“`html

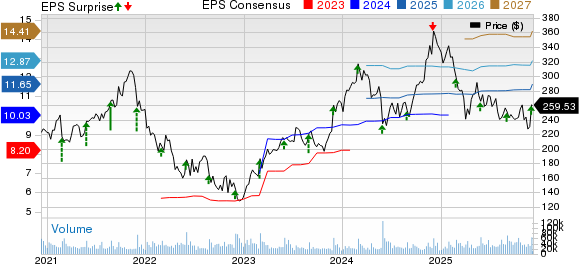

Salesforce, Inc. (CRM) reported its third-quarter fiscal 2026 results on December 3, which saw a 9.3% rise in share prices post-release. The company achieved non-GAAP earnings per share (EPS) of $3.25, exceeding the Zacks Consensus Estimate by 14.04% and reflecting a year-over-year increase of 34.9%. Fiscal third-quarter revenues totaled $10.3 billion, matching consensus expectations and showing a 10% year-over-year growth.

The company attributes its growth to its go-to-market strategy, customer success focus, and the integration of generative artificial intelligence (AI) into its products. AI-driven offerings, particularly Agentforce and Data Cloud, generated $1.4 billion in recurring revenues, marking a 114% increase year-over-year, with Agentforce alone bringing in $540 million, a 330% growth from the previous year. Despite these advancements, Salesforce is experiencing a slowdown in sales growth, with revenue increasing by just 8.7% year-over-year in the first nine months of fiscal 2026.

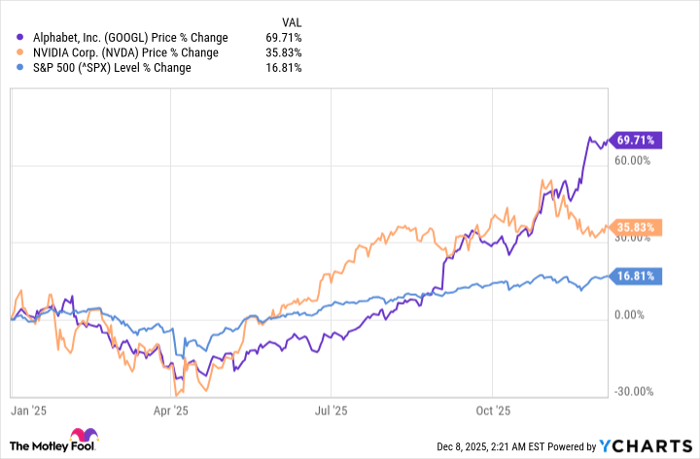

Salesforce’s stock has dropped 21.9% year-to-date, while major competitors like Microsoft and Oracle have seen gains of 34.3% and 16.6%, respectively. The company currently has a Zacks Rank of #3 (Hold), indicating a cautious approach amid slowing growth and shifting enterprise spending habits.

“`