“`html

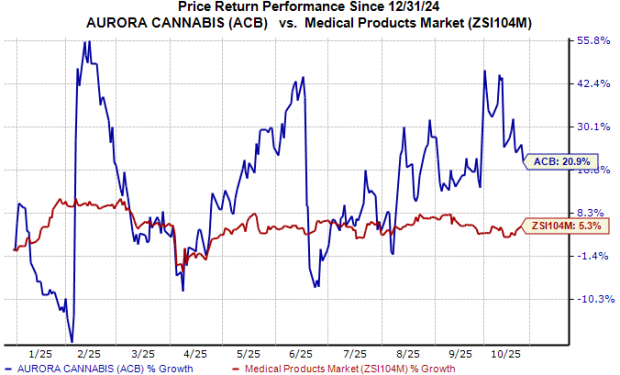

Aurora Cannabis (ACB) shares have surged 21% year-to-date, significantly outpacing the industry average of 5%. For the first quarter of fiscal 2026, Aurora reported total revenues of C$98 million, a 17% year-over-year increase, mostly driven by its medical cannabis segment, which saw a 37% rise in sales, contributing nearly C$65 million. The adjusted gross margin for the medical segment improved to 69% and adjusted EBITDA soared 209% to approximately C$11 million.

Aurora’s future growth is projected to continue, particularly in the international medical cannabis market, which is estimated to exceed $130 billion by 2032. However, the company faces challenges in its recreational segment due to increasing competition and price pressures in Canada, prompting a strategic shift towards higher-margin medical products.

The competitive landscape remains challenging with peers like Curaleaf Holdings and Tilray Brands also pursuing expansion efforts. Despite some encouraging trends, Aurora holds a Zacks Rank #4 (Sell), indicating limited upside potential and elevated risk for investors.

“`