The Trade Desk Set to Release Q1 2025 Earnings Tomorrow

The Trade Desk, Inc. (TTD) will report its first-quarter 2025 earnings on May 8, after the market closes.

The Zacks Consensus Estimate for TTD’s earnings in the upcoming quarter is set at 25 cents, down from 26 cents in the same quarter last year. This estimate was revised downward by 1 cent over the past 60 days. Additionally, the consensus for total revenues stands at $574.3 million, reflecting a 16.9% year-over-year decrease.

Despite the revenue estimate, TTD anticipates generating at least $575 million, which would indicate a 17% growth compared to the previous year. This optimistic forecast factors in a slight setback from the 2024 leap year and reduced political ad spending compared to Q1 2024.

In recent quarters, TTD has consistently exceeded Zacks Consensus Estimates, achieving an average earnings surprise of 7.68%. (Check the latest EPS estimates and surprises on Zacks earnings Calendar.)

Image Source: Zacks Investment Research

Forecast for TTD’s Q1 Earnings

Our proven model indicates uncertainty around an earnings beat for TTD this quarter. A positive earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) typically increases the likelihood of exceeding earnings estimates; however, this does not apply in this case. TTD currently has an earnings ESP of -9.45% and a Zacks Rank of #5 (Strong Sell). For additional insights, you can explore today’s top Zacks #1 Rank stocks.

Trade Desk Price and EPS Surprise

The Trade Desk price-EPS surprise | The Trade Desk Quote

Key Factors to Watch for TTD’s Q1 Earnings

Although TTD benefits from strong demand for its ad-buying platform, it faces challenges related to shifting market dynamics and competitive pressures. The digital advertising sector is highly competitive, dominated by players like Alphabet (GOOGL) and Amazon (AMZN), which can impact TTD’s market presence. Furthermore, ongoing macroeconomic uncertainties and rising trade tensions could affect advertising budgets.

TTD’s transition from its Solimar to Kokai platform is expected to be completed by the end of 2025. However, it currently operates with both platforms, presenting operational challenges.

Despite these hurdles, growth in digital spending, particularly in Connected TV (CTV) and retail media, is anticipated to support TTD’s revenue in the upcoming quarter. TTD reported over $12 billion in advertising spend on its platform in Q4 2024, indicating sustained growth in advertiser interest. The shift towards CTV contributes significantly to this trend.

In Q4 2024, TTD enhanced its support for UID2, a privacy-centric identity solution aimed at replacing third-party cookies. This initiative is designed to enhance the relevance of digital advertising while ensuring user control and privacy. Major streaming platforms such as Disney, Netflix, Paramount, Peacock, Fox, and Max are heavily investing in programmatic advertising and adopting UID2, which may improve precision targeting for advertisers and aid in CTV advertising growth worldwide.

Strategic efforts in international expansion, organizational restructuring, and a focus on operational effectiveness are expected to bolster TTD’s performance.

Recent Stock Performance

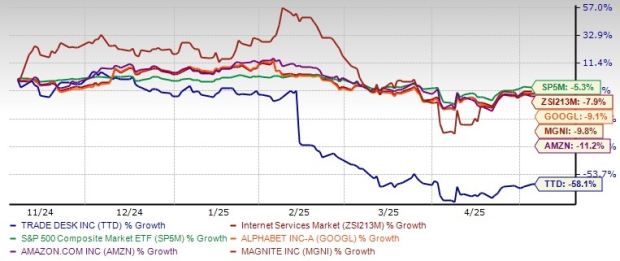

TTD shares have fallen 58.1% in the last six months, significantly underperforming its Internet Services industry, which declined by 7.9%, and the Zacks S&P 500 composite, which saw a 5.3% decline.

Price Performance

Image Source: Zacks Investment Research

Compared to its digital advertising peers, TTD has underperformed against Alphabet and Amazon, which have seen respective declines of 9.1% and 11.2%. Similarly, Magnite (MGNI) has lost 9.8% over the same period. Magnite operates as a supply-side platform, facilitating publishers in managing and selling their ad inventory across various formats.

Valuation Insights for TTD

Valuation metrics indicate TTD is trading at a premium, with a forward 12-month Price/Sales ratio of 9.08 compared to the industry average of 4.89.

Image Source: Zacks Investment Research

Investment Perspective on TTD Stock

TTD’s robust portfolio and expanding partner network are significant strengths. The company is pursuing growth through strategic measures, such as a full transition to the Kokai platform and increased penetration in CTV and retail media, along with advancements in AI-driven programmatic solutions.

Nonetheless, macroeconomic uncertainties and fierce competition from leading firms like Google and Amazon continue to challenge TTD’s market position. Additionally, regulatory scrutiny surrounding data privacy and evolving consumer data practices could disrupt established audience-targeting techniques.

Recommendations for TTD Stock Investors

Given TTD’s recent share price performance and negative earnings ESP, the company may report disappointing first-quarter results. With a Zacks Rank of #5, investors might want to consider selling this stock from their portfolios.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.