated plant for the next 20 years to support its AI data centers.

This move signals Microsoft’s confidence in nuclear energy’s safety and its critical role in the ongoing AI boom.

The biggest player in nuclear is Cameco Corp. (CCJ), a leading uranium producer valued at $21 billion. However, its large size limits growth potential. Also noteworthy are BWX Technologies Inc. (BWXT) with an $11 billion market cap and NuScale Power Corp. (SMR), valued at $2.9 billion but currently facing regulatory challenges.

Uranium exploration firms are also worth considering. My top recommendation is Uranium Energy Corp. (UEC), valued at $2 billion and ready for extraction with two important projects in South Texas and Wyoming, potentially holding up to 100 million pounds of uranium. Recent insider buying and a 15% boost in projected revenues for 2027 due to rising uranium prices make it a compelling option.

Tesla’s Upcoming Robotaxi Reveal

Elon Musk is set to headline Tesla’s upcoming “Robotaxi Day” on October 10. Analyst Dan Ives of Wedbush Securities views this event as a pivotal moment for the company.

With year-to-date sales 2% below last year and increasing competition in the electric vehicle market, Tesla needs to introduce a revolutionary product. Musk appears to be banking on a self-driving robotaxi named the “Cybercab.”

However, Luke has identified an even more promising opportunity than Tesla. This small-cap company could become a significant supplier for Tesla, with the potential for a twentyfold increase from current values.

To discover more about this investment, sign up here for Luke’s presentation, scheduled for tomorrow at 10 a.m. Eastern. Time is running out to secure your spot.

Until next week,

Tom Yeung

Market Analyst, InvestorPlace