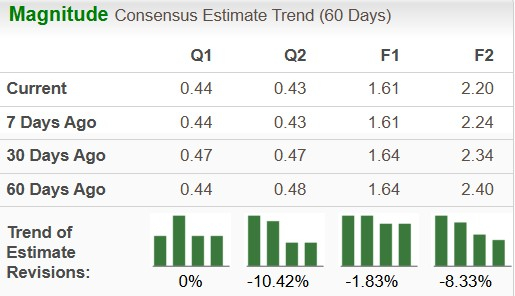

**Tesla Inc. (TSLA)** is set to announce its fourth-quarter 2025 results on January 28, with earnings estimated at 44 cents per share on $25 billion in revenue. This represents a projected year-over-year earnings decline of 40% and a revenue contraction of 3%. The earnings forecast has been revised downward by 3 cents in the last month.

In Q4 2025, Tesla sold 418,227 vehicles, a 16% decline from the previous year, below the expected 448,384 units. The drop has been attributed to the withdrawal of federal EV tax credits and heightened competition from Chinese manufacturers. In contrast, Tesla’s energy generation and storage unit achieved record deployments of 14.2 GWh, leading to an anticipated 11% increase in revenue from this segment.

For the full year 2025, TSLA’s revenue is estimated at $95 billion, suggesting a 3% decline compared to 2024. The consensus for EPS stands at $1.61, reflecting a 33% decrease year-over-year. Tesla faced challenges in meeting expectations across its automotive unit, signaling ongoing pressure in the EV market.