lithium

IGO Dismisses Prospects for WA Lithium Refinery Development

IGO (ASX: IGO) announced it has no confidence in the recovery prospects for the Kwinana lithium hydroxide refinery in Western Australia, owned by Tianqi ...

Security Officer Fatally Shot in Attack on Kodal Lithium Mine in Mali

Kodal Minerals (LON: KOD) reported that a security guard was killed during an attack on its Bougouni lithium mine in Mali on August 22. ...

Kodal Collaborates with Mali Government on Bougouni Lithium Export Permits

Kodal Minerals (LON: KOD) is advancing open pit mining at the Bougouni lithium project in Mali, facing challenges due to heavy rainfall. The project ...

Breakthrough Study Identifies Origins of Earth’s Most Abundant Lithium Reserves

Researchers from Curtin University and the Geological Survey of Western Australia (GSWA) have discovered that the world’s richest hard-rock lithium deposits likely formed deeper ...

Understanding the Harsh Realities of Lithium Economics in Electric Vehicle Batteries

SQM, the world’s second-largest lithium miner, has initiated layoffs affecting 5% of its workforce in Chile. This decision follows a drastic decline in battery ...

Arizona Lithium Approved for Saskatchewan’s Inaugural Lithium Brine Initiative

Arizona Lithium (ASX: AZL) has received approval from the Saskatchewan Ministry of Energy and Resources to commence stage one production at its Prairie lithium ...

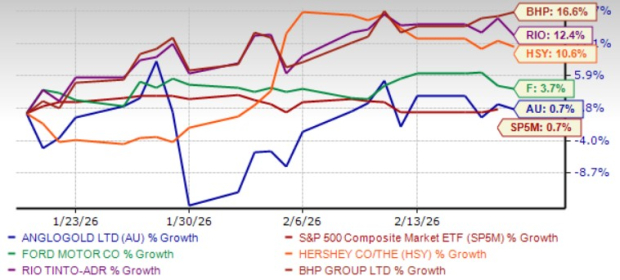

Rio Tinto Chooses JordProxa for Lithium Processing Plant at Rincon Project

Rio Tinto Partners with JordProxa for Rincon Lithium Project Rio Tinto (ASX, LON: RIO) has secured a contract with JordProxa to supply an integrated ...

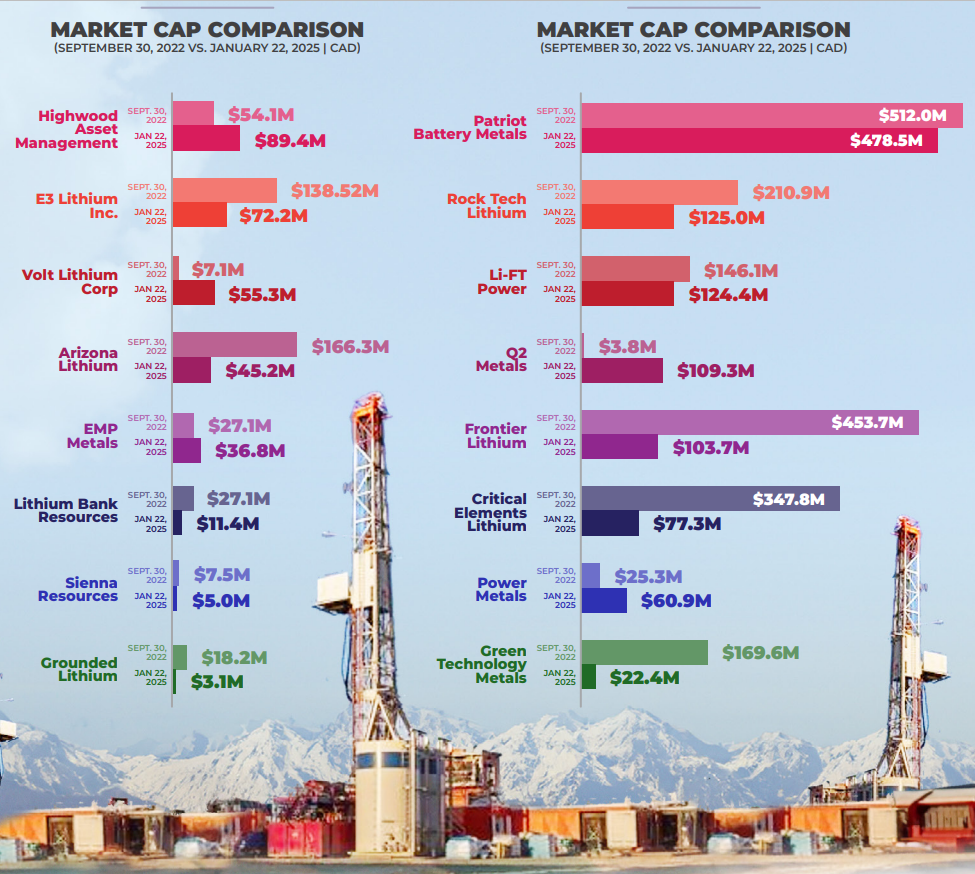

Visual Guide: Exploring Lithium Resources in Canada

Canadian Lithium Exploration Continues Amid Price Declines Patriot Battery Metals’ flagship Corvette lithium project in Quebec. Credit: Patriot Battery Metals Exploration firms across Canada ...

Stardust Power Begins Construction on $1.2 Billion Lithium Refinery in Oklahoma

Stardust Power Takes Major Step in Lithium Refinery Development Acquisition of Prime Location Near Port of Muskogee Stardust Power acquired a 66-acre site (approximately ...

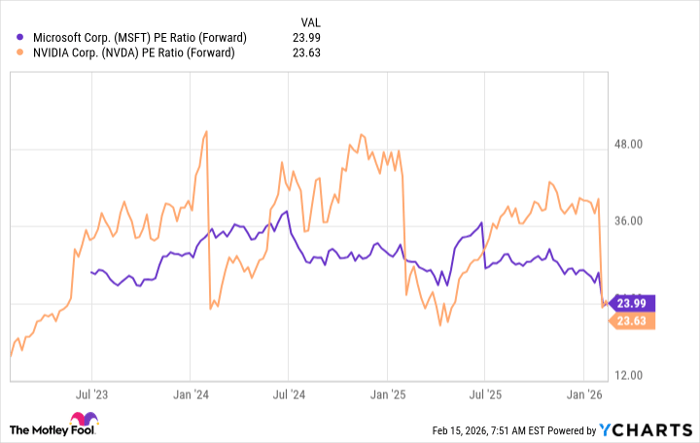

“Forecast for Lithium Market: Gradual Recovery Expected by 2025”

Growth and Challenges in the Lithium Market: What’s Ahead for 2025 In recent years, lithium prices have dropped approximately 80% from their peak levels ...