Sterling Infrastructure Shows Bullish Signals Amid Market Challenges

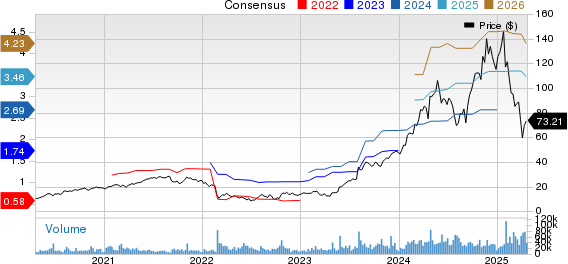

Shares of Sterling Infrastructure, Inc. (STRL) are currently trading above their 50-day simple moving average (SMA), a key technical indicator that suggests a short-term bullish trend. The 50-day SMA functions to smooth out price volatility, allowing investors to better identify the stock’s direction. When a stock trades above this level, it typically indicates upward momentum and potential for continued strength in the near term.

Sterling Price Movement vs. 50-Day Moving Average

Image Source: Zacks Investment Research

As a mid-cap company, Sterling possesses strong prospects thanks to its E-Infrastructure segment’s resilience, solid backlog, a pivot toward high-margin projects, and a commitment to operational efficiency. However, with ongoing market volatility driven by trade policy uncertainties and inflationary pressures, investors are left wondering if STRL has further upside potential.

Price Performance of STRL Stock

Year-to-date, Sterling’s stock has dropped 16.7%, but it has managed to outperform the Zacks Engineering – R and D Services industry’s 18.3% decline. Notably, the stock rallied sharply after its fourth-quarter 2024 earnings results, gaining 14.9% since the release on February 26, despite a difficult macroeconomic environment. During the same period, STRL also outperformed the Zacks Construction sector, which fell 10.2%, and the Zacks S&P 500 Composite, which was down 11.4%. The STRL stock carries a Momentum Score of B.

Moreover, STRL saw a recovery following the announcement of a temporary pause on reciprocal tariffs on April 8, 2024. This was further boosted by a tariff exemption on electronics, including smartphones and computers, announced on April 12, 2024, which is not expected to substantially impact data center capital expenditures.

STRL Vs Industry, Sector & S&P Post Q4 Earnings

Image Source: Zacks Investment Research

What’s Driving Sterling Upward?

E-Infrastructure and Data Center Expansion: Sterling’s E-Infrastructure segment, the largest and most profitable in its lineup, accounted for 44% of total revenues in 2024. This segment has witnessed substantial growth, especially through large-scale, mission-critical projects. Data centers have emerged as a primary growth driver, showcasing a 27% year-over-year increase in E-Infrastructure backlog in 2024. Sterling’s ability to deliver projects ahead of schedule and secure multi-phase contracts has maintained high demand in this segment.

The surge in artificial intelligence technologies has increased the need for sophisticated computing infrastructure, leading to heightened investments in data centers. The ongoing shift toward cloud-based services is driving further demand for data storage and processing. Research from Grand View indicates that the U.S. data center market is projected to grow from approximately $89.9 billion in 2024 to $164.7 billion by 2030, translating to a compound annual growth rate (CAGR) of 10.6% during the 2025–2030 timeframe. This growth outlook is crucial for Sterling as significant customers like Amazon (AMZN) and Meta (META) draw from STRL’s expanding capabilities in data centers and e-commerce distribution centers.

Emphasis on High-Margin Services: Sterling has strategically shifted towards higher-margin service offerings, yielding positive results, particularly within its transportation solutions segment. While revenue in this area was flat in the fourth quarter due to a conscious exit from low-margin contracts in Texas, operating margins significantly improved. Long-term, well-capitalized project wins have shielded the company from concerns regarding potential declines in federal infrastructure spending. In fourth-quarter results, gross profit margins surpassed 21%, and full-year margins reached 20.1%, exceeding earlier projections. Strong project selection and disciplined cost control have facilitated this margin expansion, promoting profitability despite slow revenue growth.

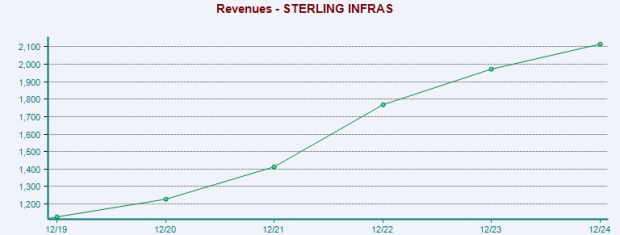

Backlog and Revenue Visibility: Closing out 2024, Sterling reported a backlog of $1.69 billion, bolstered by $138 million in pending awards. Notably, this figure does not include approximately $750 million in future-phase projects, indicating a robust pipeline that supports long-term revenue growth. Sterling has shown consistent revenue expansion in recent years, driven by significant demand across its key segments, as illustrated below.

