Merck MRK announced that a phase study evaluating its Daiichi Sankyo-partnered HER3-directed DXd antibody drug conjugate (ADC), patritumab deruxtecan, for treating EGFR-mutated non-small cell lung cancer (NSCLC), met its primary endpoint of progression-free survival (PFS).

The HERTHENA-Lung02 evaluated the efficacy and safety of patritumab deruxtecan versus pemetrexed and platinum chemotherapy for treating locally advanced or metastatic EGFR-mutated NSCLC in patients who had received prior EGFR tyrosine kinase inhibitor treatment. In the study, patritumab deruxtecan demonstrated a statistically significant improvement in PFS — the study’s primary endpoint — versus platinum plus pemetrexed induction chemotherapy.

As regards overall survival, a key secondary endpoint of the study, the data were immature at the time of the analysis. The study will continue to further assess overall survival.

Patients with metastatic EGFR-mutated NSCLC who are initially treated with an EGFR TKI sometimes experience disease progression. This creates a need for therapies like patritumab deruxtecan as treatment options for this type of lung cancer in the second-line setting are limited.

Merck plans to discuss the data with regulatory authorities to decide the next steps.

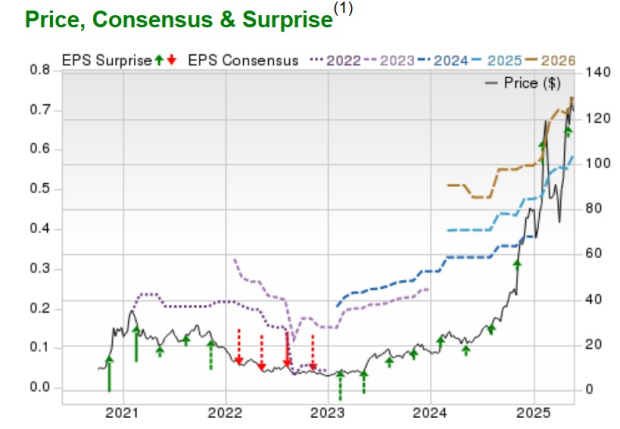

Merck’s stock has risen 8.5% so far this year compared with an increase of 25.9% for the industry.

Image Source: Zacks Investment Research

More on MRK’s Patritumab Deruxtecan

A biologics license application (BLA) seeking accelerated approval for patritumab deruxtecan for previously-treated EGFR-mutated NSCLC is already under review in the United States supported by data from the HERTHENA-Lung01 pivotal phase II study.

In June, the FDA issued a complete response letter to the BLA based on observations made after the inspection of a third-party manufacturing facility. The FDA has not requested any additional efficacy/safety studies, nor has it identified any issues related to the safety and efficacy of the candidate. Merck is working closely with the FDA and the third-party manufacturer to resolve the issue.

Merck’s Deal With Daiichi Sankyo

Merck acquired global co-development and co-commercialization rights to patritumab deruxtecan/MK-1022 and two other ADCs, raludotatug deruxtecan/MK-5909 and ifinatamab deruxtecan/MK-2400 from Japan’s Daiichi Sankyo in October last year for a total potential consideration of up to $22 billion. While raludotatug deruxtecan is being developed in phase II/III study for ovarian cancer, ifinatamab deruxtecan is being studied for small-cell lung cancer in phase III and colorectal, bladder, endometrial and head and neck cancers in phase II.

Daiichi Sankyo has retained exclusive rights for the development of the candidates in Japan. In August this year, Merck expanded its deal with Daiichi to co-develop and co-commercialize MK-6070, an investigational T-cell engager targeting delta-like ligand 3, which it obtained from its acquisition of Harpoon Therapeutics.

Other Companies Making ADC Products

ADCs are being considered a disruptive innovation in the pharmaceutical industry as these will enable better treatment of cancer by harnessing the targeting power of antibodies to deliver cytotoxic molecule drugs to tumors.

Daiichi Sankyo has six ADCs in clinical development across multiple types of cancer, being developed utilizing its DXd ADC technology. It markets Enhertu, a HER2-directed ADC for HER2-mutated breast, lung and gastric cancers, in partnership with AstraZeneca AZN. Daiichi Sankyo and AstraZeneca have also developed datopotamab deruxtecan (Dato-DXd), a TROP2-directed ADC. Dato-DXd is under FDA review for advanced nonsquamous NSCLC as well as previously treated metastatic HR-positive, HER2-negative breast cancer. The sixth ADC candidate is DS-3939, a TA-MUC1-directed ADC, which Daiichi Sankyo is developing on its own.

Pfizer PFE also has a strong portfolio of ADC drugs, which were added with last year’s acquisition of Seagen. The December 2023 acquisition of Seagen added four ADCs — Adcetris, Padcev, Tukysa and Tivdak — to Pfizer’s portfolio. Adcetris, Padcev, Tukysa and Tivdak contributed $279 million, $394 million, $121 million and $33 million, respectively, to Pfizer’s oncology revenues in the second quarter. Pfizer is particularly witnessing strong demand for Padcev.

MRK’s Rank and Stock to Consider

Merck has a Zacks Rank #4 (Sell) currently.

Merck & Co., Inc. Stock Price and Consensus

Merck & Co., Inc. price-consensus-chart | Merck & Co., Inc. Quote

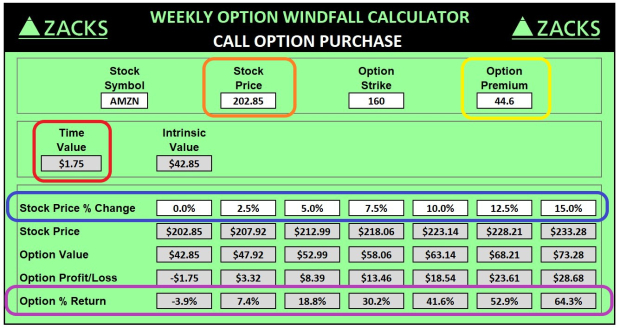

A top-ranked large drugmaker is Eli Lilly LLY, carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings estimates for 2024 have risen from $13.71 to $16.49 per share over the past 60 days. For 2025, earnings estimates have risen from $19.42 to $23.97 per share over the same timeframe. LLY’s stock is up 55.5% year to date.

Lilly beat estimates in each of the last four quarters, delivering a four-quarter average earnings surprise of 69.07%.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.