A Closer Look at Analyst Predictions for QQQM Holdings

As we delve into the world of Exchange-Traded Funds (ETFs), a surprising revelation emerges – the Invesco NASDAQ 100 ETF (Symbol: QQQM) may be poised for a promising future. Analysts, often the gatekeepers of market sentiment, have unveiled an optimistic outlook for QQQM. Their 12-month forward target price for the ETF stands at a tantalizing $195.89 per unit. With QQQM currently trading at around $178.64 per unit, these analysts foresee a potential 9.66% upside for investors. This revelation sheds a positive light on the ETF’s underlying holdings, with notable potential for growth.

A Glimpse into QQQM’s High-Flying Holdings

Delving into the vibrant tapestry of QQQM’s holdings, three standout entities catch the eye – Amazon.com Inc (Symbol: AMZN), Idexx Laboratories, Inc. (Symbol: IDXX), and Amgen Inc (Symbol: AMGN). Despite recent trading prices, these companies are painted with a bright brush by analysts. AMZN, with its recent price of $174.42 per share, is seen to have a 16.09% upside to reach the analyst target of $202.49 per share. Similarly, IDXX and AMGN are expected to soar to new heights, with 15.92% and 15.26% upsides, respectively, from their present price points. The combined weight of AMZN, IDXX, and AMGN in the Invesco NASDAQ 100 ETF stands at an impressive 6.66%, further solidifying their influence on QQQM’s potential.

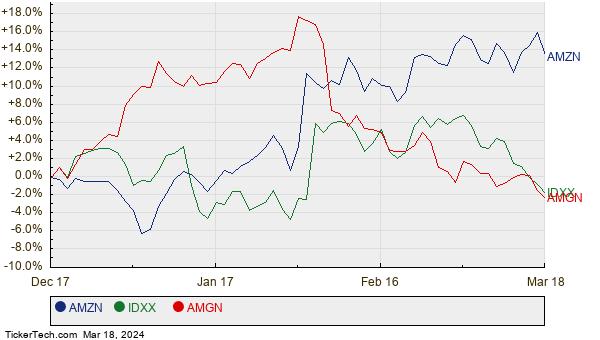

A Reflective Chart of Past Performance

Visualizing the journey of AMZN, IDXX, and AMGN over the past twelve months unveils a tale of resilience and growth. The relative performance chart paints a vivid picture of the companies’ trajectory, offering investors a glimpse into the past to navigate the future with clarity.

The Analysts’ Table: A Summary of Target Prices

Below lies a succinct table, encapsulating the current analyst target prices for the discussed entities. An insightful overview for investors seeking to align their strategies with the projected growth potential offered by these stocks.

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco NASDAQ 100 ETF | QQQM | $178.64 | $195.89 | 9.66% |

| Amazon.com Inc | AMZN | $174.42 | $202.49 | 16.09% |

| Idexx Laboratories, Inc. | IDXX | $529.77 | $614.11 | 15.92% |

| Amgen Inc | AMGN | $268.87 | $309.90 | 15.26% |

The Future Unveiled: Investigating Analyst Predictions

Do these targets herald a new dawn of prosperity, or are they perched precariously on a ledge of over-optimism? Analysts’ predictions offer a tantalizing glimpse into what the future might hold for these stocks. However, navigating the ever-evolving landscape of markets requires shrewd investor scrutiny. Balancing optimism with prudence, investors are urged to conduct thorough research to discern the true trajectory of these stocks amidst a sea of change.

![]() Explore 10 ETFs With the Most Potential Upside to Analyst Targets »

Explore 10 ETFs With the Most Potential Upside to Analyst Targets »

Also see:

• Diagnostics Dividend Stocks

• Funds Holding GBTG

• ITIC YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.