“`html

Semiconductor Sector Drives Future Growth Amid Economic Rebound

The Semiconductor – General industry continues to lead technological advancements across various sectors such as HPC, AI, electrification, automation, and IoT. The chips produced allow essential cloud operations and transform data into insights, enhancing corporate efficiency.

Riding the Wave of Semiconductors Despite Economic Concerns

Amid fears of a potential recession, 2024’s outlook has exceeded expectations, significantly supported by the semiconductor industry. This sector remains one of the main pillars stabilizing the moderating economy. Share prices have surged due to a strong growth forecast, particularly for companies like NVIDIA Corp. NVDA and SUMCO Corp. SUOPY, the latter of which is also recommended for monitoring.

Promising Growth Figures Highlight Industry Resilience

Data from WSTS, frequently cited by the Semiconductor Industry Association (SIA), projects global semiconductor sales to rise by 11.2% this year, following a 19% surge in 2024. IDC adds that demand for high-end logic process chips and high-bandwidth memory (HBM) will remain robust, largely driven by AI workloads.

Advanced nodes, or chips with features below 20nm, are set to expand by 12%, maintaining utilization rates above 90%. Most growth is anticipated in Taiwan, the U.S., and Korea. In the realm of mature nodes, utilization is expected to climb from 70% in 2024 to over 75% this year, with wafer production increasing by 7%.

Continued AI Demand Fuels Semiconductor Market Growth

Gartner projects a 13.8% increase in semiconductor sales for this year, following an 18.8% jump in 2024. This growth is primarily due to escalating AI demands and a recovery in electronics production, tempered only by weaknesses in automotive and industrial markets.

The demand for PCs will also thrive, aided by AI advancements and the discontinuation of Windows 10 support. Likewise, the IoT industry is set to expand steadily, driven by improved Internet access and supportive technologies like sensor networks. Future Market Insights anticipates the industrial IoT (IIoT) sector alone will grow at a 12.1% CAGR from 2023 to 2033, while McKinsey predicts global IIoT spending will rise from $290 billion in 2024 to $500 billion in 2025.

AI and IoT Revolutionize Industrial Operations

Together, AI and IoT will keep reshaping industrial operations. AI is expected to spur significant advancements in vehicle electrification, industrial automation, and data center efficiencies. The semiconductor industry appears well-positioned for substantial growth in the coming years.

Geopolitical Strategies and Future Industry Directions

The U.S. government’s focus on reducing reliance on China will influence the future dynamics of the semiconductor sector, particularly concerning national security implications in onshoring projects.

Overview of the Semiconductor – General Industry

The Semiconductor – General sector encompasses a variety of semiconductor devices, both integrated and discrete, including microprocessors, graphics chips, printed circuit boards, and connectivity products. Major players include NVIDIA, Texas Instruments, Intel, and STMicroelectronics.

Key Influences Shaping the Semiconductor Industry

- Artificial intelligence as the main catalyst: AI is driving efficiency and innovation across industries. Companies recognize the urgent need to invest in AI to remain competitive, thereby stimulating semiconductor demand. Factors like data-heavy applications and advancements in machine learning are significant contributors to this trend.

- Macroeconomic and geopolitical factors fueling growth: Decreased interest rates and controlled inflation allow us to focus on specific industry issues, with an inventory imbalance largely resolved. Geopolitical tensions further bolster demand for advanced technologies in defense and infrastructure.

- Short-term challenges persist despite long-term potential: While the long-term outlook is positive due to the industry’s foundational role in technology, there are immediate concerns. The automotive segment faces shifts in consumer preferences, particularly regarding EVs and hybrids, even as segments like ADAS remain in demand.

- Adjustments in semiconductor supply chains: Improvements in supply chain efficiency have reduced costs, yet increased vulnerabilities remain, evidenced during the pandemic. Ongoing adjustments are aimed at reducing dependency on Taiwan and China, with the CHIPS Act supporting domestic manufacturing initiatives.

Evaluating Current Risks in the Semiconductor Market

The Zacks Semiconductor-General Industry falls under the broader Computer and Technology Sector. Holding a Zacks Industry Rank of #195 places it within the bottom 22% of over 250 industries classified by Zacks. This ranking suggests a weakening of near-term prospects, while historically, the top half of Zacks-ranked industries tends to outperform.

“`

Strong Earnings Outlook for Semiconductor Industry Despite Drop in Estimates

The semiconductor industry remains in the top 50% of Zacks-ranked industries, showing that the aggregate earnings outlook is relatively solid. However, the earnings estimates for 2024 have decreased by 45.5% compared to last year. Interestingly, estimates for 2025 have risen by 62.6%. Leading companies like Intel (INTC), STMicroelectronics (STM), and Texas Instruments (TXN) are seeing declines in their 2024 estimates, impacting overall industry performance.

