“`html

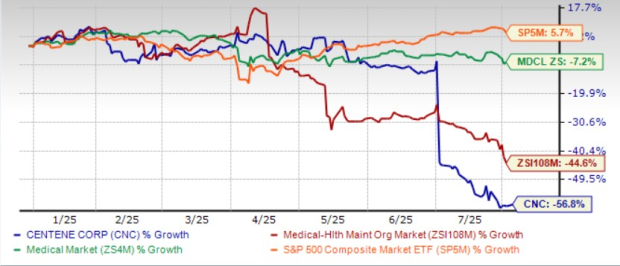

Centene Corporation (CNC) shares have plummeted 56.8% year to date, marking a significant underperformance compared to its industry, sector, and the Zacks S&P 500 composite. The company reported its first quarterly loss in over a decade for Q2 2025, largely driven by elevated healthcare utilization and rising medical costs, leading to a health benefits ratio (HBR) of 93%. Operating expenses reached $49.2 billion during the same period, a 27.4% year-over-year increase.

Due to these challenges, Centene has revised its 2025 earnings per share guidance from above $7.00 to approximately $1.75. The company is also facing a decline in membership within its Medicaid and Medicare Advantage lines, while its long-term debt stood at $17.6 billion as of June 30, 2025, surpassing cash and cash equivalents of $14.5 billion.

Analysts project a 70% decline in earnings for 2025, with a subsequent 51% increase expected in 2026. The Zacks Rank for Centene is currently #5 (Strong Sell), indicating a cautious outlook amid rising operational costs and unfavorable market conditions stemming from the recently enacted One Big Beautiful Bill Act.

“`