“`html

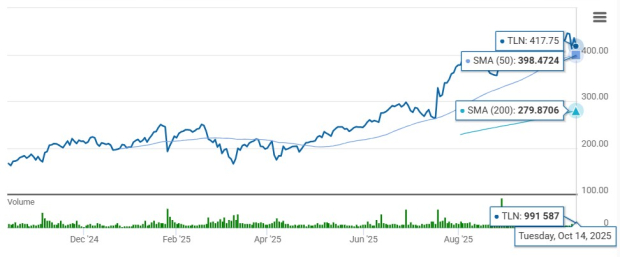

Talen Energy Corporation (TLN) has seen its shares increase by 158.7% over the past year, outperforming the Zacks Alternative Energy – Other industry, which increased by 52.2%. The company is currently trading above its 50-day and 200-day simple moving averages, indicating a bullish trend, and is positioned to expand its total generation capacity from 10.7 gigawatts to 14 gigawatts through planned acquisitions.

In a significant long-term agreement, Talen Energy will supply up to 1,920 megawatts of carbon-free electricity from its Susquehanna nuclear power plant to Amazon’s data centers through 2042. This arrangement is expected to stabilize Talen Energy’s revenue stream. The company’s return on invested capital stands at 9.27%, considerably higher than the industry average of 1.85%.

Despite these positive indicators, the Zacks Consensus Estimate for TLN’s earnings per share suggests a decline of 38.67% in 2025, followed by a projected surge of 300.2% in 2026. As a result, analysts recommend that potential investors should consider waiting for a more favorable entry point before investing, as TLN is currently rated as a Zacks Rank #3 (Hold).

“`