CoreWeave to Announce Q1 2025 Earnings Amidst Competitive AI Landscape

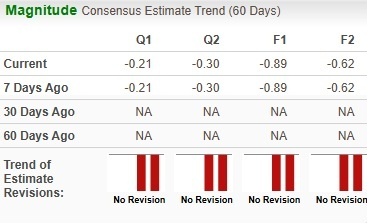

CoreWeave, Inc. (CRWV) is set to release its first-quarter 2025 results on May 14, after the market closes. The Zacks Consensus Estimate anticipates a loss of 21 cents per share, with this figure remaining unchanged over the past week. Moreover, total revenue for the quarter is projected to be $850.4 million.

Image Source: Zacks Investment Research

This marks CoreWeave’s inaugural earnings release following its transition to a publicly traded company on March 28, 2025.

Analysis of CRWV’s Q1 Projections

The results are not expected to beat earnings estimates according to our model. Typically, a positive earnings surprise is more likely with a combination of a positive earnings surprise percentage (ESP) and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold). Currently, CRWV holds an earnings ESP of 0.00% and a Zacks Rank of #3 (Hold).

Key Considerations Ahead of CRWV’s Q1 Earnings

CoreWeave is an AI-focused hyperscaler company specializing in scalable cloud solutions designed for generative AI applications. The company operates an expansive data center network across the United States and Europe, boasting infrastructure that is tailored for AI workloads, unlike traditional providers whose platforms were originally designed for other applications. A partnership with NVIDIA Corporation (NVDA) for implementing advanced GPU technologies fortifies CoreWeave’s position in the market.

The rapid growth in AI technology has intensified competition in the tech industry, with companies investing heavily in AI infrastructure. This rising demand for AI services is likely to support CoreWeave’s revenue growth.

CoreWeave’s cloud platform operates through a distributed network of data centers, which connect to major metropolitan areas using low-latency connections. As of December 31, 2024, CoreWeave operated 32 data centers housing over 250,000 GPUs fueled by more than 360 MW of active power.

In May 2025, CoreWeave completed the acquisition of Weights & Biases, enhancing its cloud capabilities. Additionally, it secured an expansion of its credit facility from $650 million to $1.5 billion through agreements with financial institutions like JP Morgan and Wells Fargo, extending the maturity date. These funds will be directed towards enhancing its AI cloud infrastructure.

Despite these advancements, CoreWeave faces formidable competition from major players like Amazon (AMZN), Microsoft (MSFT), and Alphabet. Together, Amazon Web Services and Microsoft’s Azure dominate over half of the cloud infrastructure market. The customer concentration is another risk for CoreWeave; 77% of its total revenues in 2024 came from just two customers, making them vulnerable to significant revenue fluctuations if those clients shift to competitors.

CRWV Stock Performance Overview

CRWV shares have increased by 34% in the past month, outperforming the 12.8% rise in the Zacks Internet Software industry and the 4.3% gain in the S&P 500 index. The broader Computer and Technology Sector rose by 6.5% during this timeframe.

Price Performance

Image Source: Zacks Investment Research

In comparison with peers like Microsoft and Amazon, which reported gains of 15.8% and 14.6% respectively, CoreWeave continues to show strength.

Investment Outlook for CRWV

The AI infrastructure market is flourishing in 2025 due to a surge in demand for GPU-intensive applications. This presents a favorable outlook for CoreWeave.

Nevertheless, the company faces significant competition from Azure, AWS, and Google Cloud. Issues such as customer concentration and high capital expenditures related to data center expansion remain important factors to consider.

Investment Recommendations Ahead of Q1

With robust demand trends, CoreWeave presents a captivating investment opportunity. However, potential investors should be cautious of competitive pressures and capital risks.

Currently, CRWV holds a Zacks Rank of #3, suggesting that investors may want to wait for a more optimal entry point. Existing investors can maintain their positions as growth prospects appear promising.