How to Invest

Top Stock to Watch: Photronics (PLAB)

Photronics Inc. (PLAB), a global leader in photomasks for semiconductor production, reports strong growth leading into its earnings report on February 25, with shares ...

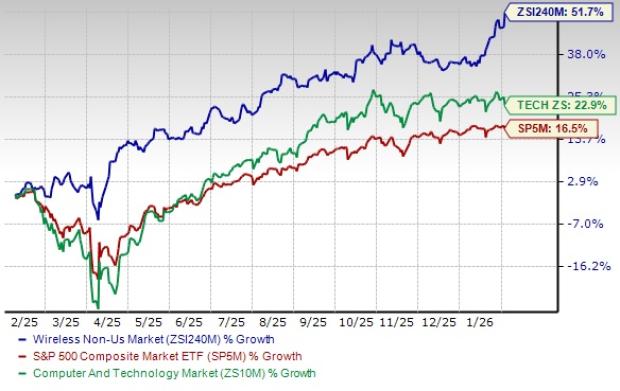

Three International Wireless Stocks Poised for Success in Thriving Market

The Zacks Wireless Non-US industry has experienced a significant uptick, gaining 51.7% over the past year, compared to 16.5% for the S&P 500. Key ...

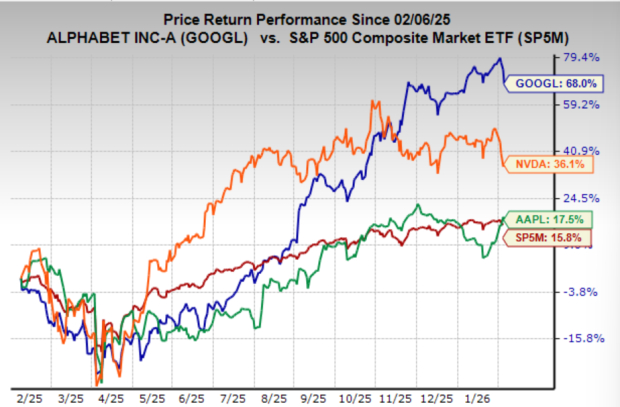

Exploring Alphabet: The Pinnacle of Business Innovation

Alphabet Inc. (GOOGL) reported its fourth-quarter and full-year results for 2023 on October 30, revealing an 18% revenue increase, with annual sales surpassing $400 ...

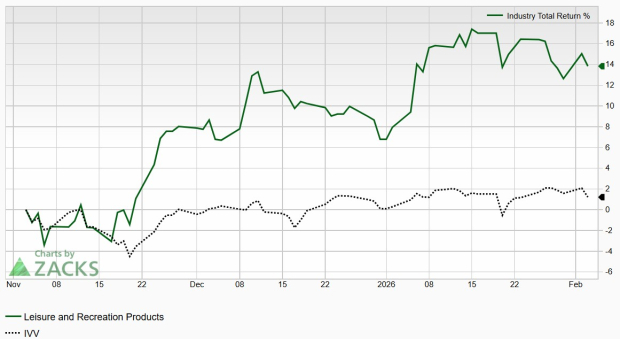

Stock Spotlight: Callaway Golf (CALY)

**Callaway Golf Company Achieves 52-Week High amid Strategic Moves** Callaway Golf Company reached a 52-week high recently, driven by increasing stock volume and buying ...

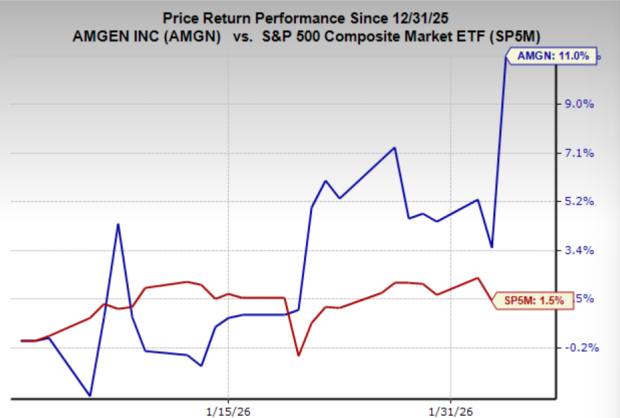

Amgen Stock Reaches New 52-Week High: Is It Time to Invest?

