Comparing Netflix and Disney: Who’s the Better Investment Now?

In the competitive realm of streaming entertainment, Netflix (NFLX) and Disney (DIS) stand out as major players, each bringing distinct advantages to attract subscribers. Netflix, known as the original streaming innovator, enjoys a significant number of global subscribers, exceptional content production capabilities, and a robust history of innovation. Disney+, although introduced later, capitalizes on Disney’s extensive content library and popular franchises that include Marvel, Star Wars, and Pixar.

Amid this intense rivalry, investors may wonder which streaming giant presents a more promising investment opportunity.

Let’s analyze the key fundamentals of both companies to evaluate their current investment viability.

The Bull Case for Netflix

Netflix has solidified its position as the premier leader in the streaming sector. In the fourth quarter of 2024, the company achieved a historic milestone with 18.91 million paid net subscriber additions, marking the largest quarterly increase in its history. This growth brought its global subscriber base to an impressive 301.63 million, reflecting Netflix’s ongoing appeal and expansion in a saturated market.

The financial results reinforce this strength, as Netflix reported a 16% year-over-year revenue increase in the fourth quarter along with a remarkable 52% rise in operating income. For the entire year of 2024, Netflix saw significant achievements with a total revenue growth of 16%, an operating margin of 27%—up six percentage points from 2023—and operating income surpassing $10 billion for the first time. Furthermore, Netflix’s strong cash position includes approximately $7 billion in free cash flow for 2024, offering considerable flexibility for content investments and returning wealth to shareholders.

From a content perspective, Netflix’s strategy continues to generate successes across various formats. Notably, the second season of Squid Game is set to become one of its most-viewed original series. The company’s venture into live programming, starting with high-profile events like the Jake Paul vs. Mike Tyson fight, achieved record streaming numbers, becoming the most-watched sporting event ever. With anticipated returns of flagship series such as Wednesday and Stranger Things in 2025, Netflix maintains its focus on sustaining subscriber engagement.

Despite these robust fundamentals, Netflix confronts challenges ahead. Although advertising revenue is anticipated to double by 2025 and operating margins are projected to reach 29%, much of this growth seems already reflected in its current stock price. Potential risks include currency pressures, increasing competition, and concerns over subscriber retention after recent price hikes. While future flagship shows and live sports initiatives could enhance long-term value, investors may want to be patient for a more favorable entry point.

For 2025, Netflix has projected revenues between $43.5 billion and $44.5 billion. The Zacks Consensus Estimate suggests revenues of $44.42 billion, translating to year-over-year growth of 13.89%. Meanwhile, the earnings estimate from Zacks shows a modest downward adjustment of 0.3% over the last month to $24.51 per share, indicating market wariness regarding Netflix’s growth potential.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks earnings Calendar.

The Dissertation for Disney Stock

Disney emerges as a strong investment choice for those seeking a diversified entertainment company. Its various segments go beyond just streaming; combining Disney+ with Hulu, the company has reached 178 million subscribers. However, Disney’s core strengths also include its theatrical releases, theme parks, traditional cable, and merchandise.

In 2024, Disney’s theatrical business delivered impressive results by becoming the first studio to surpass $5 billion at the global box office post-pandemic. Hits like Inside Out 2, Deadpool & Wolverine, and Moana 2 contributed significantly to this success. The revenue generated from these theatrical releases adds valuable content that ultimately feeds back into Disney+, showcasing effective monetization strategies across multiple platforms. Upcoming releases such as Captain America: Brave New World and new films in the Fantastic Four and Avatar franchises promise continued box office success.

Disney’s streaming approach is also evolving. The integration of an ESPN tile into Disney+ enhances its value proposition by giving subscribers access to ESPN+ sports content. This differentiation, particularly the appeal of live sports, sets Disney+ apart from Netflix. Additionally, the rollout of features such as a 24/7 Simpsons channel aligns with the preferences of traditional television audiences.

The resilience of Disney’s theme park business highlights its growth potential, especially with the upcoming 70th anniversary of Disneyland. This multi-faceted revenue model allows Disney to pursue various growth avenues while funding content development across its platforms.

