Markets

Top 5 Footwear and Apparel Brands Leveraging Premiumization Strategies

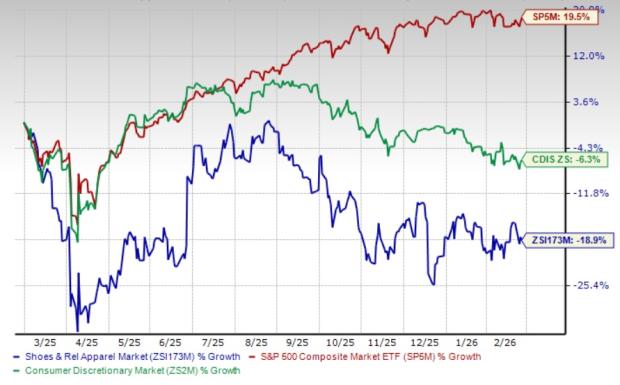

**Shoes and Retail Apparel Industry Trends Overview** The Zacks Shoes and Retail Apparel industry continues to thrive amid rising consumer preference for premium, performance-based ...

Two Home Furnishing Stocks Poised for Success Amid Industry Challenges

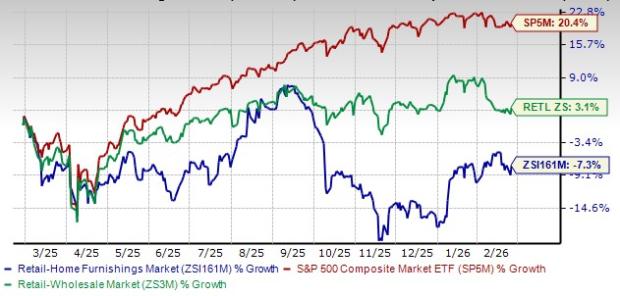

The Zacks Retail-Home Furnishings industry is currently facing significant macroeconomic challenges, including high mortgage rates and decreased housing turnover, which are suppressing demand for ...

Top Medical Instrument Stocks Leveraging GenAI to Overcome Industry Challenges

Over the past year, the application of generative AI (GenAI) in the Medical Instruments industry has evolved from experimental to operational, significantly enhancing diagnostics, ...

Top Picks: Two Promising Internet Content Stocks to Invest In

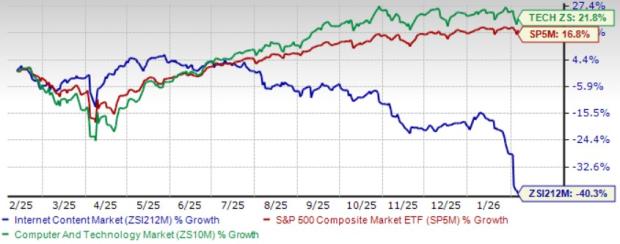

The Zacks Internet – Content industry has faced significant challenges, experiencing a 40.3% decline over the past year, compared to a 16.8% rise in ...

Top 5 Stocks in Securities & Exchanges to Monitor During Market Volatility

The Zacks Securities and Exchanges industry is projected to reach $49.6 billion by 2028, growing at a CAGR of 12.1%, driven by rising investment ...

Three International Wireless Stocks Poised for Success in Thriving Market

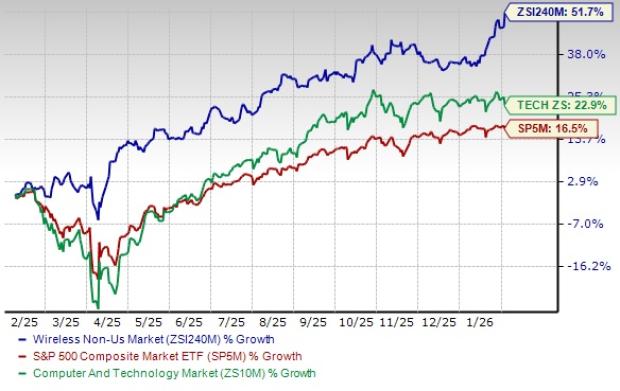

The Zacks Wireless Non-US industry has experienced a significant uptick, gaining 51.7% over the past year, compared to 16.5% for the S&P 500. Key ...

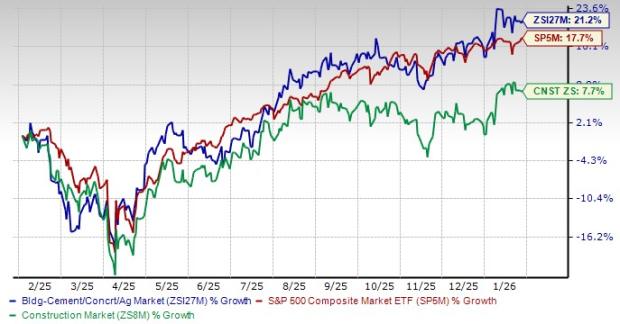

Top Concrete and Aggregates Stocks Benefiting from Infrastructure Growth

The Zacks Building Products – Concrete & Aggregates industry is projected for sustained growth due to ongoing federal and state infrastructure projects, with significant ...

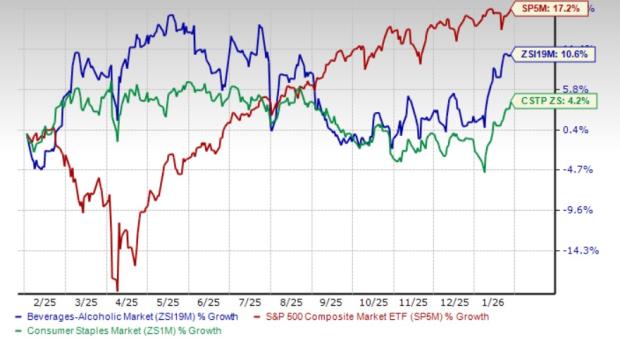

Key Alcohol Stocks to Monitor During Inflation and Tariff Challenges

The **Beverages – Alcohol** industry faces significant challenges due to ongoing inflation impacting labor, transportation, and raw material costs. Key players like **Anheuser-Busch InBev ...

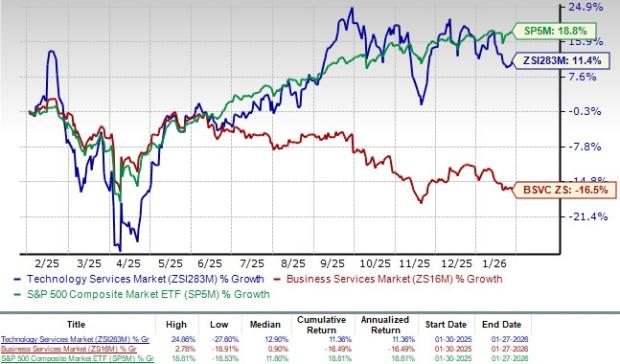

Top 3 Tech Stocks to Watch During Market Ups and Downs

The Technology Services industry is projected to return to pre-pandemic levels, driven by increased remote work adoption, rapid digital transformation, and advancements in 5G, ...

Top 3 Communication Stocks Poised for Growth Amid Industry Resilience

The Zacks Communication – Components industry is positioned to benefit from the ongoing 5G deployment and demand for cloud and fiber networks, despite facing ...