Resilient Stock Market Performance

The Zacks Semiconductor – General Industry has demonstrated robust performance over the past year. It has consistently outperformed both the broader Zacks Computer and Technology Sector as well as the S&P 500 index, widening its lead considerably.

Over the last year, the industry has gained an impressive 118.4%. By comparison, the technology sector increased by 35.1%, while the S&P 500 rose by 25.5%.

One-Year Price Performance

Image Source: Zacks Investment Research

Valuation Factors In Play

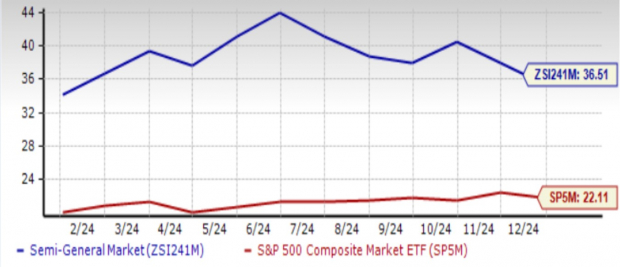

The industry is currently valued at a forward 12-month price-to-earnings (P/E) ratio of 36.51X, which is slightly below its median value of 37.87X from the past year. However, with the S&P 500 trading at 22.11X and the sector at 27.22X, the semiconductor industry seems overvalued.

An interesting trend has emerged over the past decade: the industry has shown improvement, especially after mid-2022, fueled by increased demand for technology in areas like AI and autonomous driving.

Forward 12 Month Price-to-Earnings (P/E) Ratio

Image Source: Zacks Investment Research

Stocks Worth Considering

With prospect of further interest rate cuts, the industry remains appealing, likely attracting more investment into risky assets. Key players in this sector are fundamental to modern computing and may continue to thrive, despite concerns over current valuations. Notably, we have our eyes on NVIDIA and SUMCO.

NVIDIA Corp. (NVDA): Based in Santa Clara, CA, NVIDIA specializes in graphics, compute, and networking solutions. Its graphics processing units (GPUs) lead the gaming sector and are pivotal in data centers and automotive technology today.

The explosive growth driven by generative AI has significantly increased computing requirements. NVIDIA’s energy-efficient accelerated computing solutions are increasingly chosen by companies to enhance their AI capabilities. Their offerings, including GPUs and AI enterprise software, are essential for various sectors such as automotive and healthcare.

The data center segment is performing exceptionally well, driven by heightened demand from cloud-service providers and enterprise software companies. NVIDIA also has strong momentum in professional visualization and automotive sectors through partnerships with brands like Mercedes-Benz and Audi.

In addition to growth, NVIDIA is committed to returning value to its shareholders through dividends and buybacks. In the past 60 days, the Zacks Consensus Estimate for its fiscal year ending January 2025 rose by 12 cents (4.3%), with the subsequent year’s estimate up by 38 cents (10%). The stock holds a Zacks Rank #2 (Buy) and has surged by 163.7% in the past year.

Price & Consensus: NVDA

Image Source: Zacks Investment Research

SUMCO Corp. (SUOPY)

Tokyo-based SUMCO, formed from Sumitomo Mitsubishi Silicon Corp., produces silicon wafers for semiconductor manufacturers globally, including notable clients TSMC and Samsung.

Recently, SUMCO noted a slight recovery in demand for its 300mm wafers, primarily driven by AI applications. However, softness persists in the 200mm market, reflecting broader industry challenges linked to sluggish recovery across consumer and industrial markets.

The company is leveraging AI to enhance its productivity while investing in R&D to sustain its competitive edge in chip manufacturing. Analysts recently adjusted their 2024 estimates upward by 7 cents (6.5%) and their 2025 estimates by 73 cents (41.2%). Despite this, the Zacks Rank #3 (Hold) stock has dropped 47.5% over the past year.

One-Year Price Performance: SUOPY

Image Source: Zacks Investment Research

Industry Insights: Leading Picks for Growth

A group of five Zacks experts has identified top stock picks, featuring one that stands out with the potential to double your investment. This selected stock focuses on serving millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter. As its values recently retracted, it could be an opportune time to invest. While not every pick may prove to be a winner, this stock has the momentum to exceed past Zacks successes, such as Nano-X Imaging, which increased by 129.6% in less than nine months.

Free: See Our Top Stock And 4 Runners Up

Intel Corporation (INTC): Free Stock Analysis Report

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

STMicroelectronics N.V. (STM): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

SUMCO (SUOPY): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.