Amgen Inc. (AMGN) reported robust earnings in its latest quarter, with a 9% revenue increase

Top 4 Silver Mining Stocks to Capitalize on Strong Market Trends

The Zacks Mining – Silver industry is experiencing strong momentum, driven by increasing silver prices and robust industrial demand, particularly from the solar energy ...

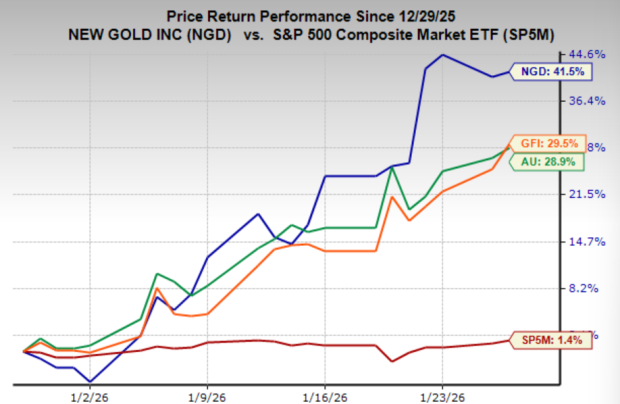

Is It the Right Moment to Invest in Mining Stocks Amid Gold’s Decline?

Gold and silver experienced extreme volatility on January 27, 2026, with gold plunging approximately 11% and silver collapsing over 30% in a single session, ...

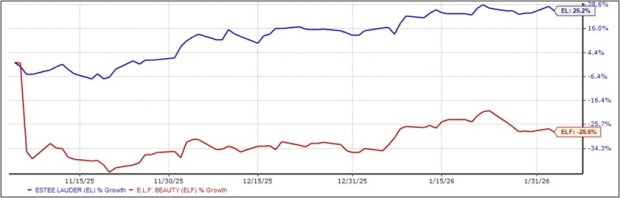

Comparing Aesthetics: ELF or EL?

During the Q4 2025 earnings season, Estee Lauder (EL) and e.l.f. Beauty (ELF) are in focus, with significant performance disparities noted. Over the past ...

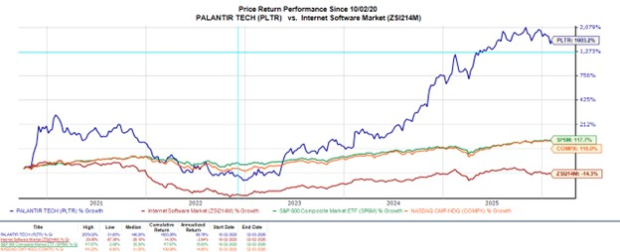

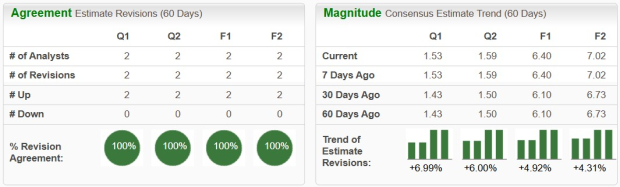

Evaluating Palantir’s Potential as a Leading Tech Investment for 2026 Following Strong Q4 Performance

Palantir Technologies (PLTR) saw its stock surge nearly 7% on Tuesday following a robust Q4 earnings report released the previous evening. For Q4 2025, ...

Identifying Top “Strong Buy” Stocks for February Investment

Wall Street experienced a significant sell-off of technology stocks on Tuesday as investors looked to secure profits amid increasing market volatility. The Nasdaq has ...