How to Invest

Lowe’s Shares Decline Amid Mixed Outlook Following Strong Earnings Report

Lowe’s reported its fiscal fourth-quarter results on Wednesday, revealing total sales of $20.6 billion, an 11% increase year-over-year, surpassing expectations of $20.36 billion. Adjusted ...

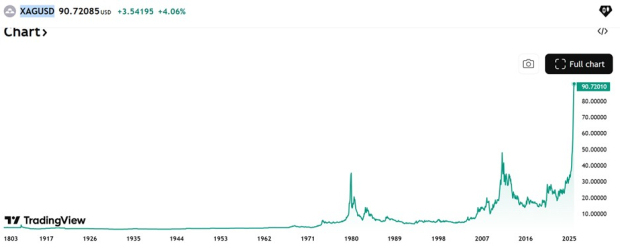

Top Three Silver Mining Stocks Poised for Continued Growth

Silver prices have reached all-time highs, trading near $100 per ounce, driven by strong industrial demand, shifting monetary conditions, and investor interest in safe-haven ...

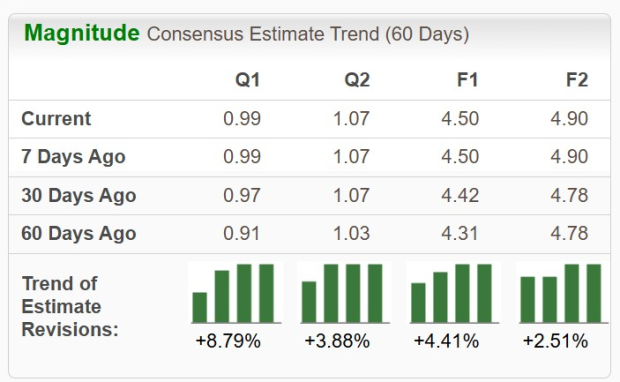

Dillard’s (DDS) Positioned for Strong Q4 Earnings: A Prudent Buy the Dip Opportunity

Dillard’s (DDS) is set to report its Q4 earnings on February 24, 2026, with expectations of flat sales at approximately $2.02 billion and a ...

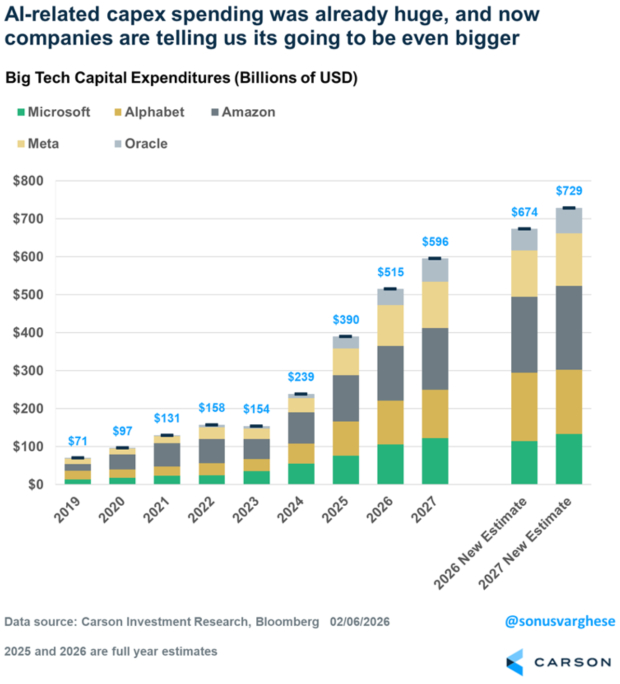

Spring Surge Ahead: Unpacking Market Optimism Amidst Concerns

AI spending is set to surge, contradicting recent market fears. Major tech companies including Microsoft, Alphabet, and Amazon anticipate capital expenditure (CAPEX) spending to ...

Top Medical Instrument Stocks Leveraging GenAI to Overcome Industry Challenges

Over the past year, the application of generative AI (GenAI) in the Medical Instruments industry has evolved from experimental to operational, significantly enhancing diagnostics, ...

Investing in Leading Asset Management Firms Now

### Asset Managers Highlighted for Strong Performance Brookfield Asset Management (BAM) and Janus Henderson Group (JHG) are two asset managers currently on the Zacks ...

Top Affordable Stocks Under $10 to Invest in This February

The S&P 500 is trading slightly below its all-time highs in early 2026, amidst recent selling across sectors such as software and AI. While ...

Top Software Stocks Resilient to AI Disruption (NET, APP, MDB)

As artificial intelligence (AI) reshapes the software industry, key players Cloudflare (NET), AppLovin (APP), and MongoDB (MDB) are expected to remain resilient. These companies ...

Top 3 Refining and Marketing Stocks Worth Monitoring

The Zacks Oil and Gas – Refining & Marketing industry, consisting of 15 stocks, is currently ranked #197 out of 243 industries, placing it ...

Stock Spotlight: Badger Meter (BMI) Underperforming Today

Badger Meter (BMI), a leader in water technology based in Milwaukee, WI, faces significant challenges as it adapts to rising costs and competitive pressure. ...