United Parcel Service (UPS) shares fell 10.57% to $90.84 on July 29, 2025, following an earnings miss and a year-over-year revenue decline. In Q2 2025, UPS reported earnings of $1.55 per share, slightly below expectations, while revenues reached $21.2 billion, surpassing estimates but down 2.7% from the previous year. The company has not provided full-year guidance due to ongoing macroeconomic uncertainties.

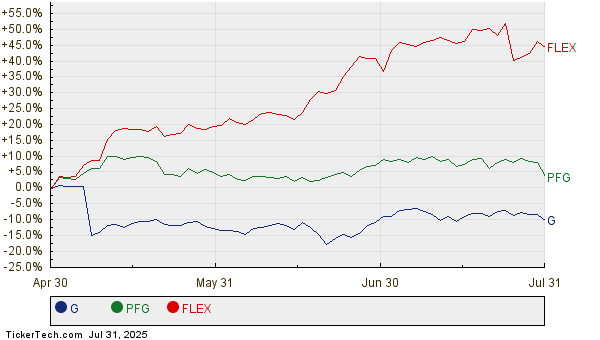

Despite capital expenditures projected at $3.5 billion for 2025, UPS is facing challenges, including a 3.8% decline in average daily volumes in the first half of 2025, driven by a slowdown in U.S. consumer sentiment and ongoing tariff issues. Year-to-date, UPS shares have dropped 28%, underperforming its industry and rivals like FedEx. The consensus estimate for 2025 earnings has been revised down to $7.03 per share, indicating an 8.9% reduction compared to the previous year.

UPS’s elevated dividend payout of $1.64 per share prompts questions about its sustainability amid declining free cash flow, which was $6.3 billion in 2024 against expected dividend payments of $5.5 billion. The company is taking steps to streamline operations, including workforce reductions and shutting down facilities, but near-term economic challenges remain significant.