Sypris Solutions Reports Mixed Q4 Results Amid Revenue Decline

Shares of Sypris Solutions, Inc. (SYPR) have seen a reduction of 3.6% since the earnings report for the quarter ending December 31, 2024. This contrasts with the S&P 500 index, which fell by 2% during the same period. Over the last month, SYPR’s stock price has decreased by 3%, while the S&P 500 experienced a more significant decline of 4.3%.

Check the Earnings Calendar for critical market updates.

For the fourth quarter of 2024, Sypris Solutions reported a net earnings per share of 1 cent, a significant improvement from a net loss of 5 cents per share in the fourth quarter of 2023.

The company generated revenues of $33.4 million, reflecting a 3.7% decline from $34.7 million in the same quarter last year. Despite lower revenues, Sypris achieved a net profit of $0.1 million, contrasting with a net loss of $1.1 million during the fourth quarter of 2023.

Gross profit experienced a notable increase of 23.1% year-over-year, reaching $5.4 million, which contributed to a gross margin improvement of 350 basis points.

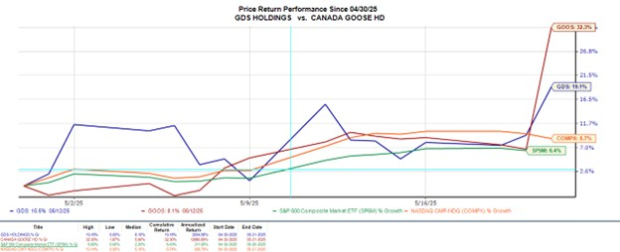

Analysis of Sypris Solutions, Inc. Earnings Performance

Sypris Solutions, Inc. price-consensus-eps-surprise-chart

Segment Insights and Revenue Performance

Sypris Technologies reported quarterly revenue of $19.5 million, a 2.7% increase from $19 million a year ago, buoyed by strong energy product shipments. The segment’s gross profit surged by 41.6% to $4.4 million, resulting in a gross margin of 22.5%, compared to 16.3% in the previous year. The improvements were attributed to favorable exchange rates, product mix, and ongoing operational efficiencies.

Conversely, Sypris Electronics saw revenues decline to $13.9 million, an 11.5% drop from $15.7 million in the same quarter last year. This decline was influenced by temporary shipment delays caused by material and supplier quality issues, resulting in a gross profit of $1 million, or 7.1% of revenues, down from $1.3 million, or 8.1%, a year prior. Increased labor and overhead costs on production ramp-ups negatively affected profitability.

CEO Reflection on Business Performance

In his remarks, President and CEO Jeffrey T. Gill emphasized the positive trajectory for Sypris Technologies, highlighting a year-over-year boost in energy product sales and a broader order backlog. He cited rising global demand for LNG and power infrastructure, driven by the expansion of AI data centers, as factors supporting future growth.

On the Sypris Electronics front, Gill noted robust demand persists in crucial end markets, such as electronic warfare, avionics, radar, and subsea communications. Despite encountering short-term delays, the segment upholds a substantial backlog exceeding $90 million, primarily supported by customer funding under multi-year contracts, expected to drive operations well into 2025.

Performance Drivers and Financial Health

The varied performances of the two segments greatly influenced the quarter’s overall results. Sypris Technologies benefited from favorable market conditions and operational enhancements, while Sypris Electronics faced challenges from supply chain disruptions. Nonetheless, a consolidated gross margin expansion and return to profitability signify operational improvement.

Moreover, inventory management showed marked improvement, with inventory levels falling from $77.3 million at the end of 2023 to $66.7 million by the close of 2024, enhancing working capital efficiency. The net cash provided by operating activities transitioned to a positive $2 million, up from a negative $11.1 million the previous year, reflecting enhanced operational control and better receivables performance.

2024 Performance Summary

For the full year, revenues rose by 2.9% to reach $140.2 million. However, the company recorded a net loss of $1.7 million, equivalent to 8 cents per share, slightly wider than the net loss of $1.6 million, or 7 cents per share, reported in 2023.

2025 Financial Outlook

Looking ahead to 2025, Sypris has set guidance projecting revenues between $125 million and $135 million, suggesting a slight decline at the midpoint compared to 2024. This projection is partially due to the transition of the company’s Mexican operations to a value-add-only sub-maquiladora model, reducing reported revenues while not affecting overall output.

Management anticipates gross margin expansion between 150 to 175 basis points, indicating a potential increase in gross profit of 10% to 15%.

While acknowledging potential cyclical challenges in the commercial vehicle market, the company remains confident that growth in energy and defense-related programs will provide offsets.

Capital Expenditure and Financial Position

In addition, Sypris continued to lower capital expenditures year-over-year, investing $1.1 million in 2024 compared to $2.1 million in 2023. This prudent approach resulted in a stronger cash balance of $9.7 million at year-end.

Expert Insights on High-Growth Stocks

Research specialists from Zacks have identified their top stock picks, predicting exceptional growth potential. Among them, Director of Research Sheraz Mian highlights one standout company targeting millennial and Gen Z markets, boasting nearly $1 billion in last quarter’s revenue. Recent price adjustments present an ideal entry point for investors. While no investment is without risk, this selection may deliver significant returns, similar to past successful Zacks recommendations.

Explore our Top Stock and Additional Recommendations

Sypris Solutions, Inc. (SYPR): Access the Free Stock Analysis Report

Originally published by Zacks Investment Research (zacks.com).

The views expressed here are solely those of the author and do not necessarily reflect the opinion of Nasdaq, Inc.