How to Invest

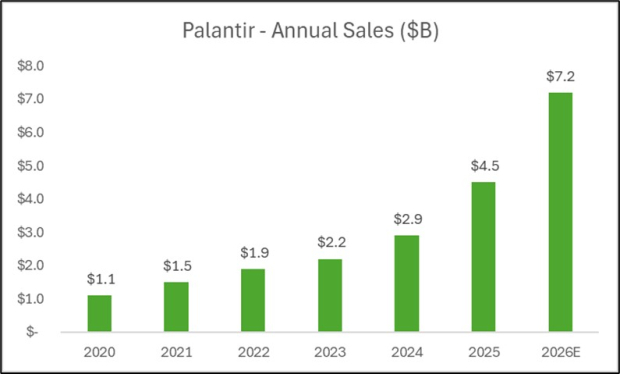

Palantir Reports Impressive Quarterly Earnings Surge

Palantir Technologies (PLTR) reported its Q4 2025 earnings, showcasing robust growth with revenue of $1.4 billion, a 70% increase year-over-year. U.S. sales reached $1.1 ...

Stock Spotlight: Revolve Group (RVLV) as Bull of the Day

**Revolve Group Reports Strong Q3 Earnings, Beats Expectations by 118%** Revolve Group (RVLV) announced a robust Q3 earnings report, exceeding forecasted profits by 118%, ...

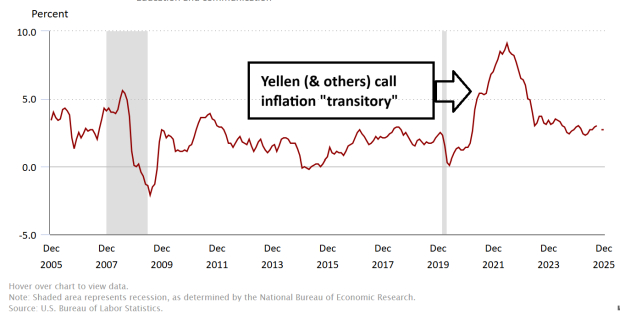

Inflation Insights: Why Experts Are Consistently Off Target

In June 2021, U.S. inflation reached 5%, with then-Treasury Secretary Janet Yellen describing it as ‘transitory.’ However, inflation surged to 9.1% by mid-2022, the ...

Understanding the Silver Market: Insights from Recent Price Declines

Silver Experiences Major Decline On January 15, silver and the iShares Silver ETF (SLV) dropped nearly 40% intraday, marking one of the largest declines ...

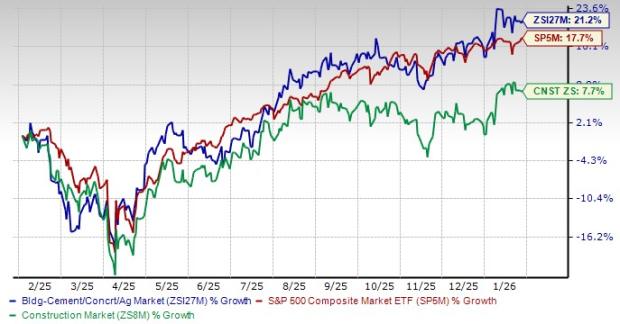

Top Concrete and Aggregates Stocks Benefiting from Infrastructure Growth

The Zacks Building Products – Concrete & Aggregates industry is projected for sustained growth due to ongoing federal and state infrastructure projects, with significant ...

Stock Spotlight: Banco de Chile (BCH) Faces Challenges

Banco De Chile (BCH), a key player in Chile’s banking sector since 1893, has been designated as Zacks Rank #5 (Strong Sell) due to ...

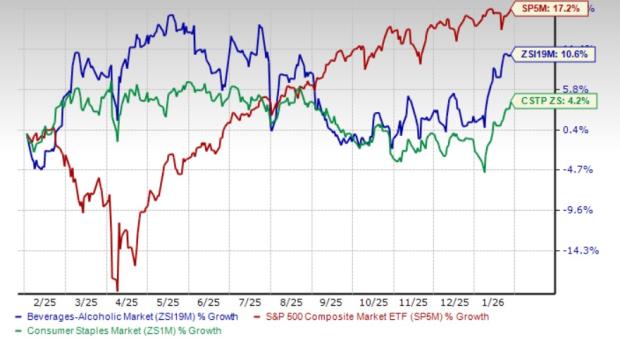

Key Alcohol Stocks to Monitor During Inflation and Tariff Challenges

The **Beverages – Alcohol** industry faces significant challenges due to ongoing inflation impacting labor, transportation, and raw material costs. Key players like **Anheuser-Busch InBev ...

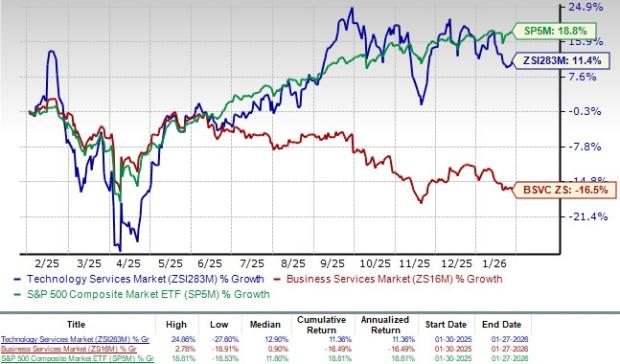

Top 3 Tech Stocks to Watch During Market Ups and Downs

The Technology Services industry is projected to return to pre-pandemic levels, driven by increased remote work adoption, rapid digital transformation, and advancements in 5G, ...

Top 3 Communication Stocks Poised for Growth Amid Industry Resilience

The Zacks Communication – Components industry is positioned to benefit from the ongoing 5G deployment and demand for cloud and fiber networks, despite facing ...

Three Leading Retail REITs Set to Benefit from Limited Supply and Market Stability

The Zacks REIT and Equity Trust – Retail industry indicates a positive outlook due to stable demand driven by necessity-based, value-oriented retailers and limited ...