Mutual Funds

Top Hotel Stocks to Monitor Amid Ongoing Industry Challenges

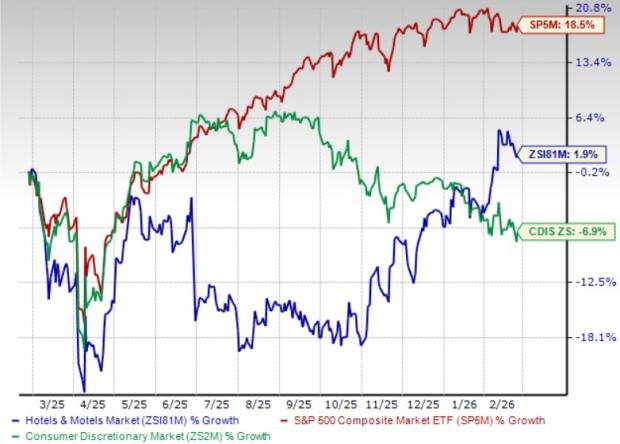

The Zacks Hotels and Motels industry is currently under pressure, facing challenges from rising costs, demand fluctuations, and competitive dynamics. Sticky inflation has elevated ...

Highlighted Stock Alert: Eagle Materials Inc. (EXP)

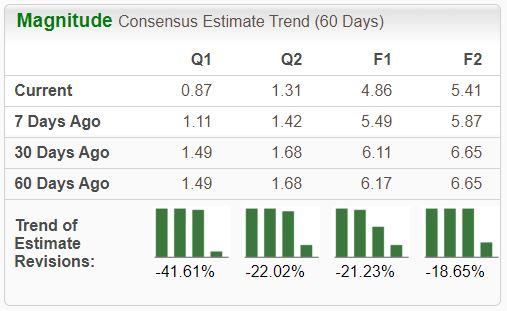

Eagle Materials Inc. (EXP), headquartered in Dallas, Texas, reported disappointing Q3 fiscal 2026 earnings on January 29, 2024, earning it a Zacks Rank of ...

Market Decline Spotlight: Xerox (XRX)

Xerox Holdings Corporation (Ticker: XRX) is experiencing significant challenges in the evolving digital landscape, leading to a notable decline in its business performance. The ...

Bull of the Day: Spotlight on Dollar General (DG)

Dollar General Corporation (DG) has reported significant growth and increased earnings estimates, positioning it as a solid investment amid economic uncertainty. The company operates ...

Transforming Trading: How Robinhood Evolved into a Fintech Leader

Robinhood Markets, Inc. (HOOD) Experiences Strong Recovery and Growth Robinhood Markets, Inc., known for popularizing commission-free trading since its 2021 IPO, has seen its ...

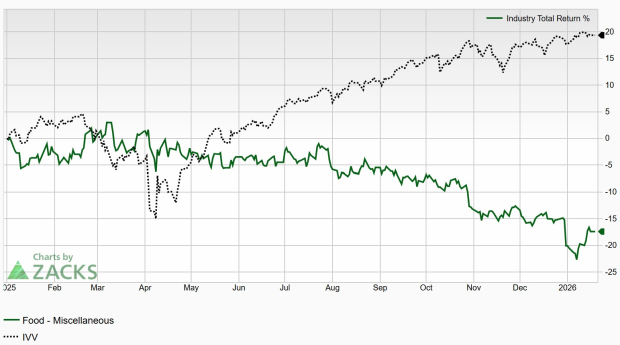

Stock Spotlight: Analyzing Lamb Weston (LW)

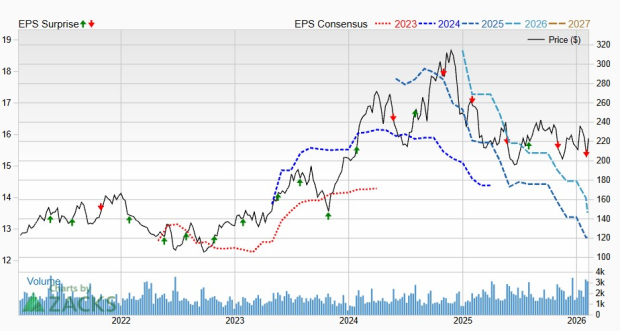

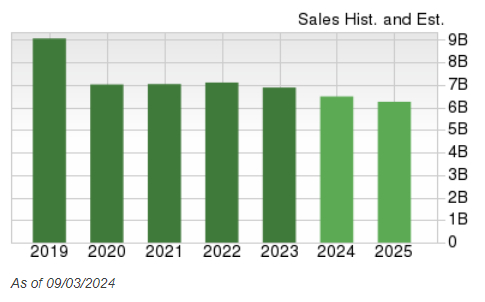

Lamb Weston Holdings (LW) reports a challenging earnings outlook, reflected in a Zacks Rank #5 (Strong Sell) as analysts express bearish sentiment. The company’s ...

Market Watch: BellRing Brands (BRBR) Declines Today

BellRing Brands (BRBR), a provider of nutrition products primarily under the Premier Protein and Dymatize brands, is facing significant challenges as it heads into ...

W.P. Carey Raises Dividend: Analyzing Long-Term Viability

W.P. Carey Inc. (WPC) has announced a 1.1% increase in its quarterly dividend, raising it from 91 cents to 92 cents per share. This ...

Key Insights to Anticipate for Builders FirstSource’s Q2 Earnings Report

Builders FirstSource, Inc. (BLDR) is scheduled to report its second-quarter 2025 results on July 31, before market open. The company is expecting adjusted earnings ...

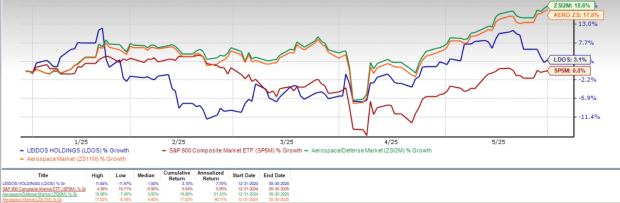

“Leidos Surges Ahead in 2023: Should You Invest Now?”

Leidos Holdings (LDOS) Exceeds Year-to-Date Market Performance Leidos Holdings Inc. (LDOS) shares have risen 3.1% so far this year, surpassing the S&P 500’s return ...