Attractive Returns on Sun Life Financial’s Class A Non-Cumulative Preferred Shares Series 3

On a recent trading day, the yield on Sun Life Financial Inc’s Class A Non-Cumulative Preferred Shares Series 3 (TSX: SLF-PRC.TO) surpassed the 6% milestone, fueled by a quarterly dividend translating to an annualized $1.1125. The shares were spotted changing hands for as low as $17.80 during the trading session. Notably, SLF.PRC was trading at a tantalizing 24.40% discount to its liquidation preference amount. It’s worth mentioning that these shares are non-cumulative, indicating that if a payment is missed, the company isn’t obliged to cover missed dividends before distributing common dividends.

Snapshot of Performance and Dividend History

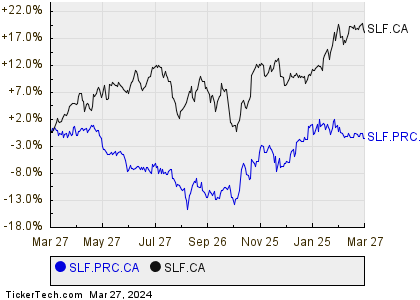

The one-year performance comparison of SLF.PRC shares alongside SLF reveals intriguing insights. On the historical front, a dividend history chart for Sun Life Financial Inc’s Class A Non-Cumulative Preferred Shares Series 3 paints a vivid picture of past dividend payments.

Market Movement and Prospect

In the latest trading session, Sun Life Financial Inc’s Class A Non-Cumulative Preferred Shares Series 3 (TSX: SLF-PRC.TO) experienced a slight decline of approximately 0.9%. Meanwhile, the common shares (TSX: SLF.TO) remained steady. This variance hints at an evolving landscape, with potential for investors to explore.

![]() Click here to find out which 9 other Canadian dividend stocks just recently went ”on sale” and crossed into new yield territory »

Click here to find out which 9 other Canadian dividend stocks just recently went ”on sale” and crossed into new yield territory »

Further Reading:

Real Estate Dividend Stocks

Top 10 Hedge Funds Holding Public Service Enterprise Group

Institutional Holders of OXLC

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.