Investing

Top 5 Footwear and Apparel Brands Leveraging Premiumization Strategies

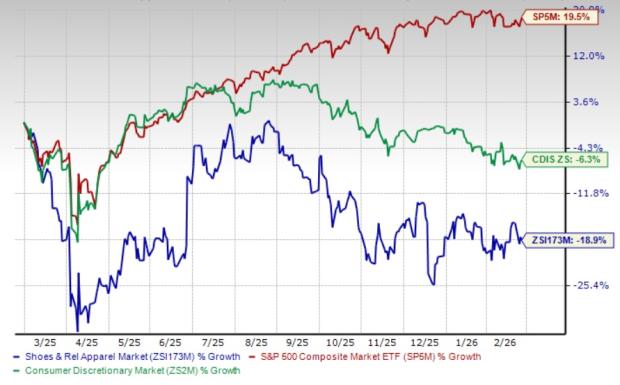

**Shoes and Retail Apparel Industry Trends Overview** The Zacks Shoes and Retail Apparel industry continues to thrive amid rising consumer preference for premium, performance-based ...

Upcoming Retail Earnings: An In-Depth Analysis

Target Corporation (TGT) is set to report its earnings before the market opens on March 3, 2026, with expectations of $2.17 per share on ...

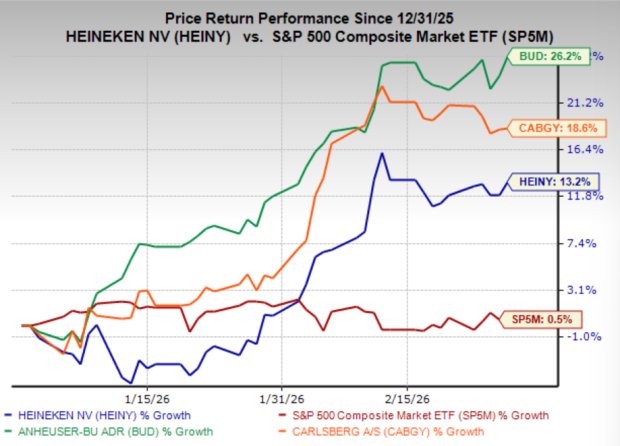

Beverage Stocks Surge: Insights on BUD, HEINY, and CABGY

Three leading beer stocks—Heineken (HEINY), Anheuser-Busch InBev (BUD), and Carlsberg (CABGY)—are experiencing a significant rebound due to improving fundamentals and rising analyst sentiment. Heineken ...

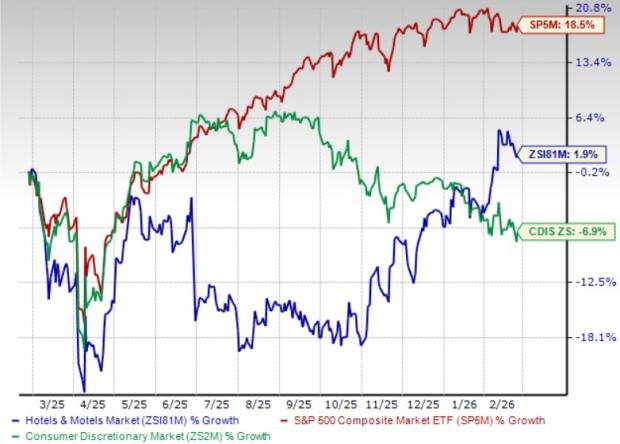

Top Hotel Stocks to Monitor Amid Ongoing Industry Challenges

The Zacks Hotels and Motels industry is currently under pressure, facing challenges from rising costs, demand fluctuations, and competitive dynamics. Sticky inflation has elevated ...

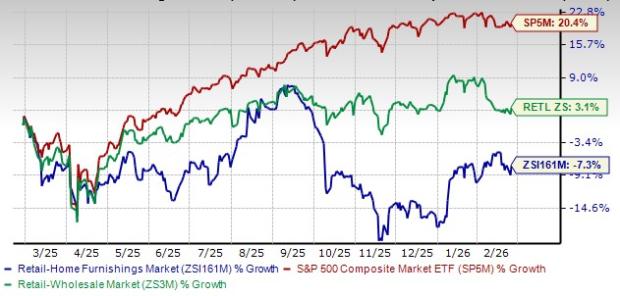

Two Home Furnishing Stocks Poised for Success Amid Industry Challenges

The Zacks Retail-Home Furnishings industry is currently facing significant macroeconomic challenges, including high mortgage rates and decreased housing turnover, which are suppressing demand for ...

Top Discount Retail Stocks to Monitor: Costco and Three Additional Picks

The Retail – Discount Stores industry remains robust, reportedly achieving an 11.8% growth in stock performance over the past year, outperforming the broader Retail ...

Lowe’s Shares Decline Amid Mixed Outlook Following Strong Earnings Report

Lowe’s reported its fiscal fourth-quarter results on Wednesday, revealing total sales of $20.6 billion, an 11% increase year-over-year, surpassing expectations of $20.36 billion. Adjusted ...

Promising Small-Cap AI Stock to Monitor: RFIL

Lumentum (LITE) has emerged as a leader in optical networking technology amid a consolidation in the AI infrastructure sector, with its shares surging in ...

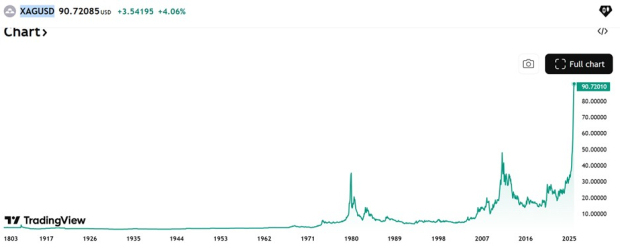

Top Three Silver Mining Stocks Poised for Continued Growth

Silver prices have reached all-time highs, trading near $100 per ounce, driven by strong industrial demand, shifting monetary conditions, and investor interest in safe-haven ...

Dillard’s (DDS) Positioned for Strong Q4 Earnings: A Prudent Buy the Dip Opportunity

Dillard’s (DDS) is set to report its Q4 earnings on February 24, 2026, with expectations of flat sales at approximately $2.02 billion and a ...