Earnings

Upcoming Retail Earnings: An In-Depth Analysis

Target Corporation (TGT) is set to report its earnings before the market opens on March 3, 2026, with expectations of $2.17 per share on ...

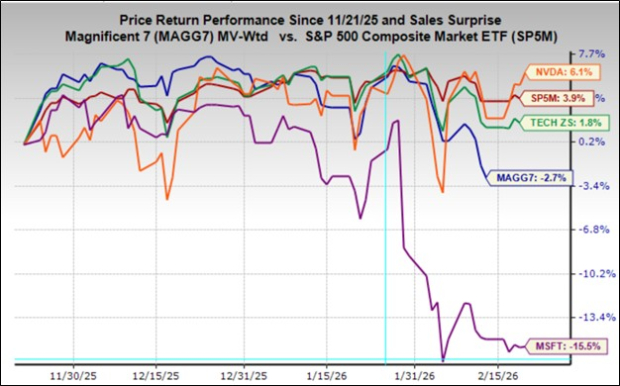

Anticipating Nvidia’s Earnings: Insights on the Mag 7 Performance

Recent sentiment regarding the Magnificent 7 tech stocks, including Amazon, Alphabet, and Microsoft, has been overwhelmingly negative. These stocks are experiencing significant underperformance, with ...

Favorable Conditions Set for Q3 Earnings Season: Key Insights

“`html This week marks the start of the Q3 earnings season, with nearly 80 companies, including 35 from the S&P 500, set to report. ...

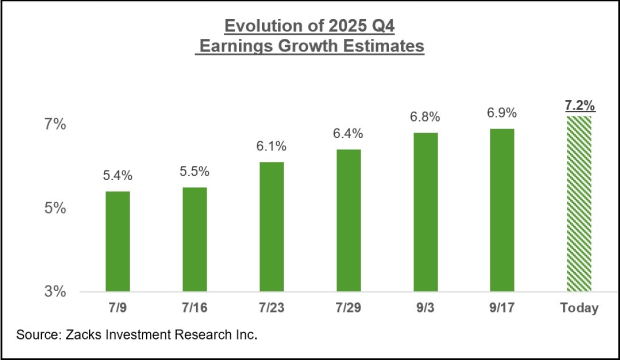

Examining the Shifting Landscape of Earnings Growth

“`html This week, PepsiCo (PEP) and Delta Air Lines (DAL) are set to report their quarterly results on Thursday, October 9th. Pepsi is anticipated ...

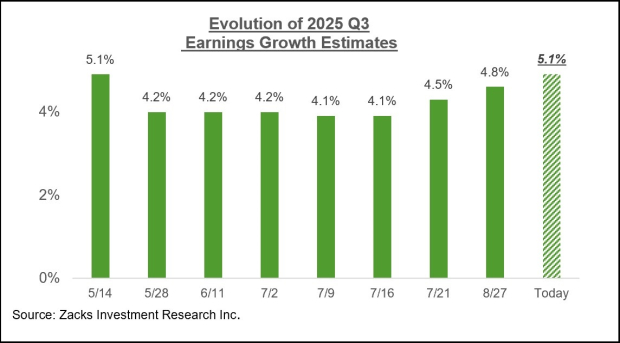

Looking Ahead to Q3 Earnings: Insights for Investors

“`html Expectations for Q3 earnings growth for the S&P 500 index are set at +5.1%, with revenues anticipated to rise by +6% compared to ...

