companies

Unlocking Chile’s Potential: A New Era of Lithium Exploration

Unlocking Chile’s Potential: A New Era of Lithium Exploration

—

The Chilean government has announced plans to open 26 lithium salt flats to private companies, initiating a tender process in April that is slated ...

New Strong Performers in the Market

New Strong Performers in the Market

—

Today, there are five stocks recognized for their strength and their potential for outperformance. These companies, selected for the prestigious Zacks Rank #1 (Strong ...

Sherwin-Williams Company’s Stocks on an Upward Trajectory!

Sherwin-Williams Company’s Stocks on an Upward Trajectory!

—

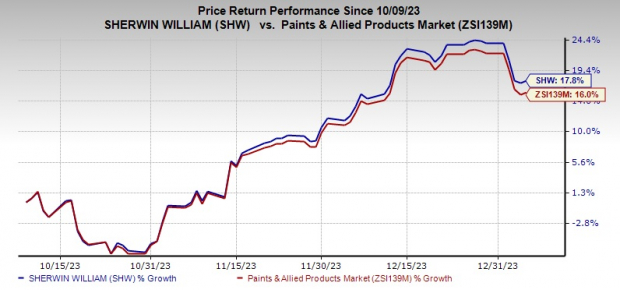

The Sherwin-Williams Company’s SHW shares have rallied 17.8% in the past three months, modestly outperforming its industry’s growth of 16% over the same period. ...