Super Micro Computer: A Strong Buy Amid AI Growth and Recovery

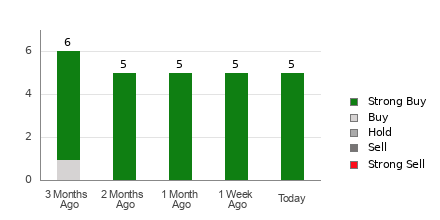

This week, Super Micro Computer’s SMCI stock has been added to the Zacks Rank #1 (Strong Buy) list, making it an attractive option in the tech sector as the company navigates ongoing investigations into its accounting practices.

Additionally, Super Micro’s efforts in the artificial intelligence domain have shown significant promise, driving impressive sales growth despite scrutiny from the Department of Justice (DOJ).

Super Micro’s AI Expansion

Super Micro has partnered with Nvidia NVDA to provide a variety of AI solutions, from edge computing to enterprise AI and large-scale AI training. Utilizing Nvidia’s latest Blackwell series GPUs, the company is optimizing these AI workloads effectively.

Recently, Super Micro unveiled new systems and rack solutions powered by Nvidia’s Blackwell Ultra Platform, enhancing its leadership in AI and enabling groundbreaking performance for high-demand AI applications, including AI reasoning and video inference.

Compelling Sales Growth

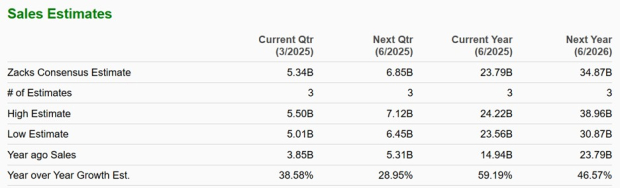

According to Zacks estimates, Super Micro’s sales are projected to jump 59% in fiscal 2025, reaching $23.79 billion compared to $14.94 billion last year. Additionally, FY26 sales are anticipated to rise another 46% to $34.87 billion.

Image Source: Zacks Investment Research

Earnings Outlook & EPS Revisions

For the bottom line, Super Micro’s annual earnings are expected to grow 15% in FY25, followed by another increase of 30% in FY26, reaching $3.33 per share. While FY25 EPS estimates have slightly decreased over the last two months, FY26 estimates have increased by 14%.

Image Source: Zacks Investment Research

SMCI Performance & Valuation

Despite a broader decline in the tech sector, Super Micro’s stock has risen 3% in 2025, outperforming the Nasdaq’s -15% drop and Nvidia’s 24% decline. Notably, over the last three years, SMCI shares have surged over 700%, significantly outpacing major indexes and Nvidia’s 266% increase.

Image Source: Zacks Investment Research

A key appeal for Super Micro is its current trading price under $35 per share, with a forward earnings multiple of 12.7X. This valuation is considerably lower than the S&P 500 benchmark and is attractive compared to its peers in the Zacks Computer-Storage Devices Industry, which average 11.2X forward earnings, and Nvidia’s 23.7X.

Image Source: Zacks Investment Research

Bottom Line

Investing in Super Micro’s stock appears increasingly attractive due to the company’s AI expansion. With an appealing valuation and robust growth potential, now may be a favorable time to consider purchasing SMCI.

Only $1 to see All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we surprised our members by offering them 30-day access to all our picks for the total fee of just $1. There is no obligation to spend any more.

Thousands have seized this opportunity, while many others hesitated, thinking there must be a catch. The reality is simple. We want you to explore our portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and more, which realized 256 positions with double- and triple-digit gains in 2024 alone.

see Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to access this free report.

Super Micro Computer, Inc. (SMCI): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.