Amidst the latest earnings reports, big tech has once again showcased its remarkable resilience and ability to generate substantial profits. Noteworthy industry frontrunners Amazon AMZN

, Meta Platforms META, and Netflix NFLX all delivered impressive earnings results, with significant upward price gaps following the announcements.

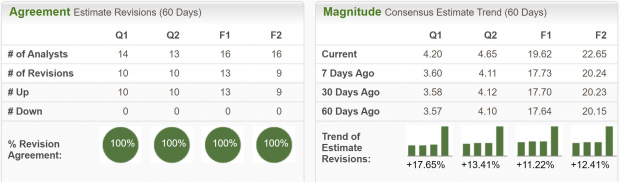

Furthermore, each of these stocks holds a top Zacks Rank, signifying positive trends in earnings revisions and robust short-term expectations for stock prices.

Image Source: Zacks Investment Research

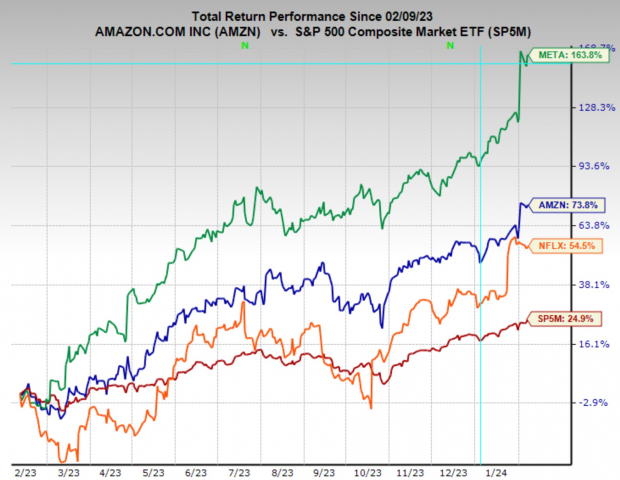

Despite potential concerns about investing in large-cap tech stocks following their substantial rallies over the past year, it is important to remember that stock price increases do not preclude further upward movement.

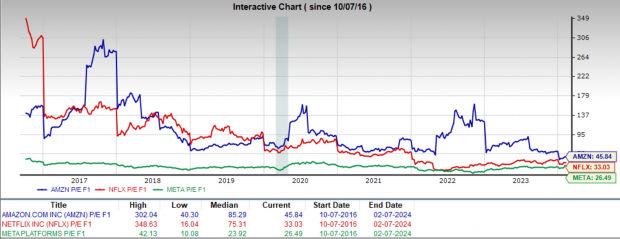

These three stocks are currently trading at historically fair relative valuations, assuaging fears of overvaluations. The robust recent growth and profitability demonstrated in their latest quarterly reports, combined with earnings estimates upgrades, have further bolstered the attractiveness of these valuations.

Image Source: Zacks Investment Research

Netflix: A Streaming Giant

During the most recent quarterly earnings call, Netflix exceeded estimates on both the top and bottom lines, achieving record subscriber growth, with 261 million paid subscribers, including a addition of 13 million in Q4 alone.

The management also revealed plans to expand the content offerings on their streaming platform, including a recent deal with WWE to weekly stream the Raw wrestling program.

Netflix possesses a Zacks Rank #1 (Strong Buy), a reflection of the positive trend in earnings revisions. Nearly all analysts have upgraded their earnings estimates over the preceding two months, with current quarter expectations rising by 10.5% to $4.41 per share and FY24 earnings climbing 6.3% to $16.93 per share.

The technical setup of NFLX stock aligns with a classical post-earnings gap and bull flag, presenting a high-probability trade. A movement above the $564 level would signify a breakout. Conversely, a dip below $553 would invalidate the setup, prompting investors to consider waiting for a new opportunity.

Image Source: TradingView

Meta Platforms: A Strong Performer

Meta Platforms also delivered stellar earnings, surpassing both sales and earnings estimates. Q4 sales escalated by 25% YoY to $40.1 billion, while expenses decreased by 8% YoY.

Moreover, Meta Platforms announced its inaugural dividend payment after its cash reserves surged to $60 billion, alongside a $50 billion share buyback program aimed at augmenting returns for shareholders.

META holds a Zacks Rank #1 (Strong Buy), with analysts unanimously raising earnings estimates over the past two months across various timeframes.

Image Source: Zacks Investment Research

Similar to its counterparts, META stock has formed a textbook post-earnings bull flag. A rise above the $474 level would indicate a breakout, while a dip below the $454 support level might lead to a gap fill before potential upward movement resumes.

Image Source: TradingView

Amazon.com: Ripe for Growth

The e-commerce and cloud-computing behemoth, Amazon, appears to have all the right elements in place for continued success. With another quarter of surpassing analysts’ estimates and a burgeoning advertising business, coupled with a Zacks Rank #1 (Strong Buy) rating, AMZN stock presents an appealing investment prospect.

Echoing the theme of post-earnings bull flags, Amazon stock exhibits a similar pattern. A move above the $171.50 level would indicate a breakout and likely prompt a swift upward trajectory. Conversely, a drop below the $168 lower limit would necessitate patience for a new setup.

Image Source: TradingView

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.