“`html

Canada Goose Holdings Inc. (GOOS) reported strong financial performance for Q1, posting an earnings per share (EPS) of C$0.33 on May 21, exceeding the consensus estimate of C$0.22. The company also delivered revenue of C$384.6 million, surpassing forecasts of C$366.9 million, primarily driven by growth in its direct-to-consumer (DTC) channel. This marks the fifth consecutive quarter of earnings surprises for the company.

Canada Goose’s adjusted EBIT rose to C$59.7 million from C$40.1 million year-over-year, with its gross margin increasing to 71.3% from 66.7%. Despite this positive performance, management did not provide financial guidance for fiscal 2026 due to macroeconomic uncertainties. The company’s market value stands at $1.3 billion with a Forward Price-to-Earnings (PE) ratio of 16.

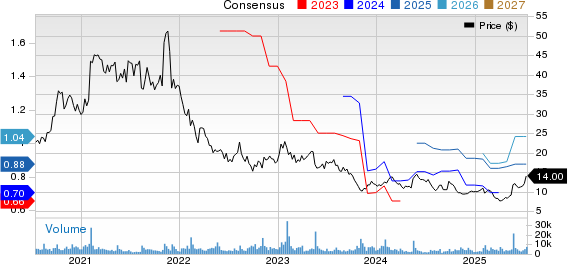

Barclays recently upgraded Canada Goose to Equal Weight from Underweight, raising its price target to $14 from $11, citing an improved margin structure and early signs of brand momentum. The stock has doubled since its April lows, pushing investors to question whether it might be time to take profits or if further gains are on the horizon.

“`