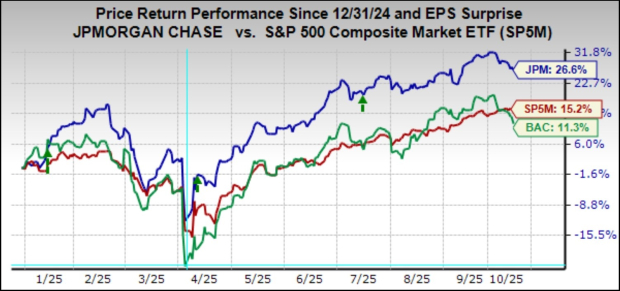

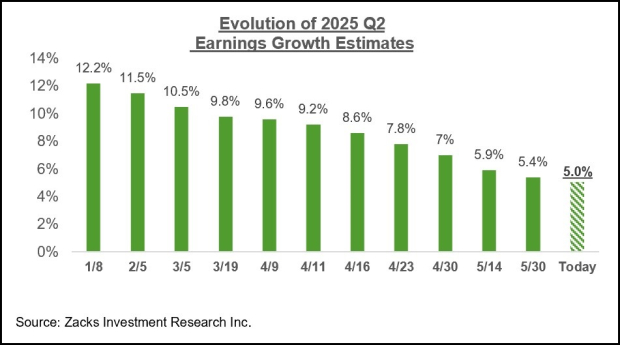

Favorable Outlook for Q2 Earnings as Major Bank Results Approach

The Q2 earnings season kicks off this week with nearly 100 companies expected to report, including 38 S&P 500 members. Major firms set to ...

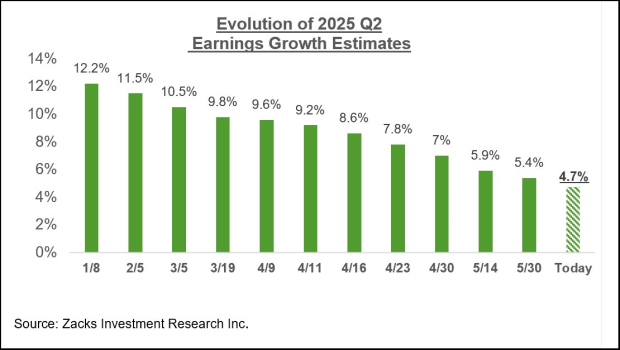

Anticipating the Upcoming Q2 Earnings Reports

Q2 earnings are projected to increase by 5% from last year, with revenues up 4%, marking the lowest growth pace since Q3 2023. As ...

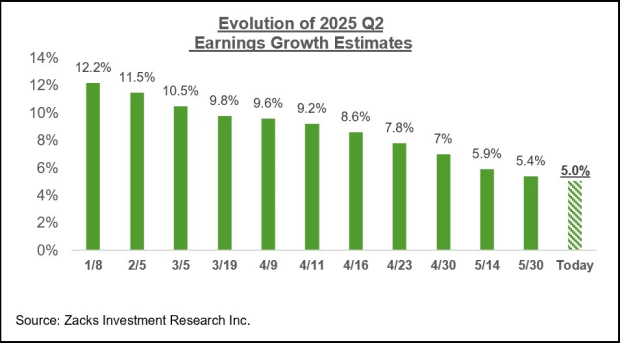

Anticipating Insights from Q2 Earnings Reports

The expected Q2 earnings growth for the S&P 500 index is +5%, accompanied by a +3.9% increase in revenues. This growth rate would mark ...

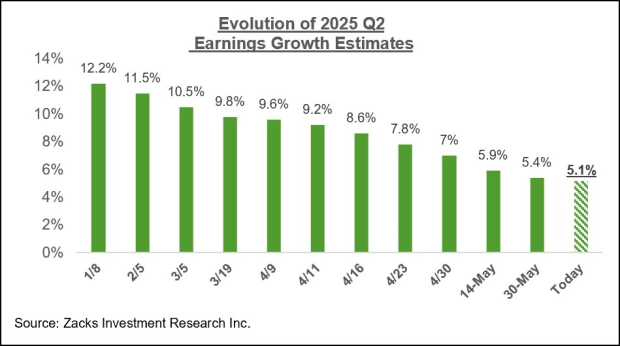

Anticipating Q2 Earnings Trends and Insights

In Q2 2025, S&P 500 earnings are expected to increase by +5.1% year-over-year on +3.8% higher revenues, marking a significant slowdown from +11.9% earnings ...