Investors have been riding the wave of Super Micro Computer ((NASDAQ: SMCI) in 2024. Surging over 267%, this stock has been the belle of the ball. However, the party seems to be winding down a tad, with the number shrinking from its peak of 318%. With the stock now hovering 15% below its all-time high, is this dip a signal to dive in once more?

The Server Design Maven

Super Micro Computer emerges as the sequel to the 2023 star, Nvidia ((NASDAQ: NVDA)). While Nvidia reigns with GPU sales powering AI systems, not all firms have the acumen to craft their own data hubs for maximum utilization. They look to experts like Super Micro for tailored server design. With custom-build prowess, customers can match servers to any workload, from drug exploration to AI model training or engineering feats.

Running a tier lower in the value chain, Super Micro didn’t immediately bask in the AI boom. In Q1 of fiscal 2024, revenue ascended 14% annually to $2.12 billion. But come Q2, the numbers skyrocketed by 103% to hit $3.67 billion, confirming suspicions of a revenue bonanza fueled by AI demand.

Alongside this robust quarter was a bullish revision in its annual revenue prognosis. From a guidance of $10 billion to $11 billion in Q1, the outlook surged to $14.3 billion to $14.7 billion for 2024. This substantial guidance spike stoked investor euphoria and triggered Super Micro Computer’s upward spiral.

Yet, with the stock’s recent retreat, is it wise to buy in?

The High Price of Success

As a company scales to these heights, its stock naturally inflates. However, this tale holds another facet.

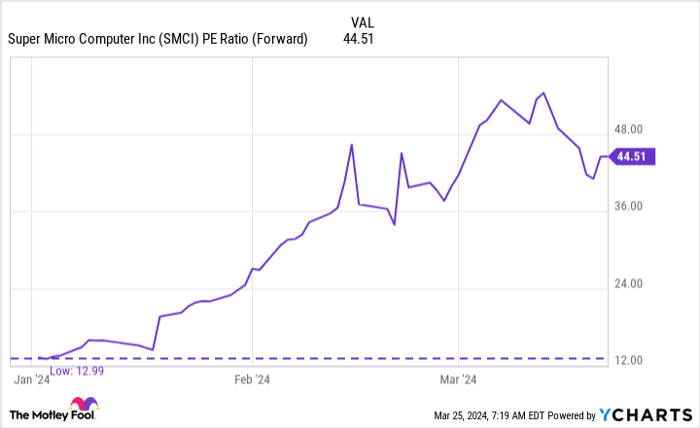

SMCI PE Ratio (Forward) data by YCharts

Commencing the year at around 13 times forward earnings, Super Micro surged with known impending quarters due to its sector. The initial 100% leap merely corrected the stock’s standing, bringing it to its rightful valuation.

However, the current 45 times forward earnings multiple seems extravagant, notably with Nvidia trading at 38 times forward earnings. Super Micro grapples with fiercer competition than Nvidia, facing rivals like Hewlett-Packard and IBM in the server domain, whereas Nvidia boasts elite GPUs for AI workloads.

Given these dynamics, the present valuation is too rich for me to advocate Super Micro. The company will likely continue its strong performance this year due to burgeoning server demand. Yet, the stock prices in vast success, impeding substantial future growth.

If you followed my previous recommendation on Jan. 10 and rode the wave, kudos on reaping around 205% profits. However, I suggest it’s now a prudent juncture to cash out, with numerous easier investment avenues in the market.

Should you invest $1,000 in Super Micro Computer right now?

Before delving into Super Micro Computer, ponder this:

The Motley Fool Stock Advisor team identified the 10 best stocks for investors to acquire, excluding Super Micro Computer. These selections hold the potential for mammoth returns in the near future.

Stock Advisor furnishes a roadmap for success, offering portfolio construction tips, analyst updates, and two monthly stock picks. Since 2002, the service has tripled the S&P 500 returns*.

Peruse the 10 stocks

*Stock Advisor returns as of March 25, 2024

Keithen Drury holds no position in the stocks cited. The Motley Fool has stakes in and commends Nvidia. The Motley Fool adheres to a disclosure policy.

Opinions expressed are solely those of the author and not endorsed by Nasdaq, Inc.