Stock Market Begins Year With Struggles Amid AI Concerns

The stock market has had a surprising start to the year. The broader benchmark S&P 500 (SNPINDEX: ^GSPC) is down nearly 5%, and the Nasdaq Composite (NASDAQINDEX: ^IXIC) has fallen into correction territory as of March 11. Investor optimism seemed overly inflated regarding President Donald Trump’s potential trade policies, particularly his intent to impose hefty tariffs on key U.S. trading partners like China, Mexico, and Canada. Additionally, disappointing economic data has heightened fears of a recession or even stagflation.

Despite this challenging environment, some stocks are experiencing significant declines, which may present buying opportunities. For instance, one stock recently hit a 52-year low.

Where to invest $1,000 right now? Our analyst team has revealed what they believe are the 10 best stocks to buy at this time. Learn More »

AI Investments Raise More Questions Than Answers

The artificial intelligence boom has driven the recent bull market, enticing investors into stocks associated with AI. These stocks, labeled the “Magnificent Seven,” are believed to be at the forefront of this technological revolution.

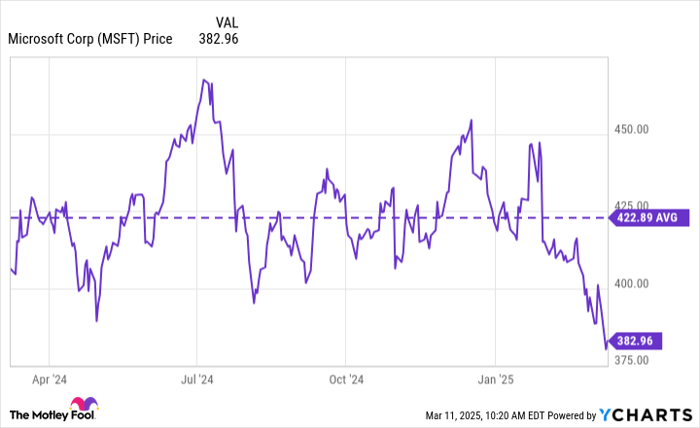

Microsoft (NASDAQ: MSFT), a key player in the Magnificent Seven, is crucial to the tech industry. However, it has struggled to generate excitement among investors, now hitting a 52-week low, significantly below its average.

MSFT data by YCharts.

Investor apprehension regarding Microsoft’s AI future has increased. Many are curious about the returns on the company’s substantial investments and their timing. Microsoft has committed to spending $80 billion on AI this year, but faces challenges in other segments.

Gross profit margins have slipped over the year, yet remain above 60%. In the latest quarterly earnings report, Microsoft exceeded Wall Street estimates in earnings per share and revenue, yet reported disappointing growth in its Azure cloud service and provided tepid guidance for the coming quarter.

The cloud sector was anticipated to benefit from AI adoption, which made the results even more disappointing. During the last earnings call, management indicated that AI revenue passed $13 billion and surpassed expectations. They also attributed lower performance in cloud services to non-AI offerings that performed below forecasts.

Analysts Remain Optimistic About Microsoft’s Future

Despite uncertainties around AI spending, analysts’ outlook for Microsoft remains positive. Out of 31 analysts who issued reports on the stock in the last three months, 28 rated it as a buy, while three suggested holding, according to TipRanks. The average target price suggests a potential upside of 34% from current figures.

In the short term, Microsoft must demonstrate the effectiveness of its AI investments. Yet, in the long run, the company’s history of innovation and extensive resources bode well for its prospects. Microsoft’s revenue diversification spans cloud services, social media, gaming, and office products, a competitive advantage that may be difficult for others to match.

Moreover, Microsoft holds a credit rating superior to that of the U.S. government, giving shareholders confidence in its resilience. For fiscal year 2025, analysts project Microsoft’s free cash flow will reach $48 billion. The forward price-to-earnings ratio stands at 28.7, lower than its five-year average of approximately 30.5, presenting a potential buying opportunity.

A Second Chance to Invest in Strong Stocks

Do you ever feel like you’ve lost your opportunity to invest in top-performing stocks? If so, you’re not alone.

Our expert analysis team occasionally issues a “Double Down” Stock recommendation for companies poised for growth. If you are concerned about missing your chance to invest in promising stocks, now may be the ideal time to purchase.

- Nvidia: Investing $1,000 at our double down alert in 2009 would have grown to $282,016!

- Apple: An investment of $1,000 when we doubled down in 2008 would now be worth $41,869!

- Netflix: A $1,000 investment at our recommendation in 2004 could be worth $482,720!

Currently, we’re issuing “Double Down” alerts for three exceptional companies, which may not present another opportunity soon.

Continue »

*Stock Advisor returns as of March 10, 2025

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.