Netflix (NFLX) and The Walt Disney Company (DIS) are vying for supremacy in the streaming market, with Netflix boasting over 300 million global subscribers and projecting full-year 2025 revenues of $45.1 billion, a 16% increase. In contrast, Disney’s fourth-quarter fiscal 2025 results reveal a Direct-to-Consumer operating income of $352 million, with total Disney+ and Hulu subscriptions reaching 196 million.

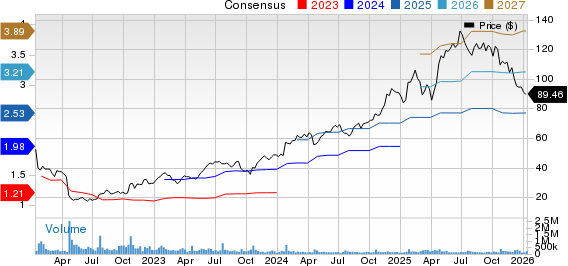

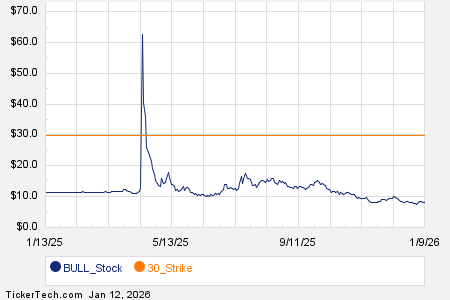

Recent performance shows Netflix shares have dropped 26.6% in the past three months, whereas Disney’s shares have increased by 5.1%. Valuation metrics indicate Netflix trades at a price-to-earnings (P/E) ratio of 27.66x, compared to Disney’s more attractive 17x, suggesting potential upside for Disney as it moves toward sustainable profitability.

In conclusion, Disney emerges as a compelling investment due to its diversified revenue streams and favorable valuation. Investors are advised to watch for optimal entry points as Disney’s multi-year transformation progresses amidst a challenging landscape for Netflix.