Apple Inc. (NASDAQ:AAPL) is set to report its fiscal Q3 2025 earnings on Thursday, July 31. The consensus estimates predict earnings of approximately $1.42 per share, indicating a slight year-over-year increase. Revenue is expected to reach $88.6 billion, a 3.3% growth from the previous year, driven mainly by Apple’s high-margin services segment. However, hardware sales, particularly iPhone sales, may decline ahead of the iPhone 17 launch in September, although new budget-friendly models could provide some support.

During the June quarter, Apple may face up to $900 million in additional costs attributed to tariffs, as warned by CEO Tim Cook. While there have been indications of easing U.S.-China trade tensions, a potential 25% import tariff on iPhones remains a concern. Apple’s current market capitalization stands at $3.1 trillion, with the past twelve months yielding $400 billion in revenue and $97 billion in net income.

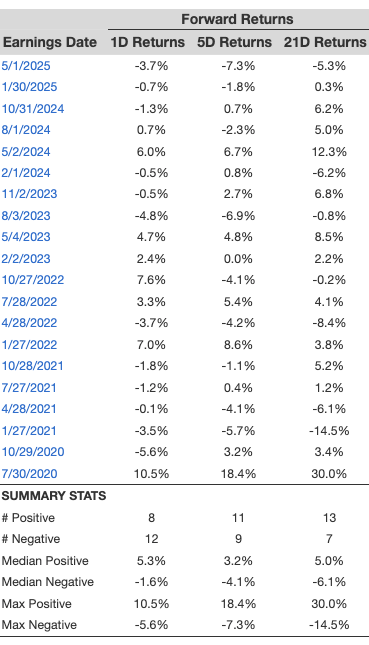

Historically, Apple has seen positive one-day returns post-earnings about 40% of the time, with recent averages increasing to 50% over the last three years. Observations indicate a median increase of 5.3% for positive returns and a median decrease of -1.6% for negative returns.