Strong Earnings Propel Palantir and e.l.f. Beauty Stocks

Key Takeaways

- Shares of PLTR surged 250% in 2024, driven by impressive quarterly results.

- ELF shares cooled but exceeded quarterly estimates by 70% this period.

- Register now to access our free report on the 7 Best Stocks for the Next 30 Days!

The third quarter earnings reporting for 2024 is winding down, but many S&P 500 companies still have results to share in the coming weeks.

Stay updated with all quarterly releases: See ZacksEarnings Calendar.

This quarter, timely performances from high-growth companies such as e.l.f. Beauty (ELF) and Palantir (PLTR) captured attention, leading to positive movements in their stock prices. Both companies saw improvements in their guidance post-earnings.

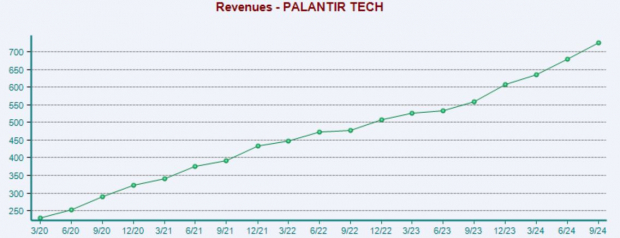

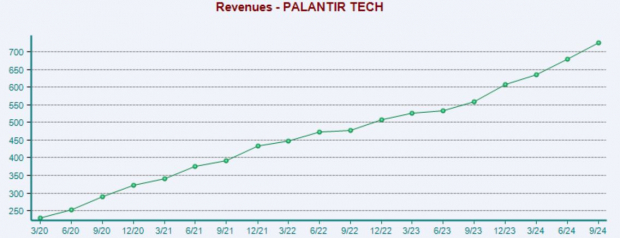

Palantir Thrives on AI Demand

Palantir creates software that helps organizations integrate data and streamline operations. The company benefited immensely from the recent AI surge, with its shares climbing 250% in 2024 due to solid quarterly results.

Image Source: Zacks Investment Research

CEO Alexander Karp remarked on their strong performance:

“We absolutely eviscerated this quarter, driven by unrelenting AI demand that won’t slow down. This is a U.S.-driven AI revolution that has taken full hold. The world will be divided between AI haves and have-nots. At Palantir, we plan to power the winners.”

Customer growth also accelerated, rising 39% year-over-year and 6% sequentially. Palantir secured 104 contracts worth over $1 million during this quarter.

Following the positive results, the company revised its FY24 revenue up, along with adjusted income from operations and free cash flow outlook. The stock now carries a favorable Zacks Rank #2 (Buy), hinting at continued growth ahead, with expectations of 53% year-over-year earnings growth and a 27% increase in sales.

Image Source: Zacks Investment Research

Palantir remains an attractive choice for investors interested in artificial intelligence, backed by relentless demand and expanding customer relationships that fostered impressive sales growth in recent periods.

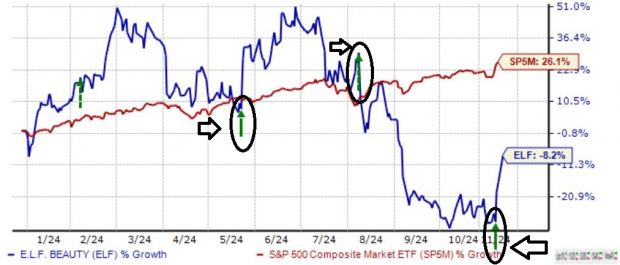

e.l.f. Beauty Recovers Strongly

Despite a 9% decline in 2024, e.l.f. Beauty shares gained momentum following an earnings report that surpassed consensus expectations, beating earnings per share estimates by 70% and posting sales 4% ahead.

As shown in the graph below, the stock has reacted strongly to its quarterly releases.

Image Source: Zacks Investment Research

e.l.f. Beauty’s earlier declines can be attributed to a slowdown in growth rates, noticeably cooling in recent periods. The next chart illustrates the percentage year-over-year changes in sales, rather than total sales figures.

Image Source: Zacks Investment Research

Thanks to effective cost control measures, e.l.f. Beauty achieved a gross margin of 71% for this quarter, marking a 40 basis point year-over-year increase. The subsequent chart displays margin trends on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Bottom Line

The third quarter earnings cycle of 2024 is concluding, with a few S&P 500 companies remaining to report. Overall, the earnings season highlights positive results, especially from the technology sector.

Palantir (PLTR) and e.l.f. Beauty (ELF) each exceeded expectations and adjusted their guidance positively, stirring optimistic market reactions post-earnings.

Palantir exemplifies strong potential in the AI market, showing significant long-term promise bolstered by the Zacks Rank #2 (Buy) rating, indicating further gains may follow.

While e.l.f. Beauty grapples with slowing sales growth, its efforts to capture market share alongside improving margins suggest a pathway forward. Observing positive revisions in earnings estimates will be crucial for future performance.

Free Report: 5 Clean Energy Stocks with Massive Upside

The energy sector, a multi-trillion dollar industry, plays a vital role in the global economy.

Cutting-edge technology is enabling clean energy solutions to surpass traditional fossil fuels. Trillions are invested in initiatives, spanning solar power to hydrogen fuel cells.

Investing in emerging companies within this sector could provide exciting opportunities for your portfolio.

Download “Nuclear to Solar: 5 Stocks Powering the Future” to discover Zacks’ top picks for free today.

Want the latest recommendations from Zacks Investment Research? Download “5 Stocks Set to Double” for free.

e.l.f. Beauty (ELF): Free Stock Analysis Report

Palantir Technologies Inc. (PLTR): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.