Astera Labs Receives Neutral Rating with Promising Price Targets

Fintel reports that on May 16, 2025, Susquehanna initiated coverage of Astera Labs (NasdaqGS:ALAB) with a Neutral recommendation.

Analyst Price Forecast Indicates 21.66% Potential Upside

As of May 7, 2025, the average one-year price target for Astera Labs is $112.16 per share. Projections range from a low of $70.70 to a high of $147.00, reflecting an estimated increase of 21.66% from its most recent closing price of $92.19 per share.

The anticipated annual revenue for Astera Labs stands at $443 million, marking a decrease of 9.59%. The projected annual non-GAAP EPS is $0.65.

Fund Sentiment Overview

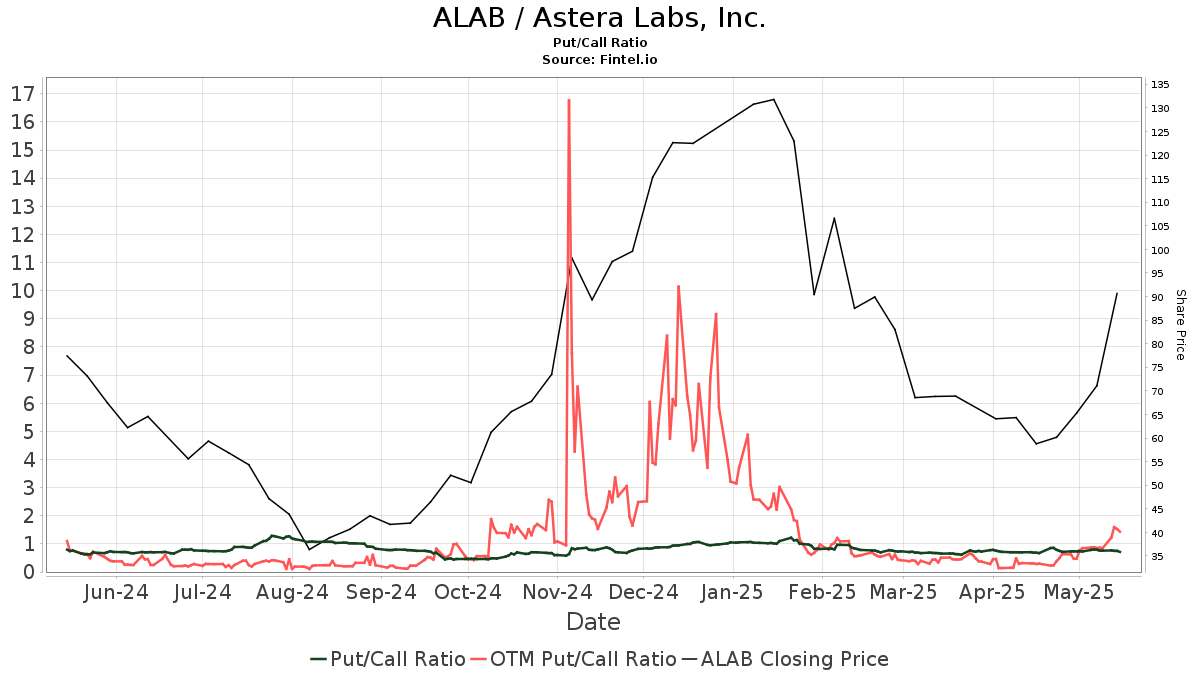

Currently, 768 funds or institutions report holdings in Astera Labs, an increase of 48 owners, or 6.67%, compared to the previous quarter. On average, the portfolio weight of all funds dedicated to ALAB is 0.36%, which is up by 13.02%. Institutional ownership has risen by 7.94% over the last three months, totaling 115,193K shares. The put/call ratio for ALAB is 0.71, suggesting a bullish outlook.

Activities of Major Shareholders

AllianceBernstein holds 8,401K shares, representing 5.09% ownership of the company. This is an increase from the prior filing, where they reported owning 3,922K shares, reflecting a growth of 53.31%. Their portfolio allocation in ALAB increased by 2.87% over the last quarter.

Atreides Management owns 4,652K shares, which equates to 2.82% ownership. Previously, they held 1,837K shares, marking a significant increase of 60.52%. Their portfolio allocation in ALAB rose by 58.21% in the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 3,732K shares, corresponding to 2.26% ownership. This ownership grew from 734K shares reported before, representing an increase of 80.34%. Their portfolio allocation in ALAB surged by 1,167.36% over the last quarter.

FDGRX – Fidelity Growth Company Fund manages 3,399K shares, representing 2.06% of Astera Labs. Their previous filing indicated 3,112K shares, which is an increase of 8.46%. However, their portfolio allocation decreased by 16.54% over the last quarter.

D. E. Shaw holds 3,376K shares, representing 2.05% of the company. In their last filing, they reported 2,447K shares, a 27.53% increase. Nonetheless, their portfolio allocation in ALAB fell by 51.86% in the previous quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.