Image Source: Zacks Investment Research

Sustained Transportation Infrastructure Investment: The transportation sector has been a significant growth driver for Sterling in 2024, supported by ongoing funding from the Infrastructure Investment and Jobs Act (IIJA). The company secured multiple high-value projects in regions such as the Rocky Mountains and Arizona, leading to a 24% increase in transportation revenues, representing 37% of total revenues.

While IIJA-related funding is beginning to stabilize following an initial surge, Sterling has built a transportation backlog that encompasses over two years of work, ensuring growth visibility moving forward. The company anticipates ongoing bidding activity and contract awards throughout 2025, particularly in its core regional markets. Despite concerns regarding potential federal budget adjustments, most of Sterling’s awarded transportation projects are fully funded and progressing, which supports stability in public infrastructure spending and provides a steady workflow.

Sterling’s Headwinds

With key clients such as Amazon, Meta, and Walmart (WMT), any cutback in their capital expenditure forecasts could lead to significant volatility in Sterling’s E-Infrastructure Solutions segment, impacting areas like data centers and large-scale distribution facilities.

Additionally, sharply rising construction costs are expected due to recently enacted tariffs on crucial building materials, including steel and aluminum, which could pose further challenges for the company.

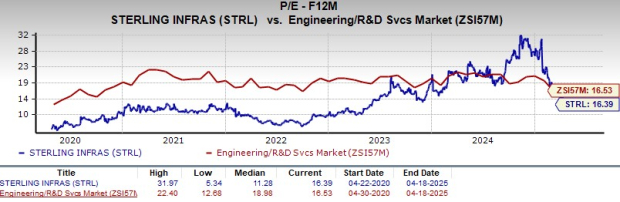

STRL’s Estimate Movement

Sterling has surpassed profit estimates in the last four quarters, achieving an average earnings surprise of 16.2%. The company is currently experiencing upward revisions for its 2025 earnings per share (EPS), which are estimated to grow 34.6% for 2024. (Find the latest EPS estimates and surprises on…

Sterling Infrastructure Stock Shows Promise Amid Challenges

Image Source: Zacks Investment Research

Valuation Insights on Sterling Infrastructure

Currently, Sterling Infrastructure, Inc. (STRL) trades at a discount compared to its industry average. However, it commands a premium relative to its historical valuation metrics, as indicated by its forward 12-month price-to-earnings (P/E) ratio, which is above its five-year average.

Image Source: Zacks Investment Research

Should Investors Buy, Sell, or Hold STRL Stock?

Despite prevailing macroeconomic challenges, Sterling appears as an attractive investment opportunity. Although STRL has experienced volatility this year, its ability to rebound after the fourth quarter earnings report, outperforming both its industry peers and broader market indices, highlights its solid underlying performance. The stock’s position above its 50-day simple moving average (SMA) supports a continuing upward trend.

Several factors are fueling growth for Sterling, particularly its high-margin E-Infrastructure division, which benefits from increasing data center demand. A substantial backlog ensures robust revenue visibility, while a focus on improving operational efficiency and prudent project selection has contributed to margin growth. Despite potential risks, such as tariffs and fluctuations in client capital expenditures, STRL presents a relative valuation discount, combined with positive upward revisions in earnings per share (EPS). With these strong fundamentals and favorable market conditions, STRL is poised for future gains.

Currently, Sterling holds a Zacks Rank #1 (Strong Buy). Investors can view the complete list of today’s Zacks #1 Rank stocks here.

Zacks’ Research Chief Identifies “Stock Most Likely to Double”

Recent analysis from Zacks research highlights 5 stocks with significant potential for 100% or greater growth in the upcoming months. Among these, Director of Research Sheraz Mian points to one standout stock projected to see substantial gains.

This leading stock is one of the most innovative in the financial sector, boasting a rapidly expanding customer base of over 50 million and a diverse array of advanced solutions. This stock is highly anticipated to achieve impressive returns, reminiscent of Zacks’ previous successful picks, such as Nano-X Imaging, which surged by 129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.