According to the Zacks Consensus Estimate, Disney anticipates fiscal 2025 revenues of $94.63 billion—a 3.58% increase from the previous year, with earnings projected at $5.48 per share, reflecting a 10.26% rise. These estimates have remained stable over the past month.

Image Source: Zacks Investment Research

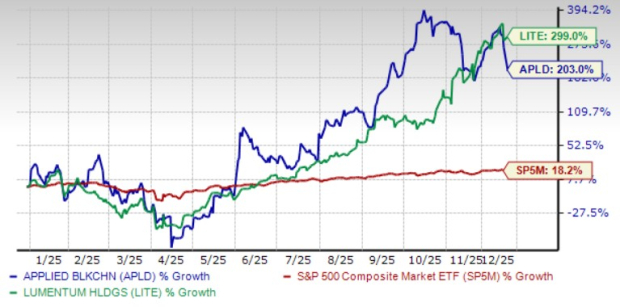

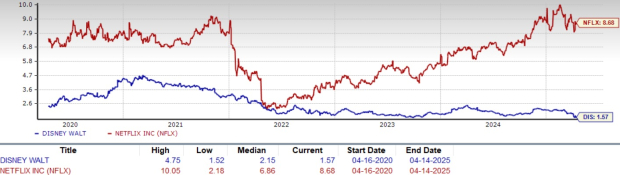

Valuation and Price Performance Comparison of Stocks

Evaluating these streaming giants through valuation metrics reveals Disney holds several advantages. Its forward price-to-sales (P/S) ratio of 1.57X presents a considerably more appealing option compared to Netflix’s higher valuation ratios. This indicates that Disney represents better relative value for investors seeking exposure within the streaming sector, particularly given its diversified business model and valuable intellectual property.

Disney’s Stock Valuation Shows More Promise Than Netflix

Image Source: Zacks Investment Research

In terms of price performance, Disney shows potential advantages owing to its expansive platform and diverse revenue streams, positioning it favorably against Netflix within the streaming market landscape.

Netflix’s Stock Surge vs. Disney’s Growth Potential: A Financial Analysis

From a performance perspective, Netflix has emerged as a significant player in the market recently. Its stock has skyrocketed by 50.8% over the past year, significantly outperforming both Disney and the overall market. Over the longer term, Netflix boasts a remarkable five-year return of 112.1% and a staggering ten-year return of 1,040.6%. This impressive track record showcases its ability to generate shareholder value. However, such strong performance could limit further upside potential when compared to Disney’s opportunities for expansion.

1-Year Stock Price Performance

Image Source: Zacks Investment Research

In terms of operating margins, Netflix currently leads with 27%, while Disney’s streaming segment is still in pursuit of profitability. Nevertheless, Disney’s extensive entertainment ecosystem presents unique advantages for creating long-term value that are not fully represented in its current share price.

Disney’s Superior Investment Opportunity

Netflix exhibits excellent operational capabilities with record subscriber growth and profitability. In contrast, Disney offers a more persuasive investment case due to its favorable valuation and diverse revenue streams. The opportunities inherent in Disney’s streaming platform have yet to be completely tapped. With its powerhouse content franchises, strategic sports partnerships, ongoing theme park developments, and theatrical successes, Disney has multiple growth channels beyond just streaming.

With a forward price-to-sales (P/S) ratio that is only one-fifth of Netflix’s, Disney presents considerably better upside potential as it fine-tunes its streaming strategy while capitalizing on its broad entertainment ecosystem. For investors focused on long-term value during the streaming war, Disney stands out as the more promising opportunity. Both DIS and NFLX currently hold a Zacks Rank #3 (Hold).

You can see the full selection of today’s top Zacks Rank #1 (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Recently released: Experts have identified 7 elite stocks from the current pool of 220 Zacks Rank #1 Strong Buys. These stocks are considered “Most Likely for Early Price Pops.”

Historically, since 1988, the complete list has outperformed the market by more than 2X, achieving an average annual gain of +23.9%. It is crucial for investors to take notice of these selected 7 stocks immediately.

For the latest recommendations from Zacks Investment Research, download the report titled 7 Best Stocks for the Next 30 Days. Click to access this complimentary report.

Netflix, Inc. (NFLX): Free Stock Analysis report

The Walt Disney Company (DIS): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.