NVIDIA’s CES 2025 Unveilings Highlight AI Innovations and Market Strength

NVIDIA Corporation NVDA, a leader in semiconductor and artificial intelligence (AI) technology, made a significant impact at the Consumer Electronics Show (“CES”) 2025 with its latest product announcements, showcasing its ambitious vision for future advancements. As NVIDIA solidifies its hold in sectors like AI hardware, robotics, and autonomous driving, investors are weighing their options on whether to hold, buy, or sell their shares.

Currently, maintaining NVIDIA stock seems to be a prudent decision, given the company’s promising growth trajectory and its commanding presence in crucial technology areas.

NVIDIA’s Innovations at CES 2025

During CES 2025, NVIDIA introduced several pioneering products that signify its intention to reshape the AI landscape. Chief among these was Project DIGITS, a compact AI supercomputer that utilizes NVIDIA’s Grace Blackwell Superchip. With the ability to support AI models containing up to 200 billion parameters, this device, set for release in May 2025 at a price of $3,000, significantly broadens AI access for small businesses and individuals, greatly increasing NVIDIA’s potential customer base.

Another noteworthy development is Mega, an Omniverse Blueprint that enhances industrial AI by allowing factories and warehouses to use digital twins for simulating and streamlining operations. This innovative framework integrates AI and robotics, providing a software-centric approach to industrial automation. By leveraging NVIDIA’s Isaac, Omniverse, and Cloud Sensor RTX APIs, Mega allows partners like KION Group and Accenture Plc ACN to improve supply chain efficiency, warehouse automation, and overall productivity, signaling a major advancement in manufacturing and logistics.

In the automotive realm, NVIDIA has collaborated with Toyota Motor Corporation TM to improve automated driving systems via its Drive AGX Orin supercomputer. This partnership emphasizes NVIDIA’s strategic push into the expanding multi-trillion-dollar autonomous vehicle sector. Furthermore, the introduction of the RTX Blackwell GPU family, including the flagship RTX 5090, cements NVIDIA’s role as a frontrunner in high-performance computing and AI-focused graphics.

Strong Financials Support NVIDIA’s Growth

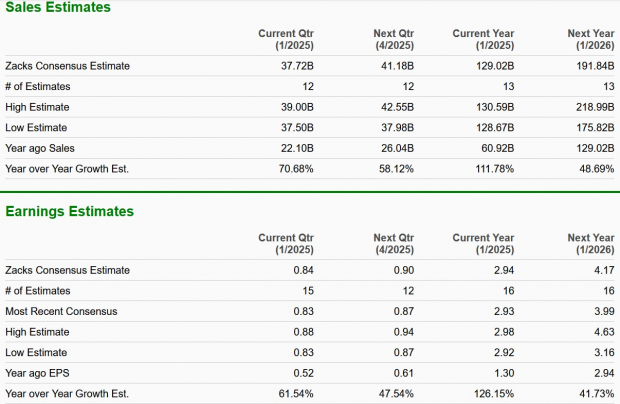

NVIDIA’s recent financial performance showcases its industry dominance. In the third quarter of fiscal 2025, revenues surged 94% year over year, with non-GAAP earnings per share increasing an impressive 103%. Expectations for the fourth quarter indicate projected revenues of $37.5 billion, reflecting a substantial rise from $22.1 billion during the same period last year.

The company’s lead in AI hardware, featuring GPUs and system-on-chip (SoC) technologies, positions it well to tap into the rapidly growing markets of AI, robotics, and autonomous vehicles. These sectors are anticipated to expand significantly over the next ten years, bolstering NVIDIA’s revenue outlook. Consensus estimates for NVIDIA’s fiscal 2025 and 2026 revenues and earnings suggest continued robust growth.

Image Source: Zacks Investment Research

A solid balance sheet further enhances investor confidence. By the end of the third quarter of fiscal 2025, NVIDIA held $38.4 billion in cash. Throughout the first three quarters of this fiscal year, the company generated $47.5 billion in operating cash flow and $45.2 billion in free cash flow. Such financial strength supports ongoing innovation while allowing NVIDIA to explore new opportunities in a changing market.

Valuation Concerns Persists Amid Growth

NVIDIA started strong in 2025, rallying 11.3% in the first three trading days, following a remarkable 171.2% gain throughout 2024. Over the past year, the stock has surged 186.1%, vastly outperforming the Zacks Computer and Technology sector, which saw a 38.1% increase. NVIDIA’s shares also eclipsed those of rival Advanced Micro Devices, Inc. AMD, whose performance fell by 11.3% during the same period.

One-Year Price Return Performance

Image Source: Zacks Investment Research

Despite this impressive showing, NVIDIA’s stock valuation has reached high levels. Currently, shares reflect a forward 12-month price-to-earnings (P/E) ratio of 36.58X, which is significantly above the sector’s average of 27.28X. This elevated valuation raises concerns about limited short-term growth potential for NVDA stock.

Image Source: Zacks Investment Research

Final Thoughts: Hold NVIDIA for Now

The announcements made by NVIDIA during CES 2025 reaffirm its status as a pioneer in technology. With its revolutionary advancements in AI, robotics, and autonomous vehicles, the company’s future growth looks promising. Nonetheless, its current high valuation gives reason for caution in the near term.

For long-term investors, maintaining a position in NVIDIA stock is advisable. As the company continues to innovate and expand, those who exercise patience are likely to see considerable rewards over time. Currently, NVDA stock holds a Zacks Rank #3 (Hold), recommending caution. You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks with Potential for Big Returns

These stocks have been carefully selected by a Zacks expert as the top picks expected to gain +100% or more in 2024. While not every selection may succeed, previous recommendations have achieved returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Most stocks highlighted in this report are currently flying under Wall Street’s radar, creating a valuable opportunity for early investors.

For insights on these 5 potential home runs, click here >>

Stay updated with the latest recommendations from Zacks Investment Research. You can download the report on the 7 Best Stocks for the Next 30 Days for free.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Accenture PLC (ACN): Free Stock Analysis Report

Toyota Motor Corporation (TM): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

For the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.